| « Back to article | Print this article |

Shares of mid-cap and small-cap companies lost ground on Tuesday, slipping up to 20 per cent on profit-booking.

Shares of mid-cap and small-cap companies lost ground on Tuesday, slipping up to 20 per cent on profit-booking.

Between September 1 and Monday, the mid- and small-cap indices have risen 10 per cent and eight per cent, respectively, compared to a rise of one per cent each in the benchmark Sensex and Nifty.

While the BSE small-cap index slipped four per cent on Tuesday, the mid-cap index lost 3.4 per cent, compared with the 1.2 per cent decline in the Sensex.

On the National Stock Exchange, the mid-cap and small-cap indices ended four per cent lower each. The fall in the overall markets comes ahead of a US Federal Reserve meeting in which analysts say Fed chair Janet Yellen might provide cues on a rate increase.

“The benchmark indices have been correcting since the past few days and we have seen some selling by foreign institutional investors in the futures and options segment.

Against this backdrop, mid- and small-caps were outperforming, and have seen a healthy gain. Therefore, a correction was imminent,” said Sunil Jain, head of retail research, Nirmal Bang.

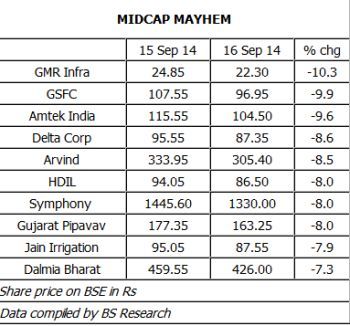

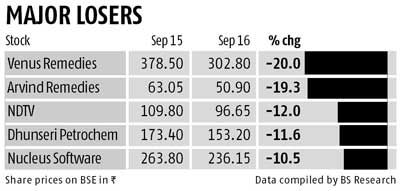

Among small-caps, Venus Remedies, NDTV, Nucleus Software Exports, Onmobile Global, Dhunseri Petrochem & Tea and Himachal Futuristic Communications declined more than 10 per cent each on Tuesday, while in the mid-cap segment, HDIL, GSFC, Delta Corp, Gujarat Pipavav Port, Amtek India and Arvind fell up to 20 per cent each.

Though the markets have lost ground since the past few sessions, analysts do not seem worried.

They suggest the long-term market story remains intact structurally. However, expect stocks in the mid- and small -cap segments to see more correction, given the recent rally.

They suggest the long-term market story remains intact structurally. However, expect stocks in the mid- and small -cap segments to see more correction, given the recent rally.

R Sreesankar, head of institutional equities, Prabhudas Lilladher, says: “This is a normal correction in the mid-cap segment, as the stocks had run up sharply.

There is nothing to be worried about.” Cummins India, Britannia Industries, UPL, Federal Bank, Tata Chemicals, PI Industries, JK Lakshmi Cement, KPIT Technologies and Ashoka Buildcon remain his favourites in the mid-cap and small–cap segments.

Jain of Nirmal Bang says for those seeking to buy mid- and small-caps from a two-year perspective, the best strategy is to wait, as these stocks could be available cheaper and at compelling valuations.

His top picks in this space are Dolpin Offshore, Dishman Pharma and Indoco Remidies.

He suggests those with a long-term perspective buy these at lower levels.

Rikesh Parikh, vice–president (equities), Motilal Oswal Securities, says investors shouldn’t expect an immediate turnaround in these stocks, as these are likely to consolidate around current levels, before resuming their upward march.