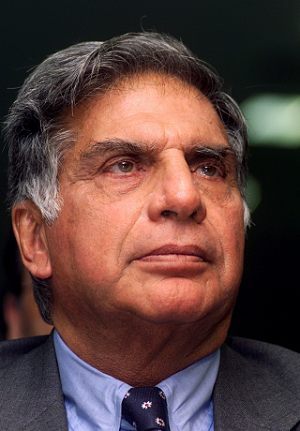

The United Kingdom-India trade and investment relationship has significant unrealized potential, given the synergies possible between the two countries, said Tata Sons Chairman Ratan Tata.

The United Kingdom-India trade and investment relationship has significant unrealized potential, given the synergies possible between the two countries, said Tata Sons Chairman Ratan Tata.

Speaking at the first meeting of the India-UK CEO Forum on Thursday at Number 10, Downing Street, Tata said: "The UK has a special place in the hearts and minds of Indians and Indian industry."

"However, I feel our trade and investment relationship has significant unrealized potential given the synergies possible between the two countries - such as what we could achieve by leveraging the technology and manufacturing capabilities in the UK, to serve the global market," he said.

Tata, who is also the co-chair of the forum, said he hoped the UK-India CEO Forum "is able to help build trade and investment between the two countries to a level approaching its potential and we intend to look at a range of sectors and ideas on how this could be facilitated by government and industry from both countries, working together."

Bilateral trade between India and the UK amounted to over 11 billion pounds in 2009.

Last year, exports from the UK to India increased by 38 per cent vis-à-vis the previous year, while 17 per cent of India's exports to the EU went to the UK.

There are around 700 Indian companies with investments in the UK and the UK garners more than 50 per cent of Indian investment into Europe.

Companies such as Tata Group, JCB, BAE, Standard Chartered and Wipro already operate in both the UK and India and are taking part in this initiative.

Addressing the forum, British Prime Minister David Cameron said: "I've always believed that the India-Britain relationship is strong, but could be much, much stronger."

"Britain is one of the most open economies in the world, one of the easiest places to come and invest, to come and do business, to come and own a business, to come and raise capital and we want to make it even more open, even more welcoming," he said.

The British prime minister said: "This is for me to listen to what the CEOs are saying about what needs to change in Britain to make us more attractive and what needs to change in India to increase the flows of investment both ways."

India's Commerce Minister Anand Sharma also participated in the forum, alongside UK Secretary of State Vince Cable and Trade and Investment Minister Lord Green.

Cable, who visited India for trade talks last month, said: "I warmly welcome this commitment from British and Indian business leaders in contributing to the India-UK CEO Forum."

"With the personal and private sector expertise across key sectors, this initiative will help firms of all sizes across both our economies to tap into the huge opportunities in both the UK and India," he said.

Standard Chartered Group Chief Executive Peter Sands said: "India and the UK enjoy strong cultural, business and economic ties. They also share many complementary strengths and similar challenges for the future. Both India and the UK will benefit from greater trade and investment and broadening and deepening their collaboration."

"The India-UK CEO Forum has an important role in making this happen. Given the strength of the CEOs involved and the strong support of both governments, I am excited about what the forum can achieve," he added.

Senior business representatives from leading British and Indian companies attended the meeting.

The forum was agreed on by Cameron and his Indian counterpart, Manmohan Singh, last July, when the British leader led the largest-ever British government delegation to India.

Members of the forum include the CEOs of UK-based Standard Chartered (Co-chair), 3i, BAE Systems, Balfour Beatty, JCB, KPMG, Penguin (Pearson), Rolls Royce Plc, Vodafone Group Plc, Wellcome Trust, besides India's Tata Sons (Co-Chair), Aditya Birla Group, Bharti Enterprises, Godrej Group, Hindustan Unilever Limited, ICICI Bank, ITC Limited, Mahindra & Mahindra, Punj Lloyd Group and Wipro Limited.

target=_new>https://im.rediff.com/money/2011/feb/03budlogo.jpg" WIDTH=300

HEIGHT=110 border=0>