| « Back to article | Print this article |

If an agent tries to sell you an FMP promising double-digit returns, remember that such returns can only come by taking additional credit risk.

Heed your liquidity needs before investing in an FMP, says Sanjay Kumar Singh.

Santosh Mishra, 47, a Delhi-based Supreme Court lawyer, wished to invest a lump sum for around three years.

Being a risk-averse investor, he planned to put his money in fixed deposits.

His financial planner friend, however, suggested that he should consider investing the money in fixed-maturity plans (FMPs) due to the considerable tax arbitrage that they enjoy vis-a-vis fixed deposits.

Owing to this, his friend said, Mishra would be able to earn much better post-tax returns from an FMP than from a fixed deposit.

Closed-end product: FMPs are closed-end debt funds that have a fixed tenure.

You can invest in them only at the time of the new fund offer.

"In FMPs, the intended asset allocation mentioning the rating profile of the portfolio is filed with Sebi seven working days prior to the launch of the fund, and is also made publicly available to investors through the fund house's Web site," says Amit Tripathi, CIO-fixed income investments, Reliance Mutual Fund.

By looking up these details, an investor or her/his advisor can get an idea of the kind of return the FMP will be able to provide, and the risk it carries.

The FMP fund manager invests the money raised from investors in a portfolio of securities.

The portfolio tends to remain static.

Investors get their money back at maturity.

While FMPs are listed on the stock exchanges, liquidity tends to be low and they usually trade at a discount to their net asset values (NAV).

This makes it difficult for investors to exit them by selling them on the exchanges.

Lock-in yields: FMPs allow investors to lock-in the prevailing interest rates.

"FMPs follow a buy and hold strategy, which helps investors lock-in the prevailing yields in the market. Hence, an investor benefits more when s/he invests in an FMP in a high or rising interest-rate scenario, as s/he can capture those higher yields," says D Jayant Kumar, head of third-party products, Karvy Stock Broking.

Experts say that yields are quite attractive at present.

Experts say that yields are quite attractive at present.

Triple-A papers offer a yield of 8% to 8.5%, double-A papers offer 9% to 10% while single-A papers offering 9.5% and above.

Locking yields is not possible in open-end debt funds.

<p"Constant inflows force the fund manager to buy new securities, while redemptions force him to sell her/his existing securities, due to which the yield profile of the portfolio keeps changing," says Aditya Bagree, director, Business Aggregate.

Avail indexation benefit: Fund houses are currently launching FMPs and also advertising them heavily.

The end of the financial year is a especially opportune time for investing in FMPs because of the added indexation benefit investors can get.

Suppose you invest in March in an FMP having a tenure of three years and one month.

This FMP will mature in April 2022.

Once the tenure of a debt fund crosses three years, the gains are treated as long-term and are taxed at 20% with indexation.

But there is an added benefit.

"By investing for just three years and a few additional days, you can get indexation benefit for four years," says Deepesh Raghaw, founder of PersonalFinancePlan.in, a Sebi-registered investment advisor.

In a fixed deposit, you are taxed at the marginal income tax rate.

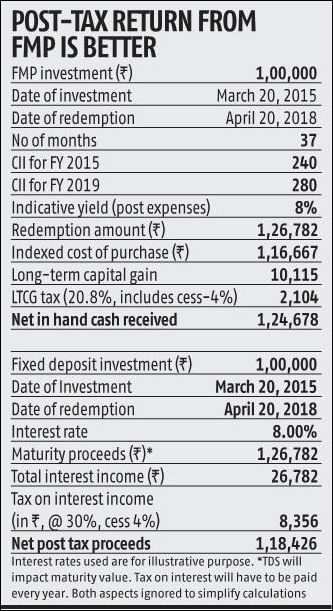

On account of this, the post-tax return from an FMP tends to be far better than from a fixed deposit, even if both offered similar pre-tax returns (please see table).

Avoid mark-to-market loss: When interest rates are rising, the NAVs of open-end debt funds take a knock.

Longer-duration funds are affected more than their shorter-duration counterparts.

FMPs become attractive in such an environment also.

"There may be interim volatility in these funds but there is no realised mark-to-market loss in them. Since the majority of the securities have a maturity that is similar to that of the FMP, by the time its tenure ends there is no residual mark-to-market impact," says Tripathi.

In case of open-end funds, investors with a low risk appetite may not be able to hold on to their funds when they see their NAVs falling in a rising rate scenario.

In an FMP, this risk gets removed if the investor stays put till the end of the tenure.

Check portfolio for credit risk: While FMPs can help investors circumvent interest-rate risk, they are susceptible to credit risk.

This is especially crucial in the current environment, when a number of corporates are facing the risk of defaults and downgrades.

"Suppose you spot a security in your portfolio which you think is of poor credit quality. You may want to exit that portfolio, but this is difficult in an FMP. Exiting is much easier in an open-end debt fund," says Raghaw.

If you decide to invest in an FMP in the current environment, check the credit quality of the portfolio the fund manager intends to create.

The portfolio should hold double-A and above rated papers (conservative investors should for FMPs that predominantly hold triple-A rated papers).

Only those with the necessary risk appetite should opt for FMPs that hold lower-rated papers.

"After the recent credit related issues, fund managers are shying away from taking any risk and are mostly launching FMPs with double-A and triple-A rated portfolios," says Abhinav Angirish, founder, InvestOnline.in.

If an agent tries to sell you an FMP promising double-digit returns, remember that such returns can only come by taking additional credit risk.

Pay heed to your liquidity needs before investing in an FMP.

"If you don't need a certain sum of money for a particular tenure, and an FMP of a similar tenure is available, you may go for it," says Bagree.

Barring the ability to lock-in yields, open-end debt funds provide most of the other benefits that FMPs do.

So, the bulk of your fixed-income portfolio should be in open-end debt funds, and only a limited amount should be allocated to FMPs, given the difficulty in exiting them.

Investors who wish to benefit from a potential fall in interest rates should also avoid FMPs, says Angirish.