| « Back to article | Print this article |

Why is Flipkart raising so much money

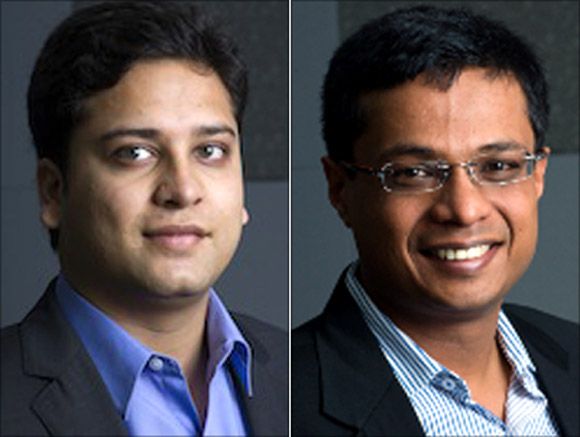

It has notched up more funds than any other e-commerce venture to strengthen its technology and supply chain as it prepares to hold its ground against Amazon, note Anusha Soni and Nivedita Mookerji

When top online retailer Flipkart raised $200 million in July, it was asked a pertinent question: Why did the company go to its existing investors rather than new ones?

While Flipkart pointed out that the move showed confidence of the current investors in the company's future, rivals and analysts argued it was a decision made due to lack of options.

“Existing investors were finding it tough to exit, so they decided to re-invest.”

Three months down the line when Flipkart went to the market again to raise $160 million, it faced a new question: “Why does it need funds so soon?”

To that, Sachin Bansal, chief executive and co-founder of the company, says the money had to be raised for ‘technology and supply-chain expansion to reach more and more people’, adding that these are long-term goals.

The company has notched up a total of $540 million in funds over the last six years, $360 million of which has flowed in two tranches this year itself.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Pitched against Bansal’s explanation is the analysts’ point that there is too striking a gap between funds raised by Flipkart and other e-commerce players.

For instance, Myntra, an inventory-led e-commerce player in the fashion space, has raised only $75 million over multiple rounds so far, a fraction of Flipkart’s tally.

Its investors are Tiger Global, IDG Ventures, Kalaari Capital and Accel Partners.

Tiger Global and Accel Partners have invested in Flipkart as well.

Myntra started operation in 2007, the same year as Flipkart, in the on-demand product personalisation space and migrated to seasonal fashion wear and lifestyle e-commerce by the end of 2010.

Another leading e-commerce company following the marketplace format, which did not want to be named, has been around for more than three years but has raised just about $200 million, not even half of Flipkart’s total.

While there are reports that Snapdeal, another marketplace player, may go for a fresh round of funding to raise $150 million to $200 million from eBay, Japanese Internet firm SoftBank and some private equity investors, the market place model in general is seen as more efficient in terms of fund requirement than the inventory-led model, which is considered to be a revenue-guzzler.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Switching models

Flipkart, which had an inventory-led format, recently announced a shift to the marketplace model, which is about hosting many retailers on a single online platform. However, industry sources reason that Flipkart may still not have left the inventory-based format and, therefore, it requires significant investments.

Major players like Amazon, eBay and Snapdeal opted for the marketplace route in India as foreign investment is permitted in that format, unlike in the inventory-led model. Bansal, however, doesn’t think too much about the format.

“Inventory versus non-inventory model is not a debate.

The focus should be on reliability,” he had said in an earlier interview to Business Standard.

On the latest infusion of $160 million a few days ago, the Flipkart chief executive points out that “it was not a different round of funding”.

He says the July round of $200 million and the one in October should be seen together. “The existing investors came on board faster as compared to the new investors.

“The new investors took some time. It takes time to understand each other as we were talking to multiple people.”

One criticism levelled against Flipkart is that it is using up funds too quickly, especially as nobody else in the industry has raised as much money as it has.

