| « Back to article | Print this article |

Why India, China are hot spots for VC/PE investors

Benefits of VC/PE investments

Venture Capital investments are early-stage monetary investments made in new start-up firms that have a high growth potential.

Not only do Venture Capital and Private Equity investments provide efficiency in business processes and ensure high level of corporate governance, they provide access to capital for business.

The enhanced visibility that the company gains due to association with high profile investors, positively impacts its top and bottom lines.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

VC/PE investments become a preferred source of funding for Indian firms

The Indian VC/PE industry made a slow start in the late 1980’s under the encouragement of financial institutions like Industrial Development Bank of India, Industrial Finance Corporation of India and Industrial Credit and Investment Corporation of India Ltd.

The Indian Government framed venture capital investment guidelines in 1988, followed with guidelines for foreign investments in 1995. Many international VC firms entered India during 1995-2000.

Some of the early entrants were Technology Development and Investment Corporation of India Ltd (TDICI) and Gujarat Venture Finance.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Chinese firms follow suit in their preference for VC/PE investments

The Chinese VC/PE industry is almost as old as its Indian counterpart. Most of the VC/PE investments were made by foreign companies and institutions.

In the early 2000s, the Chinese government enforced foreign investment restrictions accompanied with regulations related to investment vehicles. This slowed down the growth of the VC industry.

In the subsequent years, the Chinese government amended some of the existing regulations. This led to gradual and significant developments in the industry.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Development of the VC/PE markets in both countries are broadly classified into three phases

In the “Early Years” (2000-2004) there were very few successful deals and transactions. Growth in the number of investments, exits and fund size was modest. The investment cycles became longer and M&A was the typical exit strategy.

The “Boom Years” (2005-2007) were characterized by a significant increase in the volume and number of transactions. Exit strategies evolved, with IPOs becoming the most preferred in China and Trade Sales in India. Short investment cycles became the order of the day.

The “Crisis Years” (2008-2010) witnessed a significant drop in the volume of investments from and a continuous decrease in the number of IPOs.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

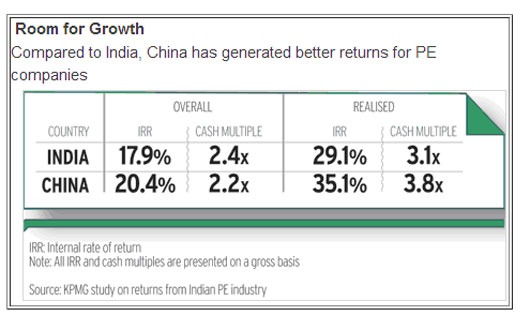

India and China have become attractive destinations for global VC/PE investors, but China has shown better returns Despite growth in domestic investments, both India and China in recent times have attracted international investments. The Asian PE investors have been earning returns which have met or surpassed expectations.

Despite growth in domestic investments, both India and China in recent times have attracted international investments. The Asian PE investors have been earning returns which have met or surpassed expectations.

Factors like overall consistent economic growth and macroeconomic conditions in the two countries have attracted many foreign investments.

Other contributory factors were, increase in the number of experienced management teams, successful exits which made investors confident about the safety of their funds and returns, plus an increase in the volume of investments and number of transactions.

However, according to a KPMG study, returns from the Chinese PE industry have outshone returns from its Indian counterpart.

