The Reserve Bank of India said on Monday it has received $17.5 billion so far through the two special windows for swapping foreign currency non-resident (banks) deposits and overseas foreign currency borrowings by banks.

The Reserve Bank of India said on Monday it has received $17.5 billion so far through the two special windows for swapping foreign currency non-resident (banks) deposits and overseas foreign currency borrowings by banks.

The central bank operationalised these special windows on September 4 to prop the rupee which had fallen close to 30 per cent between April and August.

The window will remain open till November 30.

The special widow allows banks to swap the fresh FCNR (B) dollar funds, mobilised for a minimum tenor of three years and over, at a fixed rate of 3.5 per cent per annum for the tenor of the deposit.

The RBI also allowed banks to borrow up to 100 per cent of tier I capital from overseas, which can be swapped with the central bank at a concessional rate of 100 basis points below the ongoing swap rate prevailing in the market.

The rupee has gained nearly 11 per cent from September till date on account of higher dollar inflows and other measures taken by the RBI and the government.

On November 6, the RBI said that it had received $ 15.2 billion from the special concessional window.

Many analysts have pegged inflows from these instruments to be in range of $20 to 25 billion.

The rupee was the worst performing Asian currency between end-May and September 3, losing close to 30

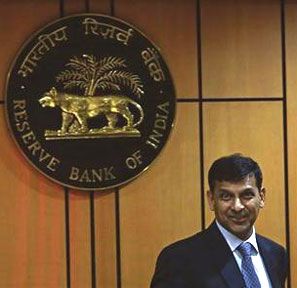

These two windows, coupled with the one for oil companies under which RBI directly sells dollars to them, apart from the sentiment booster that new Governor Raghuram Rajan offered in his inaugural address, have been the main reasons for the massive recoup of the rupee.

In September alone, the rupee had rallied more than 10 per cent.

However, on Monday, the unit plunged more than 60 paise to one-month low against the dollar at 60.03 in opening trade.

This was on renewed fears that the US Fed would look at scaling back its stimulus soon as the latest US data showed the world's largest economy is clawing back faster than expected.

In fact, the plight of the rupee started after the US Fed in its May 24 meeting hinted at shutting in a phased manner the easy money tap-repurchase of $85 billion worth of T-bills every month.

This had led to a spike in US interest rates, enticing Foreign institutional investors to plumb for better returns back home by exiting emerging markets.

This had led to scary situation on the already high current account position in the country, leading to battering of the rupee.

As a result, FIIs had sold domestic debt worth more than $13 billion between the May-end Fed warning and early September and a couple of billions in stocks.