| « Back to article | Print this article |

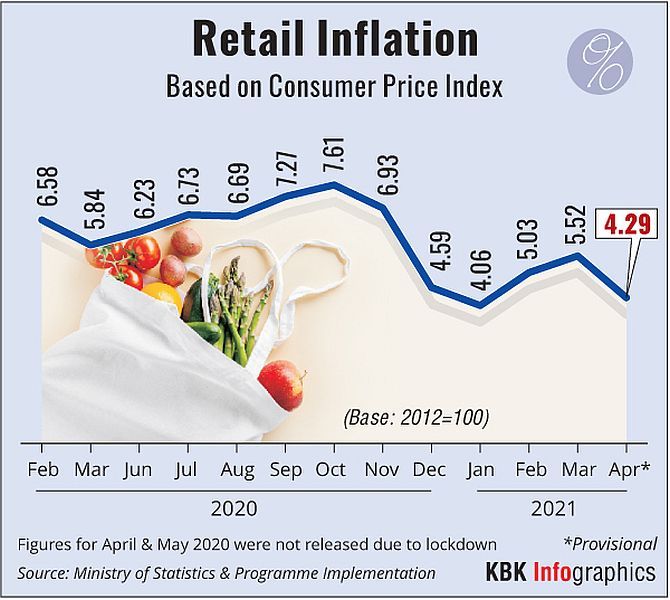

Retail inflation slipped to a three-month low of 4.29 per cent in April, mainly on account of easing of prices of kitchen items like vegetables and cereals, official data showed on Wednesday.

The Consumer Price Index (CPI) based retail inflation stood at 5.52 per cent in March.

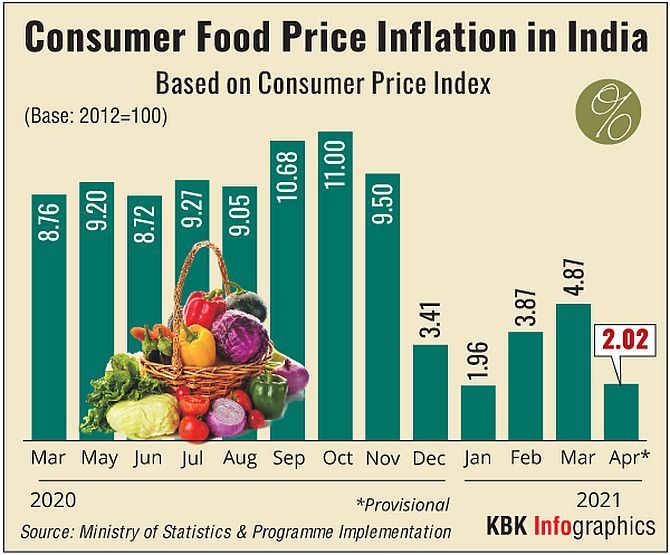

Food price inflation eased to 2.02 per cent in April from 4.87 per cent in the preceding month.

According to the data released by the Ministry of Statistics and Programme Implementation, the rate of price rise in the vegetables basket was (-) 14.18 per cent on an annual basis, sugar and confectionery (-) 5.99 per cent and cereals (-) 2.96 per cent.

CPI inflation had edged up to 5.5 per cent in March 2021 from 5 per cent a month ago on the back of a pick-up in food as well as fuel inflation, while core inflation too remained elevated.

Aditi Nayar, chief economist, ICRA Limited, said given the high base related to the supply disruptions seen during the nationwide lockdown in April 2020, the CPI inflation dipped to a three month low in April 2021, while printing somewhat higher than the expectations.

Overall, the prevailing localised restrictions appear to have had a limited impact on prices in April 2021.

"As the lockdown base fades away, we expect the CPI inflation to bounce back to an average of 5 per cent in the remainder of the first half of fiscal year 2021-22, ruling out the possibility of further rate cuts to support economic activity and sentiment.

"However, with the economic outlook remaining uncertain in light of the continuing pandemic, we expect the monetary policy stance to remain accommodative for much of 2021," she said.

The government had refrained from releasing the comprehensive retail inflation data for April 2020 as the nationwide lockdown prevented officials from collecting price data at various centres.

A lockdown was imposed in the latter part of March 2020 as the COVID-19 pandemic started spreading.

RBI, which mainly factors in the retail inflation while arriving at its monetary policy, had left the key lending rate (repo) unchanged last month on inflation concerns.

Earlier this month, RBI Governor Shaktikanta Das had said that going forward, a normal south-west monsoon, as forecast by the IMD, should help to contain food price pressures, especially in cereals and pulses.

The build-up in input price pressures across sectors, driven in part by elevated global commodity prices, remains a concern, he said.

The inflation trajectory over the rest of the year will be shaped by the COVID-19 infections and the impact of localised containment measures on supply chains and logistics, Das had said on May 5 while announcing measures to help the economy amid the second wave of the pandemic.

Photograph: Danish Siddiqui/Reuters