| « Back to article | Print this article |

A forensic audit commissioned by the Forward Markets Commission has found National Spot Exchange Ltd gave away Rs 1,700 crore as returns during its life span.

A forensic audit commissioned by the Forward Markets Commission has found National Spot Exchange Ltd gave away Rs 1,700 crore as returns during its life span.

According to regulatory officials, this sum, around 30 per cent of the Rs 5,600 crore (Rs 56 billion) the exchange owes to 13,000 investors, was paid using the money brought in by new investors, as trades on the platform did not generate actual returns.

“An unpermitted financing scheme was being run on the NSEL platform, wherein NSEL was allowing the defaulting buyers to get more money and fresh money was being brought in to ensure the earlier members were not exposed,” said a senior regulatory official.

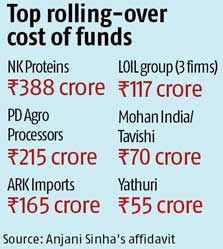

While some borrowers are prepared to pay the original amount they borrowed, they are not prepared to pay the extra amount the exchange has added to their dues as “roll-over costs”, leading to disputes.

In negotiations with the aggrieved investors over the past few weeks, the exchange’s promoters, led by Jignesh Shah, have asked them to take a hair-cut. But investors have not agreed to this which has caused a deadlock.

Now, the settlement of investors’ dues could not be completed, unless there was a decision on who would foot this Rs 1,700-crore (Rs 17-billion) bill, the officials said.

Asked by Business Standard if NSEL had taken any decision on how to generate this sum, a spokesperson of the exchange indicated NSEL was not responsible for the repayment.

“This is not correct.

When an old investor exited, he exited with returns. His returns were funded by new investors, instead of defaulters.

This way, the old investor got the returns; it’s not NSEL that got the money.

In a way, old investors enjoyed the financing