| « Back to article | Print this article |

2014: A year of change or anticlimax?

This new year will be one that will change everything - or so everyone expects. For India, the biggest event will, of course, be the general elections scheduled for the first half of the year. And, worldwide, the revival of the US economy and a jump in vitality of other developed economies - especially of Japan - suggest the world might finally, in 2014, move out from under the long shadow of the 2008 financial crisis.

In India, there is widespread hope that, sometime in 2014, there will be an end to the apparently interminable quarters of growth hovering around - indeed, below - five per cent.

Click NEXT to read more...

2014: A year of change or anticlimax?

Some analysts confidently predict a growth surge to the unimaginable heights of, well, around or just below six per cent. Others argue any sense that the Indian economy is recovering, however slowly, might be sufficient to turn sentiment around, and get people investing.

For these people, therefore, all hopes are pinned on 2014. It has to be a year that will change everything, it seems, because it is simply unaffordable for things to stay the same. This is not to say the challenges will not be substantial. For one, the revival of the West, if it gathers steam in 2014 - and no hitherto unheard-of small European country collapses in chaos - will mean the slow but inevitable drain of liquidity away from India and other emerging markets to safer bets in the developed world.

Click NEXT to read more...

2014: A year of change or anticlimax?

True, the cobbled compromises in the US and the European Union will be tested in 2014. But, if the West survives the painful renegotiation, there will be big benefits to getting in on the ground floor of a Western revival - and capital will respond to that prospect.

The Sensex zoomed upward in 2013, driven by liquidity and hope; sustaining those levels in 2014 will require something else altogether. In other words, the hopes being raised for 2014 will have to see some really good news that can weigh against the obvious gloomy consequences of less money flowing to emerging markets.

Click NEXT to read more...

2014: A year of change or anticlimax?

That is why everyone looks to the elections for hope. After all, the United Progressive Alliance government has looked since halfway into its second term that it was just marking time, with little enthusiasm and less capability for crowd-pleasing economic reform.

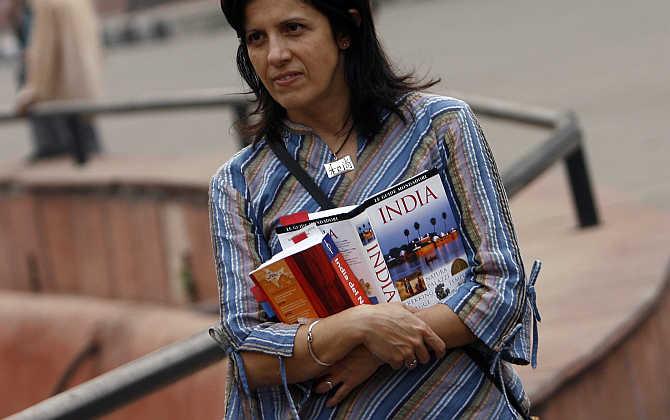

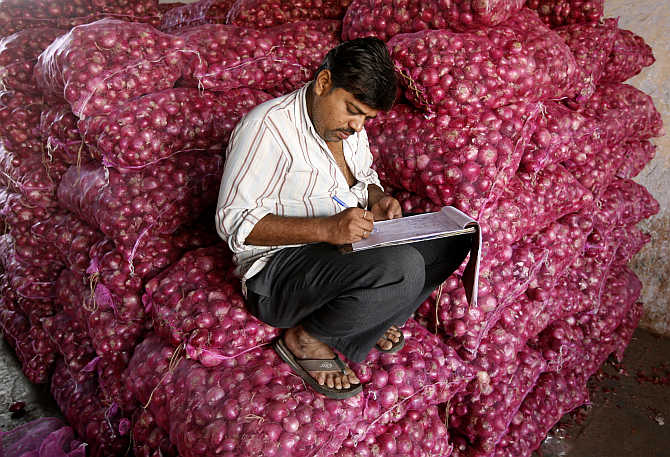

True, it might be wise to expect a sudden run of reformist announcements in the early part of the year, as the Congress tries to win back the smart money. Rahul Gandhi’s advocacy of labour law reform and changes to the wholesale agricultural trade may just be the beginning.

Click NEXT to read more...

2014: A year of change or anticlimax?

But UPA will run up against the sentiment its own years-long apparent inactivity has created: Real investments will wait for a new government. And, the more likely it looks that apostle of efficiency Narendra Modi will be the next prime minister, the more sentiment will soar.

But, one basic truth about Indian general elections is that these tend to surprise the markets. In 2004, the market collapsed on the result day; in 2009, it soared - note how disjointed from reality both reactions look in hindsight. In other words, it might not be wise at all to expect elections will indeed serve to easily revive hope, and to promise change.

Click NEXT to read more...

2014: A year of change or anticlimax?

As the governor of the Reserve Bank of India said in his foreword to the Financial Stability Report on Monday, a “stable new government” is what India needs; it’s also what investors expect. But Raghuram Rajan probably knows that the chances of that are not as high as anyone would le.

Imagine weeks of post-election manoeuvring of the sort that plagued Delhi in December. That uncertainty would serve to kill the hope-and-change expectations from 2014. In other words, 2014 may not be the year of change. It may not be the year of hope. It may be a year that’s actually a crushing anticlimax. For what seems like an aeon, Indians have looked to this year as the moment their fortunes will revive.

What if it’s just more of the same?