| « Back to article | Print this article |

How TCS helped Ratan Tata grow his empire

Apart from his vision, what helped Ratan Tata pursue his global dreams was the phenomenal success of Tata Consultancy Services, which is 74 per cent owned by Tata Sons.

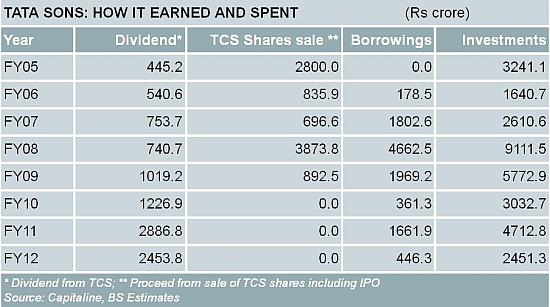

Beginning with its initial public offering in August 2004, which helped Tata Sons raise around Rs 2,800 crore (Rs 28 billion), TCS indirectly funded the bulk of investments by Tata Sons in key group companies as they went out to conquer the world.

The numbers speak for themselves. Since 2004, Tata Sons has invested Rs 34,000 crore (Rs 340 billion) in various group companies, including unlisted ventures.

During the period, Tata Sons earned around Rs 10,000 crore (Rs 100 billion) as dividend from TCS; another Rs 9100 crore (Rs 91 billion) was raised by selling TCS shares (including IPO).

A further Rs 11,500 crore (Rs 115 billion) came from borrowings largely secured by pledging shares of TCS, the group's most valuable company.

So, if not for TCS, Tata might have had to either scale down his global ambitions or the funding cost of big-ticket global acquisitions would have stretched the group's balance sheet to unsustainable levels.

Click NEXT to read more...

How TCS helped Ratan Tata grow his empire

Investment bankers agree. "The majority control of TCS gives great financial firepower to Tata Sons. The recurring cash from TCS and the market value of TCS provided Tata Sons the cushion to absorb minor losses if the bet didn't work out in the short term," said Dara Kalyaniwal, vice-president, investment banking, at Prabhudas Lilladher.

He is not exaggerating. Tata Sons' stake in TCS is currently valued at around Rs 1.8 lakh crore (Rs 1.8 trillion), nearly 6 per cent of which was pledged at the end of September.

In comparison, Tata Sons' holding in all listed group companies is currently valued at around Rs 2.4 lakh crore (Rs 2.4 trillion).

TCS has a policy to distribute 30-50 per cent of net profit as dividends, in four quarterly pay-outs. In FY10, however, it distributed 55 per cent of consolidated net profit and 70 per cent of its standalone net profit as equity dividend, by way of a special dividend.

Ratings agencies recognise the power of TCS, which, they say, plays a significant role in Tata Sons enjoying AAA ratings, helping it to borrow at the lowest possible rate of interest.

"The ratings reflect Tata Sons' exceptional financial flexibility which arises from its ability to raise additional funds by sale or pledge of TCS shares," said CRISIL, while assigning top rating to Tata Sons' non-convertible debenture programme in November.

Icra holds a similar view. "AAA ratings incorporate Tata Sons' strong financial flexibility despite increase in the debt levels to support funding requirement of its investee companies," said the agency.

Click NEXT to read more...

How TCS helped Ratan Tata grow his empire

The group's globalisation drive and its appetite for inorganic growth have closely followed the rise of TCS in the last 10 years. And, as TCS got bigger, so did the ambition of its chairman. The holding company has smartly leveraged the future cash flows from TCS (as dividends) to borrow and support various group growth plans.

A consistent financial performance by TCS and its high market valuation enabled Tata Sons to act as the investor and lender of last resort to group companies.

For example, when Tata Motors' Rs 4,145-crore (Rs 41.45 billion) rights issue in October 2008 devolved on promoters and Indian Hotels Company's rights issue in 2008 received muted response from retail and institutional investors.

TCS also enabled Tata to see new businesses and nearly half of the Tata Sons portfolio is accounted for by its investment in unlisted subsidiaries.

As of now, there is no sign of any slowdown in the TCS cash machine. In the first half of the current year, net profit jumped 43 per cent, while revenues were up by 36 per cent on a consolidated basis.

This has translated into handsome gains for shareholders, including Tata Sons, which has already received Rs 3,175 crore (Rs 31.75 billion) in the first six months, 30 per cent more than what it earned during the whole of FY12. More will come in the last quarter.