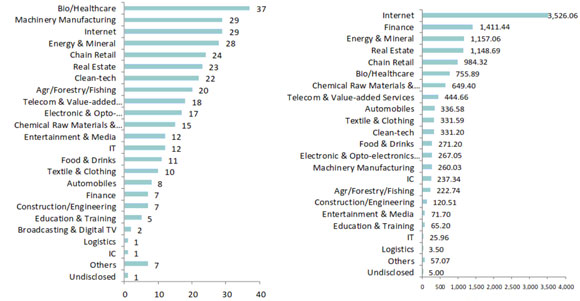

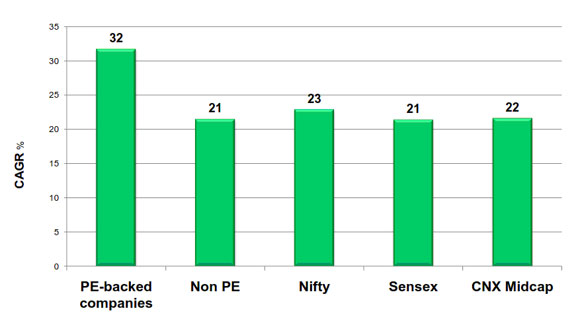

Graph: KPMG Study on Indian PE industry

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

India is steadily competing with China to emerge as leader of the Asian VC/PE market

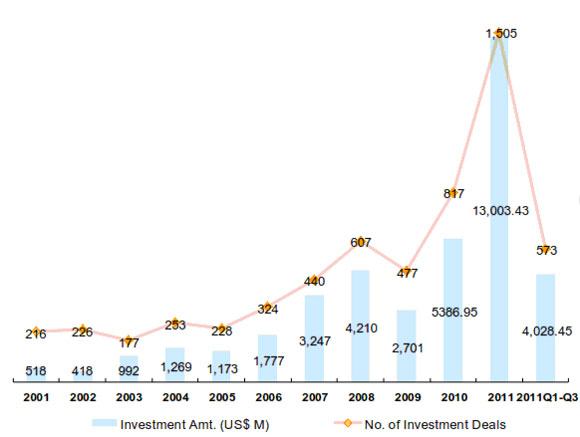

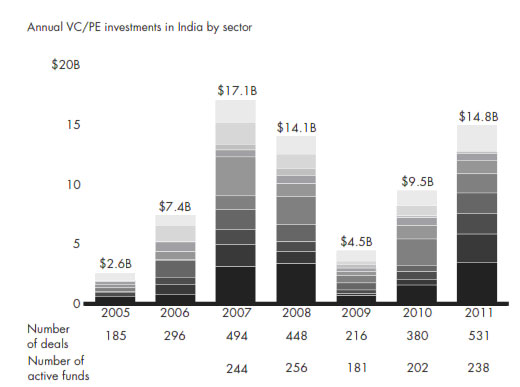

According to the Bain India PE Report 2011, India’s was the fastest growing market for VC and PE investments in the year 2011.

According to the Bain India PE Report 2011, India’s was the fastest growing market for VC and PE investments in the year 2011.

Most Indian companies seeking VC investments are in the early stages of growth and belong to the low and medium market range. Most of the investments in the industry are through foreign endowment funds, sovereign funds and other wealthy investors.

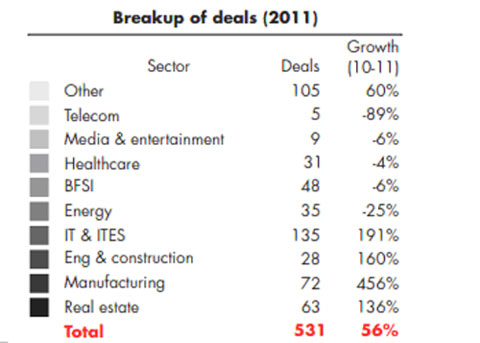

PE Investors brought in investments worth $14.8 Billion in 2011, which was a straight increase of 55 per cent compared to 2010. With a total of 531, the number of closed deals in 2011 was up by over 40 per cent.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

VC/PE funded firms perform better than their non VC/PE funded peers in India

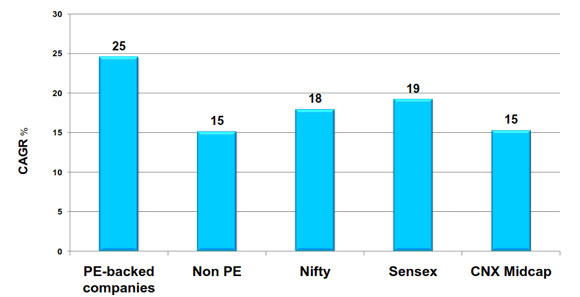

When compared on different economic performance parameters such as sales, profitability, exports, labour wages, and R&D, VC/PE backed firms have consistently performed better than their non VC/PE funded peers. They registered a higher CAGR over a period of 10 years from 2000-10.

