| « Back to article | Print this article |

Some of the country’s top real estate barons have lost the bulk of their fortunes in the past decade.

Some of the country’s top real estate barons have lost the bulk of their fortunes in the past decade.

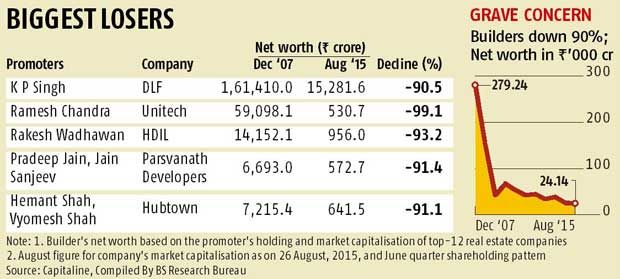

The combined net worth of the country’s 12 biggest real estate barons is down 90 per cent in rupee terms since the high of December 2007.

In dollar terms their wealth as measured by the market value of promoter stakes in listed realty companies -- is down 95 per from the peak (see chart).

With real estate prices expected to fall further, builders are likely to remain under pressure, says analysts.

Top builders are now worth Rs 24,000 crore ($3.8 billion), down from their combined net worth of Rs 2.79 lakh crore ($70 billion) at the end of December 2007.

The list includes DLF’s KP Singh, Unitech’s Chandra family and the Wadhawans of HDIL.

The analysis is based on the market capitalisation and promoter stakes of real estate companies beginning December 2007, when the BSE Realty Index and the broader market were at their peaks.

Since then, the BSE Realty Index is on a downhill journey defying two intervening bull-runs in March 2009-November 2010 and September 2013-August 2015.

The biggest loser among individual promoters is K P Singh, promoter and chairman of DLF Ltd. The value of his stake in the company is down from a high of Rs 1.61 lakh crore ($40.8 billion) in December 2007 to Rs 15,300 crore ($2.4 billion).

The Chandras of Unitech lost 99 per cent of their wealth with a meltdown in the stock price of their company. The Chandras are now worth Rs 530 crore ($81 million) from Rs 59,098 crore ($15 billion) in December 2007. The telecom spectrum scam and the arrest of the company’s managing director, Sanjay Chandra, made investors nervous.

The other big losers include Rakesh Kumar Wadhawan of HDIL, whose net worth is now down to Rs 956 crore ($147 million) from Rs 14,152 crore (Rs $3.5 billion) in December 2007.

Others who have lost a billion dollars (or Rs 6,000 crore) or more include the Jain brothers of Parsvnath Developers , Rohtas Goel of Omaxe, Ravi Purvankara of Purvankara Projects and Hemant Shah of Hubtown.

Big losers outside this list are Vinod Goenka and Sahid Balwa of DB Realty.

Their net worth is down from a high of Rs 7,142 crore (Rs 71.42 billion) in March 2010 to Rs 850 crore (Rs 8.5 billion) now.

“The blame goes to analysts who provided unimaginable valuations to developers during the boom on projected earnings that never materialised as companies began to maximise property prices rather than revenue and profitability,” says Pankaj Kapoor, managing director of Liases Foras.

As prices rose, home sales declined and builders began to pile up inventory, leading to cash flow problems.

Higher costs followed as landowners raised prices and authorities increased ready reckoner rates.

“The industry landed itself in a downward spiral of higher prices, lower sales and higher costs,” adds Kapoor.

As investors burned their fingers in realty stocks, promoters have taken out a large chunk of their money.

A back-of-the-envelope calculation shows that nine out of 12 promoters have cumulatively sold shares worth Rs 13,760 crore (Rs 137.6 billion) in their companies over the years. In addition, most promoters have pledged their remaining shares to lenders.

In addition, most promoters have pledged their remaining shares to lenders.

So it is mutual funds, financial institutions and retail shareholders who are left holding the can. DLF is an exception as its promoters have not pledged any part of their holding.

The future of the real estate sector remains grim.

Analysts say prices and demand will continue to remain under pressure due to oversupply and affordability.

The valuations of real estate companies have been affected by delays in cash flow break-even at project levels.

Liquidity tightening by the Reserve Bank of India and a volatile rupee are daunting investors.

“In the last two years, factors such as low income growth, rising debt, subdued industrial activity and an unrealistic increase in property prices have dented demand for property,” say Emkay analysts Dhananjay Sinha and Kruti Shah.