| « Back to article | Print this article |

FM's roadshow: Hints at new taxes in upcoming Budget

Expect fiscal consolidation and some new taxes in the upcoming Budget

The spectacle of a finance minister going on a roadshow to woo foreign investors is rare. It is rarer when that roadshow takes place just about a month before the Union Budget is to be presented.

The significance of Finance Minister Palaniappan Chidambaram addressing investors in Hong Kong and Singapore last week lies in that context and, therefore, should not be underestimated.

In the 1990s, Manmohan Singh avoided such roadshows. He did go on one in the latter half of 1991, but after presenting his first Budget in July that year.

On his way back after attending the World Bank annual meeting in Bangkok, he stopped over at Singapore and told groups of foreign investors how he planned to steer the Indian economy and reform its economic laws.

Later, he visited Tokyo with the same purpose. But none of those visits took place so close to the Budget as is happening now.

One reason finance ministers avoid such meetings before the Budget is the Indian Parliament's convention, propriety and requirement that Budget ideas should remain a secret till they are unveiled before the Lok Sabha members.

So, finance ministers hold many meetings with stakeholders before the Budget but are rarely seen making any comment that indicates their thinking on the proposals their Budget speech would contain. It is a risk that most finance ministers avoid.

Click NEXT to read more...

FM's roadshow: Hints at new taxes in upcoming Budget

But Chidambaram is a veteran politician and knows well how not to violate the Budget-related conventions. In August 2012, he began his third stint as finance minister and what he will present next month would be his eighth Budget.

Yet, the various statements attributed to him during his meetings with investors in Hong Kong and Singapore reveal a lot about the broad trend of ideas that would influence his next Budget. A quick look at these would be instructive.

Barely four weeks before presenting his Budget, Chidambaram is supremely confident about meeting the revised fiscal deficit target of 5.3 per cent of gross domestic product.

A few weeks ago, most analysts, commentators and even a few officials within the government were extremely doubtful about this promise. What has given Chidambaram the confidence to claim now that he would still meet his target?

Two possibilities exist: One, he has succeeded in ensuring a massive expenditure compression by the various Central ministries.

Going by what the financial advisors in many central ministries are saying, Chidambaram has cut expenditure hugely and is going to reap the benefit of that through a lower fiscal deficit.

Two, several items of expenditure, particularly under the subsidies head, may be rolled over to the next financial year.

Click NEXT to read more...

FM's roadshow: Hints at new taxes in upcoming Budget

Remember that in his earlier stint as finance minister in the United Progressive Alliance government, he would present large chunks of the government's subsidies Bill as off-Budget items.

This gave the Budget a better fiscal deficit number, but there was no real gain for the government's finances. This year, he is not likely to take the subsidies off-Budget once again.

But do not rule out a postponement of expenditure on such subsidies on the ground that decisions on raising prices of subsidised items like petroleum products and fertilisers have already been taken, which would reduce the overall subsidies burden next year and, therefore, the deferred burden could be absorbed in the course of the next year.

It is also clear from his recent reported statements that the finance minister is likely to adopt a two-pronged taxation strategy in his next Budget.

One, he is not likely to introduce any tax proposal that upsets or adversely influences financial investors. He has managed to get the ghost of the general anti-avoidance rules (GAAR) out of the way by postponing its enforcement until 2016.

Given the nature of the modified GAAR regime, the main beneficiary of that move would be financial investors. With that, he expects to ensure that foreign financial flows keep coming so that his most pressing concern arising out of a widening current account deficit is addressed.

Click NEXT to read more...

FM's roadshow: Hints at new taxes in upcoming Budget

Higher portfolio flows would help the government bridge the current account deficit that may continue to give the finance minister sleepless nights as India's exports show no signs of revival and imports of crude oil continue to rise.

Even gold imports may not see any significant fall although the Customs duty on the yellow metal has been raised.

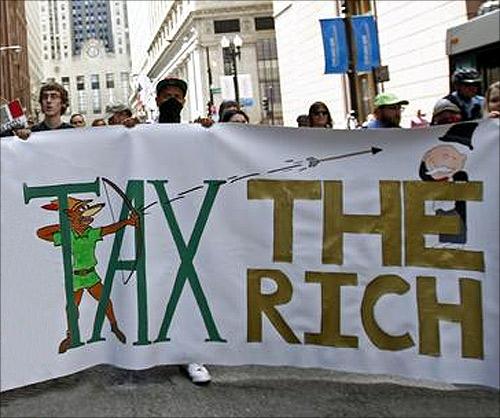

Two, the finance minister may not raise tax rates in line with his promise of providing a stable taxation regime, but that does not mean he would give up on his plans to introduce some new taxes. He loves introducing new taxes.

This year it could take the form of a super-rich tax and to soften its impact on the vocal urban middle class, he may fix a much higher income limit than what most people are talking about.

An inheritance tax is also being talked about, though both this and the super-rich tax would be able to raise insignificant amounts of additional revenue.

Far more could be garnered by better tax administration and plugging leaks in revenue collection. But remember, such new taxes would go down well with the aam-aadmi political philosophy of the Congress party, whose concerns, too, have to be addressed by the finance minister.

So, next Budget, expect fiscal consolidation and some new taxes.