When compared on different economic performance parameters such as sales, profitability, exports, labour wages, and R&D, VC/PE backed firms have consistently performed better than their non VC/PE funded peers. They registered a higher CAGR over a period of 10 years from 2000-10.

Given the better performance of VC/PE funded firms, not only did the total VC investments display an upward trend, the number of exits declined dramatically by 30 per cent in 2011.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Factors contributing to the success of VC investments in India

Firstly, given the volatile economic environment in India, promoters do not have much confidence in equity as a capital raising tool for businesses. Thus, VC investments have become a good substitute for equity.

Secondly, the increasing cost of funds, coupled with high cash reserve ratios, has led to high interest rates. This has made debt markets unattractive for promoters seeking funds.

The third factor, which has encouraged promoters seeking VC/PE funds, includes business challenges related to volatile supply and demand situations, pricing pressures, etc. The VC/PE investors not only infuse the requisite capital, they also bring to the table vast expertise and business networks, and help companies meet different business challenges.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Current environment prevalent in the Indian VC/PE market

The prospects of the Indian VC/PE industry have been brightened by considerable initiatives by the Indian government. Income tax announcements in the second quarter of 2012 included reduction in the capital gains tax and deferrals.

The announcement also proposed rationalization of the General Anti Avoidance Rules (GAAR) and regulation of the Alternative Investment Funds (AIF) by SEBI.

However, the Indian VC/PE industry still has a long way to go. The number of large scale investment opportunities in India is only 500; opportunities available in China and USA are 1150 and 3500 respectively.

Click NEXT to read more...

Why India, China are hot spots for VC/PE investors

VC/PE industry in China is on a high growth trajectory

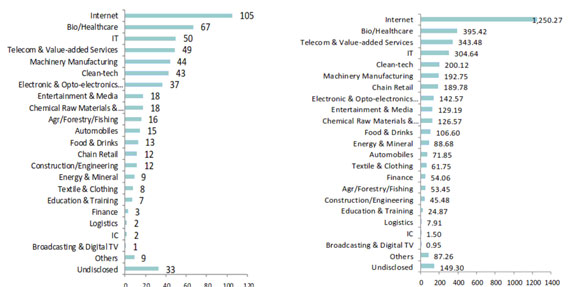

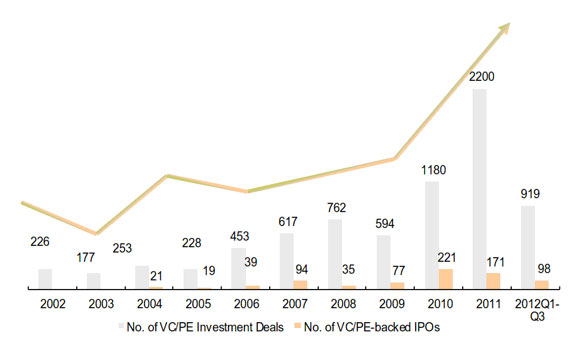

Starting with a modest 100 transactions per year up till 2003, China has established itself as one of the premier players in the emerging VC/PE industry. By end 2007, the number of deals surged to 719.

There are now more than 6,000 VC/PE firms in the country. China’s most popular financial districts, Beijing and Shanghai, account for over three-quarters of the total VC deals and a third of the invested value.

