| « Back to article | Print this article |

The system has gone through three rounds of testing for its load-bearing capacity.

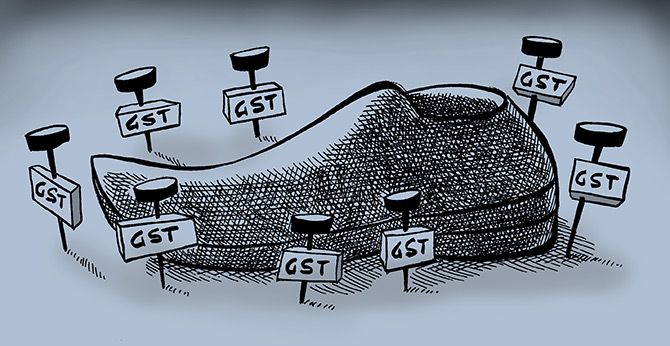

Illustration: Uttam Ghosh/Rediff.com.

It could take at least a fortnight for the e-way bill generation to take off, though it was introduced at midnight of March 31 for inter-state movement of goods worth over Rs 50,000.

Not many e-way bills might be generated in April since businesses had stocked up in advance to lengthen the time required to shift to the new system, experts said.

However, the authorities seem to be prepared this time after the collapse of the portal in the first phase of the roll-out.

For the past several weeks, awareness campaigns have been carried out across the country to educate people about the new system.

The e-way bill portal collapsed on the very first day of its introduction on February 1, when only 480,000 bills were generated.

To avoid a repeat, the load has been increased to 7.5 million this time. The system has gone through three rounds of testing for its load-bearing capacity, officials said.

However, according to experts, the real test would come once the bill is rolled out. “The proof of the pudding is in the eating,” one of them said.

Cargo shipments are likely to go up five to six times of their capacity on Friday and Saturday.

“One reason for the high volume is the annual closing of books. Also, people want to avoid the e-way bill till the midnight of March 31.

"They want to create an inventory for the next four to six weeks. For example, the assignment from Delhi to Chennai will take five to six days, so those consignments, if they leave by March 31, need not be compliant of the e-way bill system,” said SP Singh, senior fellow and coordinator, Indian Foundation of Transport Research and Training.

This was being done to evade taxes, he added. “In the next fortnight, volumes might dip to 50 per cent as demand would be low and people would take time to adjust to the new system,” he said.

Also, charges for ferrying cargo had also gone up and businesses were trying to beat the e-way bill introduction clause, transporters said.

“Transporters are charging three times the truck rentals since they are ferrying untaxed cargo.

"No vehicles would be stopped, border check posts have been abolished in most states, the value and volume of goods being transported has increased,” said a transporter who has over 1,000 trucks ferrying cargo all over the country.

However, companies involved in backend preparations for a smooth roll-out said they were ready though ground-level implementation would be key.

“We have prepared a system, which will get integrated with transporters’ system to generate an e-way bill and load with minimum intervention. The success of the e-way bill system depends on correct implementation at the ground level,” said Praveen Dhabahi, chief operating officer, Payworld.

Others questioned the very relevance of the e-way bill under the goods and services tax system. An effective invoice-matching system, aided by technology, could actually create an environment, where one would not need an e-way bill to monitor movement of goods, either within or outside the state, they added.

“If today the GST Council introduced invoice matching, there would be tighter reconciliation between sales and purchase data of buyers and suppliers.

"The same data could be made available to transporters and tax officials guarding state boundaries, which would help them keep a tab on the inter-state movement of goods,” said Tejas Goenka, executive director, Tally Solutions.

While authorities and large businesses are well prepared for the e-way bill, some small and medium enterprises (SMEs) are not sure about its processes and various other aspects, added ClearTax chief executive officer Archis Gupta.

Between 2.6 million and 5 million bills were expected to be generated per day once it started, said Sudhir Singh, managing director, MargERP. “We expect a smooth roll-out,” he added.

Karnataka has notified simultaneous roll out of the bill for intra-state movement of goods too. However, Goods and Services Tax Network officials said the system would generate bills only for inter-state movement.

“It would be good to have an unequivocal clarification stating that intra-state transactions were not contemplated now for any state,” said M S Mani, partner of Deloitte India.

It was necessary for a new concept like the e-way bill to stabilise before it was extended to cover movements of goods within a state, he added.

Bills for intra-state movements of goods were originally scheduled to be introduced in a phased manner later in April.