| « Back to article | Print this article |

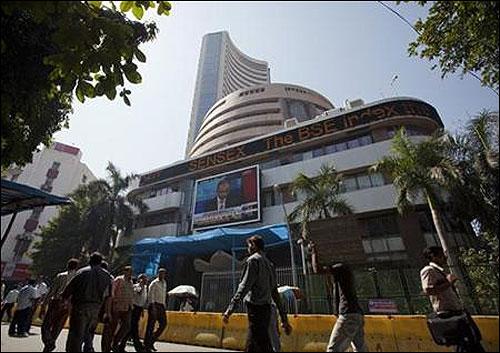

Sensex loses 88 points, Nifty ends below 6,000

Markets extended losses to end lower for the seventh straight day on profit taking in index heavyweights.

The 30-share Sensex ended down 88 points at 20,194 and the 50-share Nifty ended down 28 points at 5,990.

The rupee firmed up against the US dollar and was trading at day's highs in late noon trades at 63.42 compared with TUesday's close of 63.71. The rupee firmed up on widespread speculation the Reserve Bank of India may be considering extending its swap facility window to provide dollars to state-run oil companies.

Asian stock witnessed selling pressure on Wednesday on emerging signs that the US Fed may start unwinding its monetary stimulus measures sooner than expected. Nikkei ended marginally lower by 0.15% while Hang Seng and Shanghai Composite were down nearly 2% and Straits Times was down 0.4%.

European share were also trading lower in early trades as investors turned cautious on signs that the US Fed decision may start reducing its bond-buying programme. The CAC-40, DAX and FTSE were trading 0.3-0.9% lower.

The BSE Realty was the top loser among the sectoral indices on the BSE down 1.1% followed by FMCG, IT, Bankex, Capital Goods and Oil and Gas indices. Auto, Consumer Durables and Metal indices ended marginally up.

TCS ended down nearly 2% at 2,049 on the NSE contributing the most to the Nifty's decline today.

On the BSE, ITC contributed the most to the decline on the Sensex. ITC ended down 1.7%, HDFC Bank fell 1.8%, TCS ended 1.7% lower and Reliance Industries ended down nealry 1%.

Other Sensex losers include, L&T and Bharti Airtel.

Tata Motors ended up 1.6% contributing the most to the gains on the Sensex. Other Sensex gainers include, Hindustan Unilever, Tata Steel and ONGC.

SBI ended up 1.3% after the PSU banking major reported 11% growth in net interest income during the second quarter.

M&M ended nearly 2% up after the auto major reported nearly 10% growth in Q2 net profit at Rs 989.50 crore compared with Rs 901.80 crore in the same quarter last fiscal.

Sun Pharma ended up 1.6% ahead of its second quarter earnings due later today.

Among other shares, Tata Global Beverages has dipped 6.6% to end at Rs 144 after reporting a 51% year-on-year (yoy) growth in consolidated profit to Rs 180 crore for the quarter ended September 30, 2013 (Q2) due to exceptional gains of Rs 92 crore. The company had profit of Rs 119 crore in the corresponding year-ago period.

Bata India has surged 1.6% to end at Rs 967 after its parent company Bata BN BV acquired about 1% stake of the company through open market transaction.

Symphony has rallied 5.2% to end at Rs 398 after the consumer durables firm has tied up with Carrefour in Indonesia for selling Symphony air coolers.

Aban Offshore gained 2.4% to end at Rs 243 on reporting a strong 58% year-on-year (yoy) jump in consolidated net profit at Rs 77.68 crore for the second quarter ended September 30, 2013(Q2). The company engaged in exploration and production business had profit of Rs 49.24 crore in a year ago quarter.

The BSE Mid-cap and Small-cap indices were both down 0.6% each.

Market breadth ended weak with 1,381 declines and 1,050 gainers on the BSE.