| « Back to article | Print this article |

10 countries with highest inflation rate

The entire world - from a rich nation like the United States to one of the poorest countries, Congo - is trying to bring soaring inflation rates under control.

So, let us have a look at some of the countries trying to deal with this rising problem.

Click NEXT to read on...

10 countries with highest inflation rate

Afghanistan has long been a theatre of conflict and that has affected its economy adversely.

Perpetual battles, an environment of fear, lack of infrastructure, industry and services has led to a once-proud nation turn into one of the world's poorest.

The inflation rate in Afghanistan is at 13.30 per cent.

The influx of billions of dollars of international aid has not really helped the economy much, although it is much better now than it was in 2002.

Click NEXT to read on . . .

10 countries with highest inflation rate

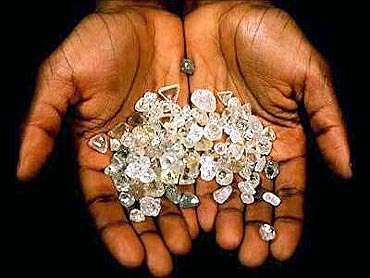

Angola's growth rate in recent years was driven by high international prices for its oil. Angola became a member of Organization of Petroleum Exporting Countries in late 2006 and in late 2007 was assigned a production quota of 1.9 million barrels a day.

Oil production and its supporting activities contribute about 85 per cent of GDP. Diamond exports contribute an additional 5 per cent.

Subsistence agriculture provides the main livelihood for most of the people, but half of the country's food is still imported.

Increased oil production supported growth averaging more than 15 per cent per year from 2004 to 2008.

Lower prices for oil and diamonds during the global recession led to a contraction in GDP in 2009, and many construction projects stopped because Angola accrued $9 billion in arrears to foreign construction companies when government revenue fell in 2008 and 2009. Angola abandoned its currency peg in 2008.

Click NEXT to read on . . .

10 countries with highest inflation rate

Mozambique grew at an average annual rate of 9 per cent in the decade up to 2007, one of Africa's strongest performances.

However, heavy reliance on aluminium, which accounts for about one-third of exports, subjects the economy to volatile international prices.

The sharp decline in aluminium prices during the global economic crisis lowered GDP growth by several percentage points.

Despite 8.3 per cent GDP growth in 2010, the increasing cost of living prompted citizens to riot in September 2010, after fuel, water, electricity, and bread price increases were announced.

In an attempt to contain the cost of living, the government implemented subsidies, decreased taxes and tariffs, and instituted other fiscal measures.

Mozambique's inflation rate is 13.50 per cent. .

Click NEXT to read on . . .

10 countries with highest inflation rate

Inflation in Pakistan remained in single digits for many years, but for the past three fiscal years, it has been hovering at around 15 per cent.

In November of 2010, Pakistan's central bank raised its key policy rate to 14 per cent, its third consecutive raise in six months.

Other factors fuelling the inflation rate are political instability, persistent violence; government's heavy borrowing from the State Bank of Pakistan, which is then forced to print money.

Increase in global commodity prices have added to the pressure.

Pakistan's consumer price index saw an increase of 15.46 percent in December from a year earlier.

Although government has been trying to bring down the inflation rate, it is expected to remain high in the near term. .

Click NEXT to read on . . .

10 countries with highest inflation rate

Although blessed with rich mineral wealth - with huge iron ore, gold and diamond deposits - Guinea has been languishing as one of the poorest nations on earth with large-scale unemployment, lack of industry and infrastructure dogging it.

Guinea is also one of the world's poorest countries. The inflation in the nation is at 15 per cent. .

Click NEXT to read on . . .

10 countries with highest inflation rate

Uzbekistan: 15%

Uzbekistan is slowly moving from a somewhat closed to a market-based economy. The economic reforms have helped achieve some growth, but not nearly as much as the nation would ideally like to enjoy.

Also, lack of infrastructure, tight state control over the economy, occasional skirmishes with neighbouring nations, and an unstable political environment have seen inflation rise sharply. .

Click NEXT to read on . . .

10 countries with highest inflation rate

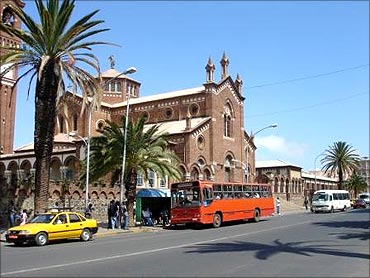

Eritrea: 20%

Since independence from Ethiopia in 1993, Eritrea has faced the economic problems of a small, desperately poor country, accentuated by the recent implementation of restrictive economic policies.

Eritrea has a command economy under the control of the sole political party, the People's Front for Democracy and Justice.

Like the economies of many African nations, a large share of the population - nearly 80 per cent - is engaged in subsistence agriculture, but they produce only a small share of total output.

Since the conclusion of the Ethiopian-Eritrea war in 2000, the government has maintained a firm grip on the economy, expanding the use of the military and party-owned businesses to complete Eritrea's development agenda.

