From a legislative perspective, things have been reasonable as the government has been able to get key bills, such as the Bankruptcy Code, cleared.

Markets are gearing up for the outcome of Assembly elections in five states -- Tamil Nadu, Kerala, West Bengal, Assam and Puducherry – scheduled for May 19.

Markets are gearing up for the outcome of Assembly elections in five states -- Tamil Nadu, Kerala, West Bengal, Assam and Puducherry – scheduled for May 19.

Though an unfavourable outcome for the Narendra Modi-led National Democratic Alliance could trigger a knee-jerk reaction in the markets, analysts rule out a significant correction from the current levels.

Factors like the progress of monsoon, corporate earnings, inflation trajectory and the Reserve Bank of India’s stance on policy rates will be key in determining market direction over the next few weeks, they say.

“The markets could see a negative knee-jerk reaction and come under pressure in the short-run in case the NDA were to lose in Assam, the only state where it hopes to win.

"Even then, I do not expect the Nifty50 index to slip below 7,500 levels.

"The upside, too, seems to be capped around 7,900 levels.

"Besides the election, the ongoing results season and the progress of the monsoon over the next few weeks will have a bearing on market direction,” says U R Bhat, managing director, Dalton Capital Advisors.

For Tirthankar Patnaik, India strategist at Japan-based Mizuho Bank, the progress of monsoons over the next few weeks is a bigger concern than State election outcomes.

He, too, expects the Nifty50 to find support at 7,500 levels in case of unfavourable election outcome and sees the upside capped at 8,000.

“The election outcome may not dent market sentiment severely.

"On the contrary, any additional delay in monsoon than what was forecast by Indian Metrological Department last week may impact more.

From a legislative perspective, things have been reasonable as the government has been able to get key bills, such as the Bankruptcy Code, cleared.

"The government is already on the back foot given the development in Uttarakhand. So, even if election results are unfavourable, they will be marginally negative for markets,” Patnaik says.

Reform agenda

Reform agenda

As regards key policies, experts say the results of these elections alone cannot meaningfully change the government's ability to push through reforms. Bharatiya Janata Party, they say, stands to benefit from the fact that 56 of the Upper House’s members are coming up for re-election.

However, it is hard to predict how many of the 56 seats will go to the BJP, as Rajya Sabha membership depends not just on state election results, but also on the interplay between the slow-moving retirement calendar, proportional representation and ranked voting in the Upper House.

June and July will be critical, as 54 of the seats will be decided during this period, in time for the monsoon session of Parliament, which continues until mid-August.

On the other hand, only six seats from the five poll-bound states are up for re-election in the Rajya Sabha, where the government aims to increase its influence.

“Over the rest of 2016, significantly, 56 out of 245 members will be up for re-election.

"This is important because the Bharatiya Janata Party lacks a majority in the Upper House.

"A change in the balance of power could help BJP push through long-delayed pieces of legislation, such as the goods and services tax bill, that are regarded as important parts of the reform process,” said Pranjul Bhandari, chief India economist at HSBC, in a recent report.

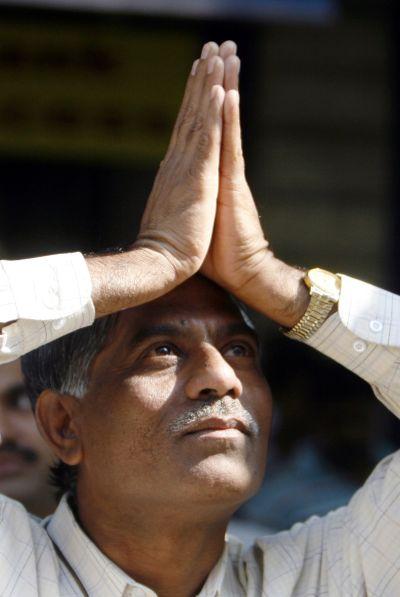

Image: An investor gestures with folded hands towards the Bombay Stock Exchange building while watching a large screen displaying India's benchmark share index in Mumbai. Photograph: Arko Datta/Reuters

.jpg)