| « Back to article | Print this article |

Scooters, once the fastest growing sub-segment, also declined for the second consecutive month in September.

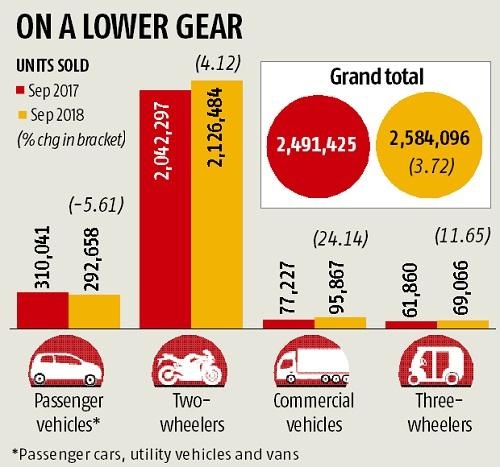

Passenger vehicles, the most valuable segment of the domestic automobile industry by revenue, reported a decline of 5 per cent in September, when other segments -- two-wheelers, three-wheelers and commercial vehicles -- registered growth.

The overall automobile industry's domestic sales rose 3.72 per cent last month to 2.58 million units.

According to data released by the Society of Indian Automobile Manufacturers (Siam) on Friday, the passenger vehicle (cars, utility vehicles and vans) segment reported a decline of 5.61 per cent in September domestic sales to 292,658 units.

This was the steepest monthly decline in the first half of this fiscal year, and the third consecutive month of decline.

In the first half (April-September) of the year, the PV industry has grown 6.88 per cent to 1.74 million vehicles, even though the second-quarter volume slipped more than 3 per cent.

Rajan Wadhera, president of Siam, said the growth of near 7 per cent in H1 is not very different from the 7.9 per cent growth registered in the whole of FY18.

"We had estimated FY19 growth to range from 9-11 per cent. The actual rate may be at the lower end of this band. The outlook is positive for H2 of the year," he said.

He explained that festivals like Navratri and Diwali will help growth in PV and two-wheelers during October and November.

Within the PV segment, the biggest sub-segment of cars reported a decline of 5.57 per cent to 197,124 vehicles.

Utility vehicles declined more than 8 per cent to 77,378 units. Vans happened to be the only sub-segment to report a growth of 7 per cent. All the leading producers -- Maruti Suzuki, Hyundai, M&M and Honda -- reported a decline. The industry measures dispatches to dealerships as sales.

Two-wheelers, the biggest segment of the industry by volume, reported a growth of 4 per cent in September. The sub-segment of motorcycles grew at 7 per cent to 1.36 million units.

Scooters, once the fastest growing sub-segment, declined for the second consecutive month in September.

Scooter volumes dipped 3 per cent to 660,000 units. In H1, two-wheelers grew at 10 per cent to 11.56 million units, driven by a 13 per cent surge in motorcycle volumes. Scooters grew 5 per cent in H1 to 3.75 million units.

"The rural demand is driving motorcycle growth, while scooters have been little changed," said Wadhera.

Source: Siam

Three-wheeler volumes grew more than 11 per cent to 69,066 units. Besides three-wheelers, commercial vehicles (CV) was the only other segment to report a double-digit growth last month. Total CV sales rose 24 per cent to 95,867 units. The sub-segment of medium and heavy CVs grew 26 per cent to 39,208 units last month. The light commercial vehicles (LCVs) grew 23 per cent to 56,659 units.

The first half has been one of the strongest for CVs in recent years. The industry reported growth of 38 per cent to 487,316 units.

Medium and Heavy Commercial Vehicles (M&HCVs) reported growth of 48 per cent to 190,795 units, while LCVs expanded 32 per cent to 296,521 units.

"While demand for M&HCVs is gaining traction on the back of pick-up in construction activity, healthy demand from core sectors like cement and steel, the LCV segment has benefited from healthy consumption-driven demand as well as better financing avenues," rating agency ICRA said.

Wadhera said the industry is seeing headwinds in the form of fuel prices, but in a relief, commodity prices have started softening or stabilising.

"The growth story of the automobile industry will continue in H2 due to festive purchases and rural demand. Every manufacturer is looking forward to a good festive season," said Wadhera, who is also president (automotive sector) of Mahindra & Mahindra.