| « Back to article | Print this article |

Founded in 2006, PremjiInvest’s assets under management are worth over $2 billion across India

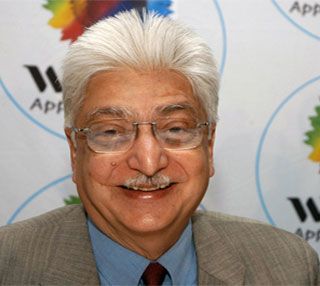

Even as he was spearheading information technology (IT) services provider Wipro over the past four decades, Chairman Azim Premji built a parallel empire, where he holds investments in about 40 public and private companies through his family office, PremjiInvest.

Even as he was spearheading information technology (IT) services provider Wipro over the past four decades, Chairman Azim Premji built a parallel empire, where he holds investments in about 40 public and private companies through his family office, PremjiInvest.

While these investments have mostly remained under wraps, the portfolio of PremjiInvest is a unique mix of companies ranging from sectors such as technology, e-commerce, financial services, retail, fashion, healthcare and consumer goods.

The diversification of PremjiInvest’s portfolio is perhaps the billionaire’s forte as he took Wipro from an edible oil manufacturer to India’s third largest IT services company over three decades. During the same time, Wipro also built itself as one of the leaders in the consumer goods and electronics segments.

Founded in 2006, the late-stage investor PremjiInvest’s assets under management are worth over $2 billion across India, the US and China. It is known for making investments in the range of $20 million to $60 million.

Set up in 1945, Western India Vegetable Products, later abbreviated to Wipro, made vegetable and refined oil. Between 1970 and 1980, Stanford-educated Premji shifted the company’s focus to computer hardware and technology.

At a time when there is a split between believers of e-commerce and those of traditional retail, PremjiInvest has positioned itself uniquely by placing bets on e-tailers such as Snapdeal and Myntra on the one hand and retail giants such as the Kishore Biyani co-promoted Future Lifestyle Fashions, Tata Group’s Trent, Koutons, Shoppers Stop and ethnic retailer Fabindia on the other.

It was reported on Wednesday Premji was infusing Rs 175 crore (Rs 1.75 billion) in Future Retail. The funds will help Kishore Biyani, chief of the retail giant, sail through the coming rights issue of his flagship company and cut debt. The Rs 1,600-crore (Rs 16 billion) rights issue will open on January 15 and close on January 29. For Premji, this is the second investment in the Future Group. In May, PremjiInvest had bought eight per cent in Future Lifestyle Fashions for Rs 125 crore (Rs 1.25 billion).

PremjiInvest's portfolio

Mar 2012: PremjiInvest acquired 4.91% in Trent for Rs 122 cr

Mar 2012: Ethnic retailer Fabindia sells 7% to PremjiInvest for Rs 125 cr

Oct 2012: PremjiInvest invests $35 mn in JSM Corp, which runs Hard Rock Cafe and California Pizza Kitchen restaurants

Dec 2012: PremjiInvest buys stake in Hyderabad-based Heritage Foods

Aug 2013: PremjiInvest buys ‘non-voting preference shares’ in Tata Capital for Rs 75 cr

Feb 2014: Myntra raises $50 mn from PremjiInvest

May 2014: PremjiInvest buys 10% in Biyani’s fashion firm

Oct 2014: Payments processor FSS raises Rs 350 cr from PremjiInvest

Dec 2014: PremjiInvest to buy under 1% in HDFC Standard Life insurance for $31 mn