"You only have to do a very few things right in your life so long as you don't do too many things wrong." Warren Buffett

Warren Buffett’s words should be an eye opener for Indian companies that have landed in a soup in their zest to conquer the world.

Several high profile companies are burdened with losses, mounting debt and have a huge load of operational costs.

Ironically, the companies that have either shutdown or are facing huge debts are run by billionaires.

Flamboyant Vijay Mallya started Kingfisher in his flashy style, only to shut down the airline.

Another corporate giant DLF which tasted success with real estate diversified into running hotels, wind power and even selling insurance, running into huge losses.

Indian businessmen have tried to do many things at the same time in a bid to expand business. This greed led to over borrowing of huge amount of money in foreign currencies. Economic crisis and devaluation of the rupee added to their woes.

During FY13, debt levels at 10 big companies have risen by 15 per cent year-on-year even as profitability continues to be under pressure, says a Credit Suisse report.

Take a look at the companies run by some of the richest Indians which are sinking under mounting debt…

SpiceJet

Promoter: Kalanidhi Maran

Net Worth: $2.3 billion

SpiceJet is the latest victim of debt crisis, though its promoter, Kalanidhi Maran with a net worth of $2.3 billion is 38th richest man in India.

SpiceJet owes about $94 million to oil companies and airport authorities. Its net debt stood close to $230 million at the end of September.

Maran, who owns 75% stake in Sun TV Network and wife Kavery are also India’s highest paid promoter-CEOs.

They earn a whopping Rs 59.89 crore (Rs 598.9 million) each, including salary, perks and other allowances.

Kingfisher

Promoter: Vijay Mallya

Net worth: $800 million

Another high profile businessman who has seen a major business failure is UB group chairman Vijay Mallya.

Last year, he was the 84th richest person in India, however, this year he is out of the top 100 richest Indians.

Kingfisher launched in 2005 owes banks, oil companies, aircraft lessors a whopping Rs 7,000 crore (Rs 70 billion).

While hundreds of employees are yet to receive even their salaries since 2012, Mallya continues to lead a flashy lifestyle.

Even while Kingfisher owes Rs 350 crore to it employees, Mallya, who owns - Royal Challengers Bangalore - spent around Rs 28.70 crore (Rs 287 million) buying players at the Indian Premier League auction.

Adani Enterprises

Promoter: Gautam Adani

New Wealth: $7.1 billion

A self-made billionaire Gautam Adani has seen his net wealth zoom by $4.5 billion this year as his company stocks hit new highs after Narendra Modi’s victory in the elections.

After a profitable run, Adani Power slipped into the red in 2011-12, pushing the company’s debt levels further.

In the last two financial years, Adani power has seen debt levels rise by 71%, according to Credit Suisse.

The total debt of the Adani group stood at Rs 72,632.37 crore (Rs 726.32 billion) as on September 30, 2014 from Rs 7,653.33 crore (Rs 76.53 billion) in March 2014, according to Credit Suisse.

Questions have also been raised about the viability of State Bank of India’s $1 billion lifeline to finance Gautam Adani's controversial coal venture in Australia.

ADAG Group

Promoter: Anil Ambani

Net wealth: $6.3 billion

Anil Ambani’s Reliance ADA has seen gross debt levels up by 24% in FY13 from FY12, according to Credit Suisse.

Reliance ADA Group’s gross debt rose to Rs 1,13,543.9 crore (Rs 1.13 trillion), making it one of the highest debt-ridden companies.

One of the group companies, Reliance Communications (RCom), which had debt of Rs 37,478 crore (Rs 374,78 billion) till March 31, 2013, more than half of it in foreign currency.

Due to huge losses, several companies have now witnessed 22–80% net worth erosion in the last two years even as their debt levels continue to rise,” Credit Suisse report points out.

Reliance Communications has been badly hit as a large part of the borrowings are through forex loans.