In a short span of about 15 years, the VC/PE industry in China has experienced an exponential increase in AUM, volume of investments in target companies, and also in the number of domestic and foreign investors.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Surge in domestic and international VC/PE fundraisers in China

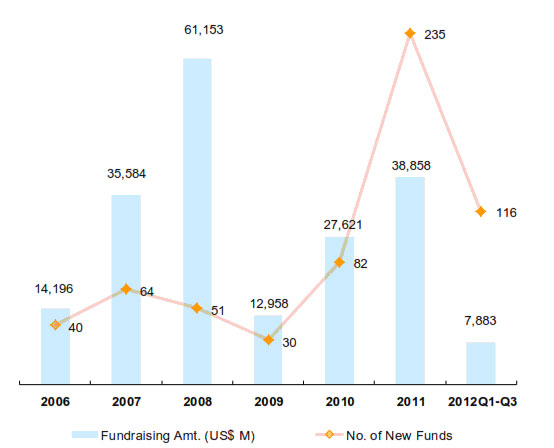

Since 2006, Chinese PE/VC firms have invested approximately $126 billion in multiple small and medium sized companies from different business sectors and domains.

During the same period, over $261 billion was raised through foreign and domestic investors, with majority funds being raised by domestic managers.

Despite the growth, the number of foreign firms investing in the domestic currency, RMB, is still small. Most international groups, particularly from the US are increasingly managing both RMB and USD funds.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Current environment prevalent in the Chinese VC/PE market

A significant development in the Chinese VC/PE industry was the launch of “ChiNext” in 2009,which like NASDAQ is a stock exchange for small and medium sized start-ups funded by VC investors.

About 60 percent of the SMEs listed are backed by RMB funds, hence providing the investors with exit options like IPOs.

Another notable development is the Chinese government’s decision to allow institutions to invest in VC/PE funds.

For example, the China Insurance Regulation Commission (CIRC) has allowed the Chinese Insurance Companies to invest up to 4 percent of their assets in domestic PE funds. This could potentially free assets worth $33 billion for PE funds.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

A significant development in the Chinese VC/PE market has been the growth in the number and amount of funds raised in the domestic currency (RMB).

Of the total investments in 2010, the RMB denominated funds accounted for 60 percent of the total VC funds and 40 percent of the PE funds.

A remarkable development in 2012 was that out of the total funds, about US$2.81 billion was raised through 74 RMB funds and US$567 million was raised through five foreign currency funds.

Click NEXT to read more...

Why India, China are hot spots for VC/PE investors

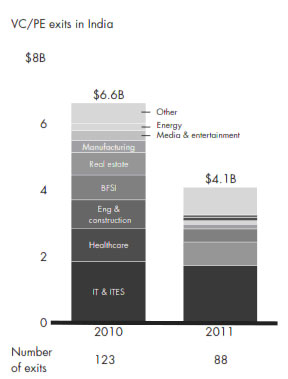

Exit by VC/PE firms in India

Where 2010 witnessed 123 exits by PE investors, 2011 recorded only 88 such exits. This trend continued in Q2 of 2012 as there were only 11 closure announcements which to $0.8 billion.

The dull environment in the exit market can be attributed to weak public markets. The primary reason for this was the premium valuation of deals done during the recessionary period of 2008-09. Such high valuations made it difficult to achieve attractive exit IRRs.

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

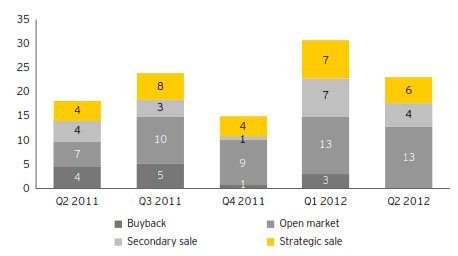

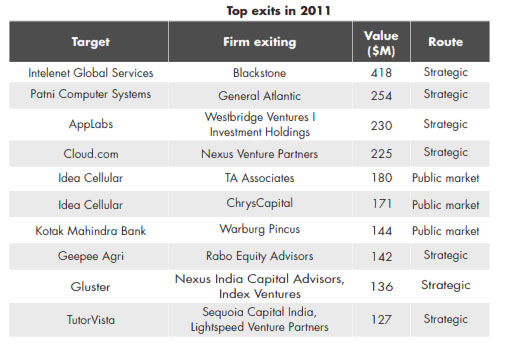

Exit strategies prevalent in India Exit options mostly preferred include buy back, IPO, M&A, open market and secondary sales. Considering that the PE investors have a minority stake, the funds are dependent on how they agree to the timing and terms of exits.

