| « Back to article | Print this article |

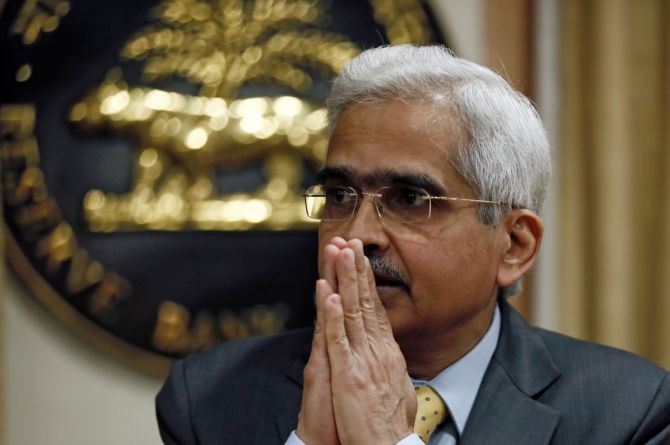

Uncertainty is emerging as the only certainty, said RBI Governor Shaktikanta Das as he emphasised on continued policy support at the December MPC meet during which members expressed concerns over spread of the Omicron variant of coronavirus, as per the minutes of the rate-setting panel released on Wednesday.

After three days of deliberations, the six members of the Monetary Policy Committee (MPC) on December 8 unanimously voted for status quo on policy rates for the ninth consecutive time.

At the meeting, the RBI Governor said risks stalking the global economy have amplified with rapid spread of the virus mutations, including the Omicron variant, leading to countries scrambling for restrictions.

These developments, he said, certainly have two major takeaways for central bankers.

"First, uncertainty is emerging as the only certainty with which central bankers will have to deal with in the period ahead.

"Second, since monetary policy is at an inflection point, the journey of monetary policy which is hardly smooth in the best of times is going to get more challenging," he opined as per the minutes.

The Indian economy is facing several headwinds emanating from global factors – some old ones getting prolonged compared with the initial assessment, coupled with new ones, he noted.

He further said there is growing uncertainty regarding the evolving global macroeconomic outlook.

On the domestic front, even as the prospects for economic activity are improving, there is still a slack with key drivers like private consumption remaining well below their prepandemic levels, Das added.

"Given these uncertainties, continued policy support is warranted for a durable, broad-based and self-sustaining rebound, especially to nurture revival in sectors which are lagging and to safeguard those which are exposed to the evolving headwinds," the Governor said.

All members of the MPC – Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Mridul K Saggar, Michael Debabrata Patra and Shaktikanta Das – had unanimously voted to keep the policy repo rate unchanged at 4 per cent.

All members, except Varma, had also voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

Varma had expressed reservations on this part of the resolution.

Patra is RBI Deputy Governor and Saggar is executive director of the central bank.

The others are external members appointed by the government on the panel.

At the meeting, Patra said suddenly, the global outlook has darkened.

Three fundamental questions about Omicron have put national authorities on high alert – is it more transmissible than other variants?

Can it evade immunity conferred by previous infections or vaccination?

Does it cause more severe disease?

"As countries race to contain Omicron with travel restraints and new quarantine and social distancing measures, the global recovery and the inflation outlook are at risk again," he said.

Saggar said the Pascal's principle for transmission of fluid pressures very much holds and appropriate liquidity levels are key to monetary adjustment at this stage.

This is also important to address unintended effects reflected in asset prices inflation, income inequalities and future risks of macro-financial imbalances.

"Keeping in view the Swiss knife-like policy tools the central bank possesses to deal appropriately with the emerging trends, I vote to leave the repo rate unchanged at 4.0 per cent and also vote for retaining the stance," the RBI official had said, as per the minutes.

The minutes further said Varma was also of the view that the MPC needs to remain data driven so that it can respond rapidly and adequately to any unforeseen shocks that may arise in future.

Goyal said global risks are rising with the Omicron variant as well as with expectations of an earlier US Federal Reserve taper.

Markets are volatile as are oil prices.

"In such circumstances it is better for the MPC to remain steady and watchful through the next couple of months.

"International oil prices may fall further after the winter season.

"Their high volatility means collapse is possible," she added.

Bhide said the agricultural sector is expected to be supportive of the overall GDP growth in FY2021-22, with normal rainfall conditions although they were also marked by uneven rainfall.

In view of the projected growth and inflation rates and the emerging uncertainty from the renewed surge of Covid infections and macroeconomic adjustments at a global level, Bhide said he voted in favour of keeping the policy repo rate unchanged at 4 per cent.

According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee.