| « Back to article | Print this article |

The first major devaluation of the rupee happened in 1966 when it was pegged against the US dollar at Rs 4.75/$

The first major devaluation of the rupee happened in 1966 when it was pegged against the US dollar at Rs 4.75/$

In the pre-independence days, the Indian rupee had been strong. In the olden days, all international currency was pegged to the value of gold and silver, followed by the British pound and the American dollar in the post-War world.

In the period around 1947, the year of India’s independence, the Indian rupee was valued as $1 = Rs 1.3, i.e. its near equivalent.

This means one rupee and thirty paise could buy a dollar back in 1948. Thanks to frequent devaluations and fluctuations in exchange rates, it will take around Rs 67 today to buy a dollar.

Whenever the rupee has been devalued, exports have become cheaper and more competitive but imports have become costlier. Thus, purchase of oil and gold becomes more expensive.

Here is the history of rupee devaluation since 1947

|

Year |

Exchange rate (Rs per $) |

|

1948 |

1.3 |

|

1949 |

3.67 |

|

1950 - 1966 |

4.76 |

|

1966 |

7.5 |

|

1975 |

8.39 |

|

1980 |

7.86 |

|

1985 |

12.38 |

|

1990 |

17.01 |

|

1995 |

32.427 |

|

2000 |

43.5 |

|

2005 (Jan) |

43.47 |

|

2006 (Jan) |

45.19 |

|

2007 (Jan) |

39.42 |

|

2008 (October) |

48.88 |

|

2009 (October) |

46.37 |

|

2010 (22 January) |

46.21 |

|

2011 (April) |

44.17 |

|

2011 (21 September) |

48.24 |

|

2011 (17 November) |

55.395 |

|

2012 (22 June) |

57.15 |

|

2013 (15 May) |

54.73 |

|

2013 (12 Sep) |

62.92 |

|

2014 (15 May) |

59.44 |

|

2014 (12 Sep) |

60.95 |

|

2015 (15 Apr) |

62.3 |

|

2015 (15 May) |

64.22 |

|

2015 (19 Sep) |

65.87 |

|

2015(30 Nov) |

66.79 |

|

2016(20 Jan) |

68.01 |

|

2016(25 Jan) |

67.63 |

|

2016(25 Feb) |

68.82 |

|

2016 (14 April) |

66.56 |

Over the years, the Indian rupee has devalued itself every year, and now it costs Rs 67 and two paise as of September 15, 2016 to buy one American dollar.

Reasons behind currency devaluation

Interest Rate Arbitrage: There are many reasons behind the devaluation of the rupee, but the primary reason is interest arbitrage.

In the last ten years which also encompassed the period of the great recession of 2008, the US federal fund rates have been flat at 0.25 per cent (currently 0.5 per cent) while the rates in India have hovered between 4.5-8.5 per cent (currently 6.5 per cent) in the same period.

On average, there would be an approximate difference of 6 per cent in the interest rates of the two economies.

And this is why the value of the rupee depreciates by about 6 per cent to maintain a balance.

If not, there would be an interest rate arbitrage opportunity, i.e. people earning in dollars would like to invest in India to earn 6-8 per cent on investment and then take the earnings back to the US where the returns are significantly lower.

In order to overcome this arbitrage opportunity of interest rates, the rupee depreciates every year by about 6 per cent. Now, in order to boost exports or overcome other immediate financial crises, countries devalue their currency deliberately at times.

Current Account Deficit or CAD: CAD is basically the difference between the import and the export in a country. India being a primarily import driven economy has a high historical CAD.

In June 2016, there has been an astonishing decline in India's CAD to $0.3 billion, i.e. 0.1 per cent of the GDP.

This decline happened from $7.1 billion or 1.3 per cent, in third quarter primarily due to lower trade gap.

This is the first time India is heading towards a Current Account Surplus situation. However, by being a net importer, India buys more than it sells.

This gap between income and expenditure keeps a sustained downward pressure on the value of the rupee.

Inflation: There has been a difference in the inflation of both the economies primarily because the RBI supplies money faster to the Government of India than the US Federal Reserve does to the US.

Thus by printing more money, the RBI boosts inflation of the economy with no rise in taxation.

In the recent past, oil price-driven inflation surged, and India as a net importer of oil, contributed to the inflation with its demand for oil. India has had a consistently high inflation rate, averaging around 8 per cent since the early 1970s.

Rupee devaluation history

The first major devaluation of the rupee happened in 1966 when it was pegged against the US dollar at Rs 4.75/$. With two major wars, against China and Pakistan, and with multiple changes to India’s leadership in the post-Nehru era, led to the steep devaluation of 57 per cent, taking the value of the rupee to Rs 7.5/$.

From 1966 to 1980, the rupee remained largely stable. However, the global economic problems of the early 1980s followed by the energy crisis of 1991 during which the prices of oil and gold surged, rupee had to be devalued again, to Rs 17/$ by 1991.

In 1991, India had an economic crisis. The government had a balance of payment problem, and was on the verge of defaulting. The rupee was further devalued to Rs 25/$ as part of the measures to overcome the crisis.

By 1993, with the so-called liberalisation of the economy, the rupee started to slide towards the Rs 35/$ mark, as the open market had taken control of its exchange.

In 2008, with the global recession, the rupee rose to Rs 51/$, after having appreciated to Rs 39/$. In 2012 with the Greece-Spain sovereign debt crisis, Indian government’s budget conditions worsened and GoI had resorted to selling dollars which devalued the rupee further to Rs 56/$ in June 2012.

Why do countries devalue their currency?

Countries opt for devaluation only to save the economy from external factors and boost export. China is a very recent example of deliberate devaluation of its currency.

This not only boosts export but also reduces trade deficit and lowers the interest burden on outstanding government debts.

As currency depreciates in the global parlance, exports become more favourable and imports unfavourable. This boosts the internal economy towards export and internal usage of own goods.

Thus, when exports become favourable, demand for the country’s exported goods increases which in turn increases price and negates devaluation. Secondly, if all countries devalue their currency deliberately then there is a serious reason for concern.

By devaluing the currency, trade deficits are lowered which also favours the balance of payments and thus helps the economy by providing temporary relief.

Also, sovereign loans become more expensive in the home currency and becomes a serious threat to currency devaluation.

China is an export-driven economy and in order to sustain, the Chinese government has been constantly devaluing its currency.

Does it actually help?

There are pros and cons of currency devaluation. Of course it helps in reducing trade deficit and achieve temporary economic stability but it also creates huge uncertainty in the global economy.

The asset market is threatened and can tempt countries to get into a currency race to the bottom. This can be very dangerous and thus very few countries opt for the same. India, however, has enough dollar reserves to be able to devalue the rupee.

There has been a sudden drop in the rupee after recent reports about a possible rupee devaluation. The finance ministry confirmed that this news is not true. The exporters have reportedly been pushing the commerce ministry for the same, but the finance ministry isn’t moved.

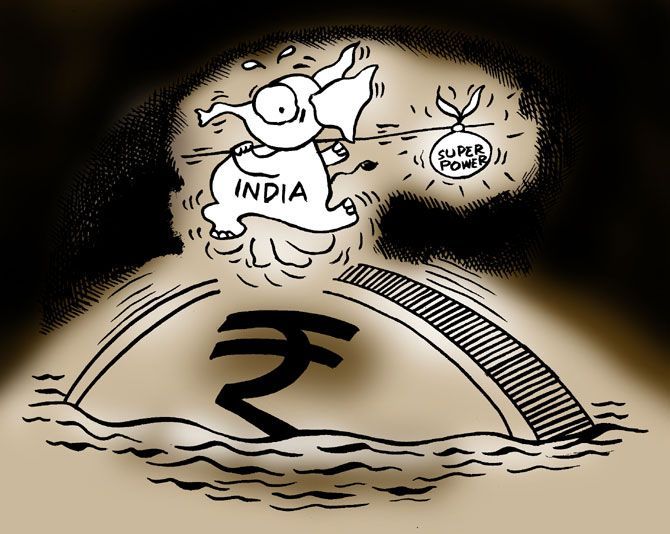

Illustration: Uttam Ghosh/Rediff.com

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2008 www.BankBazaar.com. All rights reserved.