Exit options mostly preferred include buy back, IPO, M&A, open market and secondary sales. Considering that the PE investors have a minority stake, the funds are dependent on how they agree to the timing and terms of exits.

When there is a phase of less investments and successful exits prevalent in the market, most managers seem to be anxious about the liquidity of their investments.

Attributing to the weak public markets, the number of exits through the IPO route reduced, leading the way to secondary sales and buybacks.

Open market exits became the most preferred non-IPO exit route in the Q1 and Q2 of 2012. However, a strong Indian PE industry requires an active and strong IPO market.

Top exits in 2011: Bain India PE Report 2012

Click NEXT to read more…

Why India, China are hot spots for VC/PE investors

Exit scenario in China

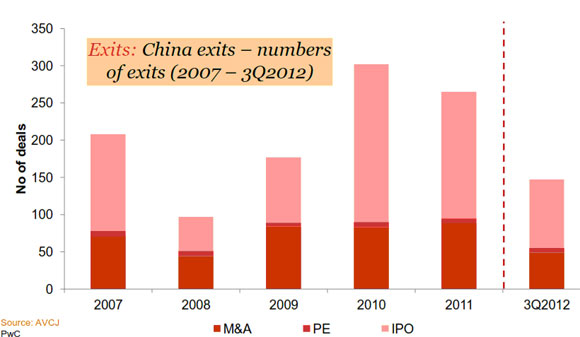

The exit scenario in China was very limited and slow until 2003. The period between 2003 and 2005 recorded several PE exits with a surge in exits reported in the first phase of the investments.

The reason for this was attributed to the persisting bull phase in the market.

The first peak in the exit activity was recorded in 2007. The reported 167 exits in 2007 were 6.5 times the exits in 2003. From then on, IPOs became the most preferred exit route. Out of the total exits, 94 exits were through IPOs. M&A has also emerged as an attractive exit option.

Click NEXT to read more...

Why India, China are hot spots for VC/PE investors

Exit strategies prevalent in China

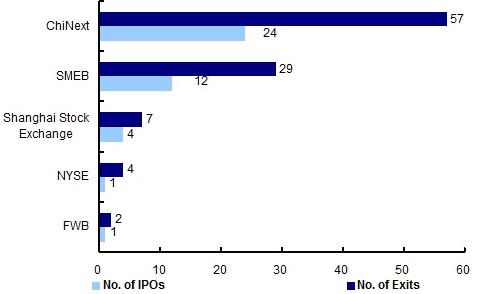

The trend of choosing IPO as an exit option continued in 2012. IPOs accounted for 77.34 percent of the total 128 exits in the year. The largest PE backed IPO in 2011 raised over $855 million and was achieved by NYSE listed Renren, which was backed by the PE investors General Atlantic and DCM.

The trend of choosing IPO as an exit option continued in 2012. IPOs accounted for 77.34 percent of the total 128 exits in the year. The largest PE backed IPO in 2011 raised over $855 million and was achieved by NYSE listed Renren, which was backed by the PE investors General Atlantic and DCM.

Secondary sales and M&As are non-IPO exit channels that have become prominent in China.

Most PE backed companies are considering listing themselves on the domestic “ChiNext” stock exchange rather than going abroad.

This trend can be attributed to the Chinese Government’s efforts at strengthening their VC/PE industry through undertaking many investor friendly measures such as improving governance and transparency.

Graph: No. of VC/PE deals and VC/PE backed IPOs in China during 2002-12

Source: PwC Report on China’s VC/PE Industry, 2012

Nupur Pavan Bang is senior researcher, Centre for Investment, Indian School of Business, Hyderabad. She can be reached at: Nupur_bang@isb.edu