| « Back to article | Print this article |

The probe agency found irregularities in loans amounting Rs 3,642 crore sanctioned by Yes Bank to the travel firm.

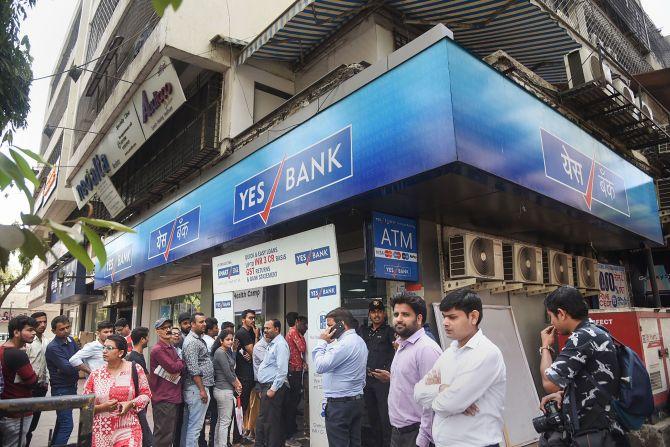

Widening its probe in the Yes Bank fraud case, the Enforcement Directorate (ED) on Monday searched five premises of the promoters, directors and auditors of outbound travel firm Cox & Kings (CKL).

This is in connection with the tour operator’s financial dealings with Rana Kapoor, the co-founder of private Yes Bank, who is under judicial custody for alleged money laundering.

According to the central agency, a total outstanding loans aggregating Rs 3,642 crore sanctioned to the travel firms showed 'irregularties'.

“During investigation, irregularities were noticed in relation to the loan sanctioned to Cox & Kings group. Group had created multiple layer of onshore and offshore subsidiary across the globe through which the monies were siphoned off,” ED said.

The search operation followed a formal complaint filed by Yes Bank on March 18 against the travel firm.

“We have so far searched the offices and residences of promoter Ajay Ajit Peter, director Pesi Patel, cheif financial officers Abhishek Goenka and Anil Khandelwal and auditor Naresh Jain,” said an ED official.

Sources say that this action is part of ED’s probe in a case involving half a dozen Yes Bank borrowers with total loan claims of about Rs 30,000 crore.

ED is investigating how the bank sanctioned the loans and whether the travel firm’s promoters siphoned off the money.

It is also examining illegal quid pro quo and suspected kickbacks in credit extended during Kapoor’s tenure at the bank.

Sources indicated that investigation will reach out to all borrowers summoned by the agency but their questioning was postponed due to the coronavirus pandemic.

The agency is preparing a second or supplementary chargesheet that will include its findings about the bank's borrowers.

Explaining the break-up of the outstanding loans, ED said Cox & Kings borrowed Rs 563 crore; its group firms Ezeego and Cox & Kings Financial Services Ltd had borrowed Rs 1,012 crore and Rs 422 crore respectively.

While its two UK-based entities--Prometheon Enterprise and Malvern Travel owe dues of Rs 1,152 crore and Rs 493 crore, respectively.

ED action triggered after it came into possession of crucial documents and audit reports highlighting the roles of CKL promoter, executives and its entities.

Findings says that Malvern Travel, having an outstanding of Rs 493 crore, had submitted a forged bank statement and certificates of BDO LLP (statutory auditor) to avail the loans from Yes Bank.

This forgery was pointed out by KPMG which is the administrator of this UK-based entity.

In relation to Cox & Kings Limited (CKL), the company forged its consolidated financials by forging the balance sheets of the overseas subsidiaries.

Even the Prometheon Enterprise uses the fictitious domain name impersonating the current officials of Raffingers UK LLP, ( statutory auditor) For this, Raffingers UK LLP filed a criminal complaint to National Crime Agency, UK.

After default by CKL, the lenders appointed PwC for forensic audit but the management did not cooperate.

However, based on the limited data available with them, audit confirmed falsification of accounts, overstating the sales figures and understating the debt figures, fictitious transactions and so on.

Audit highlighted that between FY15 and FY19, sales of Rs 3,908 crore were made to 15 non-existent/fictious customers.

Most of the collections shown in ledgers from Ezeego (another group entity) were not found in the bank statements.

Another 147 sets of customers are also suspicious and not existent. Audit further say that Anil Khandelwal, diverted Rs 1100 crore to Alok Industries without any approval of board.

CKG sold Holiday Break Education, another subsidiary for Rs 4387 crores and instead of discharging the liability of bank, they siphoned off majority of the money.

From this siphoning, USD15.34 million was transferred to Kuber Investment Mauritius Pvt Ltd which was controlled by Peter Kerker.

From Ezeego, Rs 150 crore were diverted to Redkite Capital Private which was promoted by Anil Khandelwal and Naresh Jain (internal auditor of CKL).

This fund diverted to Redkite was used to buy controlling stake in Tourism Finance Corporation Of India Ltd, a listed NBFC.

Photograph: ANI Photo