The inflation rate is estimated to be 20 per cent.

Click NEXT to read on . . .

10 countries with highest inflation rate

Argentina: 22%

Argentina's official annual inflation for 2010 stood at 10.9 per cent, significantly lower than estimates released by independent consulting companies, which suggest an inflation rate of around 22 per cent.

With growing pressure for price and pay rises in line with the unofficial figures, inflationary pressures within the economy are rising, eroding income potential for both consumers and businesses.

If the unofficial inflation estimates are correct, expectations of high inflation will erode consumer purchasing power, undermining spending potential and reducing potential profits for businesses.

In addition, public assumptions of higher than official inflation are driving broader price increases, exacerbating inflationary pressure.

Argentina's inflation is set to continue rising in 2011, with the government forecasting an inflation rate of 12.1 per cent in 2011.

However, private analysts continue to believe this is significantly underreported and assess that inflation will be closer to 30.0 per cent during the year.

Click NEXT to read on . . .

10 countries with highest inflation rate

Democratic Republic of Congo: 26.20%

Global investors do not feel that the Republic of Congo has a foreigner-friendly investment environment as it does not offer any incentive to the investor.

Added to that a disorganised yet costly work force, high electricity costs, irregular supply of raw material, occasional civil unrest and political instability have only added to Congo's woes.

And even as the nation grapples with its myriad problems, the Congolese economy has been going from bad to worse.

Its current rate of inflation is 26.20%.

Click NEXT to read on . . .

10 countries with highest inflation rate

Venezuela: 29.80%

Venezuela's inflation rate may exceed 30 per cent in 2011 as the government's move to weaken the currency has a greater impact on food prices than the devaluation a year ago.

The government in January weakened the official exchange rate on imports of essential goods such as food and medicine to 4.3 bolivars per dollar from 2.6 bolivars, unifying its two fixed exchange rates in a bid to pull the country out of recession.

President Hugo Chavez in 2010 devalued Venezuela's currency (bolivars) for the first time in almost five years after the bolivar had been pegged at 2.15 bolivars per dollar since March 2005.

Rising food prices were the main driver of inflation in 2010.

The government may delay raising prices on regulated foods such as milk, rice and corn flour in a bid to delay the devaluation's inflationary impact.

Such measures could cause shortages as producers struggle to sell their products at a profit amid rising prices for raw materials.

Click NEXT to see the inflation rate in the United States, China and India.

Inflation rate in US, China and India

While prices for food and energy have been increasing, inflation in the United States has remained low, at 2.1 per cent in February, 2011.

One reason for low inflation is that the US has exported inflation to China and other countries through the Federal Reserve's monetary policy.

America's monetary policy has involved excessive money creation since 1995; however, it has not produced inflation in the US because the dollar is a reserve currency, so excess dollars goes to countries whose economies are more vulnerable to inflationary pressures.

Since 2008, the excess money has gone to China, India, Brazil and other fast-growing emerging markets.

It also has fuelled a massive growth in foreign exchange reserves among the world's central banks.

Central bank holdings of forex reserve have grown more than 16 per cent per annum since 1998.

With oil prices hovering above $100 per barrel and commodity prices rising, it is likely that the Fed's plan to export inflation won't last for too long.

In 2011, it is projected that inflation rate in the US will see a big increase.

When that happens, the Fed will have to raise interest rates to fight rising prices.

Click NEXT to read on . . .

Inflation rate in US, China and India

China's inflation is projected to hit 5 per cent through this 2011 primarily due to rising international commodity prices, higher wages, commodity prices and flood of liquidity.

The unrest in North Africa and West Asia will also be a contributing factor in pushing the inflation rate up, especially since China imports about 55 per cent of oil.

The government, meanwhile, is targeting a four per cent rise in consumer price index in 2011.

CPI, a key gauge of inflation, rose 5.1 per cent year-on-year in November, the fastest increase in more than two years, as food costs continued to soar.

The authorities have ordered a range of steps to boost supplies of key goods after severe summer flooding and recent cold snaps hit yields and drove up prices.

As part of these efforts, the central bank announced in October the country's first interest rate hike in nearly three years.

It has also ordered lenders to keep more money in reserve as authorities struggle to stem the flow of liquidity into the economy, which is fanning the inflation problem.

Click NEXT to read on . . .

Inflation rate in US, China and India

To say that food inflation in India is a big concern is an understatement.

With continuous rise in prices of essential commodities, Indians are finding it harder than ever to make ends meet.

The reasons for the high food inflation are many, but the main are:

Supply-constrained economy - Indian agricultural output is very volatile, partly because of poor infrastructure, bad supply chains and poor storage facilities.

This makes it very difficult for the country to meet excess demand, and that in turn puts pressure on the economy.

Soaring oil and gas prices with the West Asia in turmoil, and the oil and gas prices rising, the Indian Government is forced to spend more on export and subsidy on these two essential commodities.

The government in an effort to rein in the inflation rate, which was 8.3 per cent in February 2011, has announced several measures, such as enhancing food and non-food supply, reducing wastage of grain, improving storage, etc.