Bharti Airtel

Promoter: Sunil Bharti Mittal

Net worth: $7.8 billion

Sunil Bharti Mittal’s Bharti Airtel has been burdened with debt especially after its buyout of Africa's Zain Telecom.

A competitive market in India has led to cut in tariffs, which further dented its fortunes.

Bharti Airtel’s net debt at the end of first quarter ended June 30, 2014 stood at Rs 57,744.3 crore (Rs 577.44 billion).

According to Morgan Stanley, has forecast Bharti’s net debt would come down to Rs 40,480 crore (Rs 404.80 billion) by FY15.

The cumulative debt of Indian telecom companies has zoomed by over 200 per cent to an estimated Rs 2.5 lakh crore in 2012-13 from Rs 82,726 crore in 2008-09.

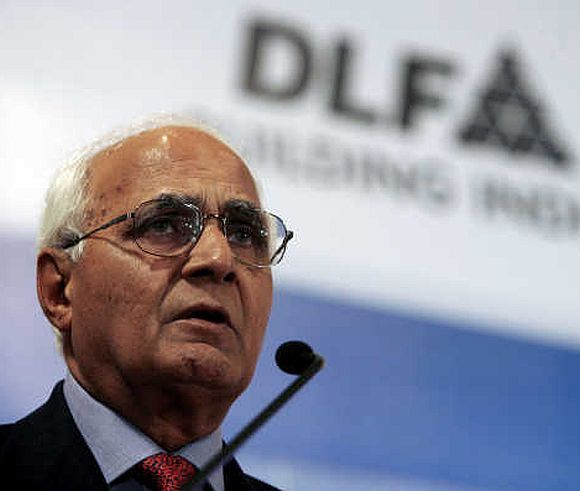

DLF

Promoter: K P Singh

Net Worth: $3 billion

2014 has been perhaps the worst year for K.P Singh.

In a severe blow to DLF, Sebi banned it from the capital markets for three years.

With this ban, it will be an uphill task to bring down its debt.

DLF’s debt has risen to a whopping Rs 19,100 crore ($3.13 billion) at the end of June this year after several land acquisitions.

DLF was banned as it failed to provide information on subsidiaries and pending legal cases at the time of its 2007 initial public offering.

Essar Group

Promoter: Sashi & Ravi Ruia

Net worth: $5.9 billion

Essar Group’s debt has risen by 15% in FY13.

Essar Group’s debt stood at Rs 98,412 crore (Rs 984.12 billion) during FY 2013 according to a Credit Suisse report.

Debt servicing ratios for Essar Group has deteriorated YoY. Interest cover ratios are already under 1, according to a Credit Suisse report which means it will be difficult for the company to pay the interest on outstanding debt.

Vedanta Group

Promoter: Anil Agarwal

Net worth: $3.5 billion

Vedanta’s net debt has risen to Rs 99,610 crore (Rs 996.10 billion) in FY2013. The company’s YoY loan growth rose by 5%.

Despite the mounting losses, Agarwal has pledged 75 per cent of his wealth to charity.

GMR Group

Promoter: G M Rao

Net worth: $1 billion

Infrastructure giant GMR Group has seen its net debt zoom to Rs 40,824 crore (Rs 408.24 billion) in FY2013 from Rs 36,028 crore (Rs 360.28 billion) in FY2012.

GMR Infrastructure, which operates Delhi and Hyderabad airports, plans to sell off at least 10-15 acres of land at Delhi International Airport (DIAL) to garner more funds.

Videocon Industries

Venugopal Dhoot

Net worth: $2.1 billion

Venugopal Dhoot has tried his hand in a diverse range of businesses, though electronics and home appliances remains the mainstay.

The company's net debt at stood at Rs 27,283 crore (Rs 272.83 billion) in FY12.

Videocon sold 10% stake in Mozambique’s Rovuma 1 offshore block for $2.47 billion, which helped the company bring down debt levels.