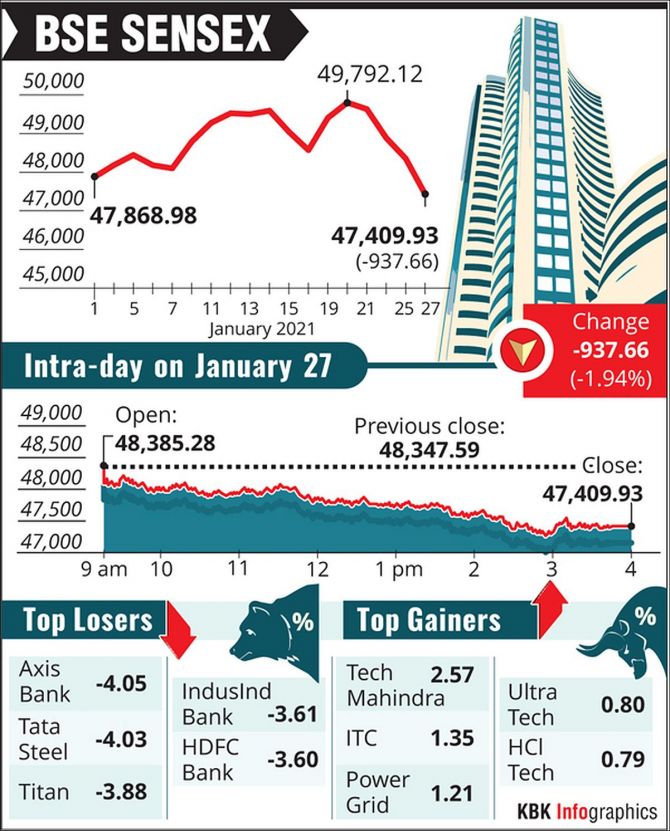

Axis Bank, Titan, IndusInd Bank, HDFC Bank, Dr Reddy's, HDFC and Asian Paint were major losers, shedding up to 4.05 per cent.

On the other hand, Tech Mahindra, ITC, PowerGrid, UltraTech Cement, HCL Tech and Nestle India rose up to 2.57 per cent.

The BSE benchmark Sensex crashed 938 points to slip below the 47,500-mark and the NSE Nifty plunged below the psychological 14,000-level due to rampant selling across counters amid foreign fund outflow.

Marking its fourth straight session of loss, the Sensex tumbled 937.66 points or 1.94 per cent to settle at 47,409.93 – taking the aggregate four-session loss to 2,382.19 points or 4.78 per cent.

Intraday, the BSE gauge swung 1,117.65 points.

Likewise, the NSE Nifty plunged 271.40 points or 1.91 per cent to close the session at 13,967.50.

Over the last four sessions, the 50-share index has lost 677.20 points or 4.62 per cent.

On the Sensex chart, 24 shares closed in the red and 6 in the green.

Axis Bank, Titan, IndusInd Bank, HDFC Bank, Dr Reddy's, HDFC and Asian Paint were major losers, shedding up to 4.05 per cent.

On the other hand, Tech Mahindra, ITC, PowerGrid, UltraTech Cement, HCL Tech and Nestle India rose up to 2.57 per cent.

Of the 19 sectoral indices, barring FMCG index all ended with losses.

Among the major losers were banking (2.93 per cent), finance (2.72 per cent), metal (2.54), realty (2.28) and auto (2.11 per cent).

Broader smallcap, midcap and largecap indices fell as much as 1.87 per cent.

Analysts said investors of late have preferred taking profits off the table ahead of the Union Budget and futures and options (F&O) expiry.

Foreign institutional investors (FIIs) sold equities worth Rs 765.30 crore on a net basis in the Indian capital market on Monday, exchange data showed.

"It is well-known that a fall in FIIs inflows will be the biggest risk to the liquidity-driven rally. Indian bourses mirrored mixed sentiment from global peers with a downward rally owing to consecutive days of FII selling,” said Vinod Nair, head of research at Geojit Financial Services.

Global markets were mixed today ahead of the US Fed meeting amid uncertainty over the US stimulus, he said, adding that higher volatility in the coming days is expected, given pre-budget event risk.

Indian equity markets were closed on Tuesday for the Republic Day.

Elsewhere in Asia on Wednesday, stocks ended mixed as investors turned cautious after Wall Street slipped from record levels.

On the forex market front, the rupee ended 2 paise higher at 72.92 against the US dollar.

Photograph: PTI Photo