| « Back to article | Print this article |

The amount for which free check-up is offered can be quite low, while in some policies it comes only after a considerable waiting period, reports Priyadarshini Maji.

Nowadays, many insurance companies advertise free health check-up as one of the key attractions of their policies.

Regular check-ups can help in the early detection of ailments, and are especially valuable in a country where people don't go for regular check-ups on their own.

However, before you buy a policy for its free checkup feature, examine the details closely.

Treatment of any illness at a later stage costs a lot more than if it is detected at the initial stages. Regular health check-ups can help in early detection.

"Keeping in mind the increased occurrence of lifestyle-based ailments, it is advisable to undergo a health check-up at least once every year," says Anuj Gulati, MD and CEO, Religare Health Insurance.

Such check-ups can also make you more aware of your health situation.

Says Naval Goel, CEO, PolicyX.com: "They help you understand how your healthcare needs are changing due to growing age, and allow you to make changes to your existing health insurance policy at the right time."

You could, for instance, hike your sum assured with growing age.

According to the Insurance Regulatory and Development Authority of India (IRDAI), health insurance penetration in India currently stands at 3.49 per cent.

An industry expert informed that less than 10 per cent of policyholders avail the free health check-up benefit from their insurers.

Normally a full body check-up from a clinic or hospital costs around Rs 1,600 to Rs 3,000. Policyholders should follow up with their insurance companies once a year or during renewal and avail of this benefit.

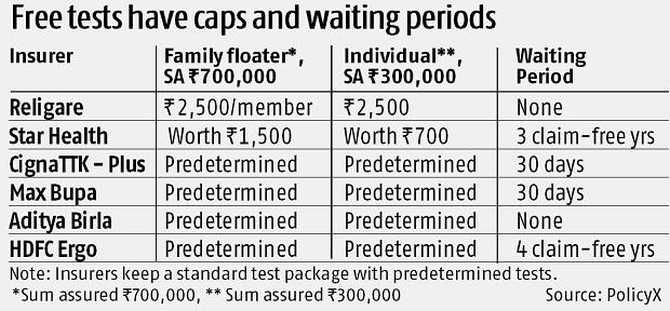

The amount for which free health check-up is offered varies between an individual and a family floater policy, and also from one insurer to another (see table). Often, this feature comes with a waiting period.

HDFC Ergo General Insurance, for instance, provides it after a waiting period of four years.

Religare Health Insurance, on the other hand, offers it from day one.

Sometimes the value up to which the free check-up is provided can be quite inadequate for all the insured members of the family.

A family floater policy by Star Health insurance, with a sum insured of Rs 300,000, provides health check-up of a meagre Rs 750 for all the members of the family.

Another catch is that the amount of free health check-up that insurers provide depends on your initial sum insured.

If the sum insured rises due to no-claim bonus, it doesn't result in the value of the free health checkup also rising commensurately.

In some policies, this may not be an annual feature but may only be offered once every two years.

Apollo Munich, for instance, provides free checkup worth one per cent of the sum insured, up to Rs 5,000 per insured person, once after every two continuous years.

Experts suggest that though this feature provides the much-needed health check-up free of cost, it shouldn't be a major determinant while buying a health insurance policy.

Other features such as exclusion of pre-existing diseases, claim process, waiting period, network of hospitals, pre- and post-hospitalisation cover, and lifetime renewal should play a bigger part in making this decision.

"This may be an essential feature for young families and aging elders who need regular check-ups. For others it is just a perk to encourage regular checkup without having to worry about burning a hole in their pocket," says Vaidyanathan Ramani, head-product and innovation, Policybazaar.com.

The basic coverage provided by a health insurance policy should be the primary consideration while choosing a policy, adds Ramani, whereas additional benefits such as free health check-up should be given only secondary consideration.

Illustration: Uttam Ghosh/Rediff.com