Bansal, however, steers clear of such debate.

Click NEXT to read further. . .

Why is Flipkart raising so much money

If the market is growing at 100 per cent and Flipkart grows at 30 per cent, it’s not a good growth, according to him.

“What is important is that we are in the investment phase.

“We are building infrastructure and core pieces.”

Flipkart, which started off as an online book store six years ago and has widened its product offerings since then, is building technology that can handle ten times more traffic than it does right now.

“This requires change in everything from the website to the delivery mechanisms.

“Each phase of our growth will require further development of the existing technology. “For example, we are developing in co-ordination with our partners, technology like Ezetap.

“It can work through a dongle that can be plugged into smartphones and tablets and customers can then swipe their cards to make the payment when the delivery boy gives them their product,” says Bansal.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Spending spree

On the supply-chain side, the company is building physical infrastructure.

For example, it is looking at expanding the number of warehouses from six at present, building some in Tier II cities and expanding the existing ones.

It is also scouting for partners in the warehouse segment.

Besides, Flipkart says it is building a software that will help customers track their orders.

“We will be able to track the delivery boy and the route he is taking to deliver products. We are also building mobile applications that can help delivery boys find routes, and take payments on the phone,” says Bansal.

Apart from that, the funds would go into back-end systems that manage data flows.

On the logistics side, the company is developing technology that can help optimise the existing network of courier services. Investing in training its people, currently pegged at 2,500, is a focus area as well.

Flipkart will be in an investment phase for at least the next two years, Bansal states.

Does that mean then that it will return to the market again soon to raise funds?

“Funding is not on the top of our mind right now.

“It is unlikely that we will raise funds next year,” says Bansal.

But there are other goals he has keenly set his eyes on. The foremost among them is to make Flipkart a billion-dollar company in gross merchandise volume by 2015.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Many experts tend to believe that the entry of American online major Amazon in India has triggered the fund-raising frenzy at Flipkart.

“It’s no surprise that e-commerce players would want to invest more after Amazon’s entry. Worldwide, we have seen the impact that Amazon can have,” says Saloni Nangia, president, Technopak Advisors, a retail consultancy.

But she adds that e-commerce holds a lot of promise in the long-term, and therefore this is the time to invest in the future.

Nangia says e-commerce is a technology-driven game and in that sense Flipkart has its priorities right.

Agrees Pinaki Ranjan Mishra, partner & national leader for consumer products and retail, EY (earlier Ernst & Young).

“Logistics and supply chain are among the most critical investment areas for an online company,” he says.

Only that will make the service faster and better, he adds.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Promising future

E-commerce, which is now a minuscule portion of the $500-billion Indian retail market, is set to be the fastest growing channel in the sector.

On why other online retailers are not raising as much money as Flipkart, Nangia says, “Each company has its own set of plans and aspirations.”

Also in a slow market, most e-commerce companies have found it challenging to raise funds, with many players falling by the wayside in the process.

Will Flipkart, which is now being valued at over $1.5 billion, manage to use the hundreds of millions it has raised the right way and emerge as India's Amazon?

Or, is it on just a high-burn track with no focus on profitability?

The great opportunity versus the high-risk game should soon be in full play.

Only then will there be a clear answer to these questions.

Click NEXT to read further. . .

Why is Flipkart raising so much money

Funds raised by e-commerce firms ($ million)

Flipkart - 540

Myntra - 75

Mydala - 6

Timeline of funds raised by Flipkart amount and investors

2013: $360 mn in 2 phases

$200 mn in July from Naspers, Accel Partners, Tiger Global & Iconiq Capital

$160 mn in October from Dragoneer Investment, Morgan Stanley, Sofina, Vulcan Capital, Tiger Global

2012: $150 mn from Naspers, Tiger Global, Accel Partners

2011: $20 mn from Tiger Global

2010: $10 mn from Tiger Global

2009: $1 mn from Accel Partners