Governor Rajan once again surprised the market with a 50-bp rate cut, against the consensus 25-bp cut. The RBI now expects inflation to fall to 5.8% in Jan’16 and 4.8% in Jan-Mar’17. If this downshift plays out, there is room for another 50- to 75-bp rate cut in 2016. The Governor also indicated a shift in focus from policy rates to greater transmission of these rates. The move will be positive for interestrate-sensitive segments: durable and capital goods, but negative for the public-sector banks.

Governor Rajan once again surprised the market with a 50-bp rate cut, against the consensus 25-bp cut. The RBI now expects inflation to fall to 5.8% in Jan’16 and 4.8% in Jan-Mar’17. If this downshift plays out, there is room for another 50- to 75-bp rate cut in 2016. The Governor also indicated a shift in focus from policy rates to greater transmission of these rates. The move will be positive for interestrate-sensitive segments: durable and capital goods, but negative for the public-sector banks.

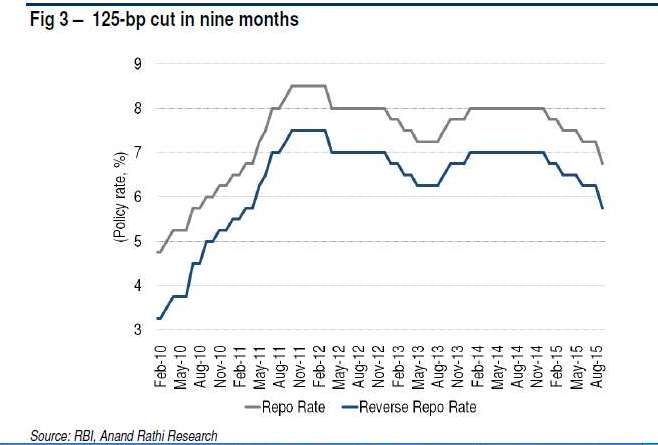

Policy rate slashed rate by 50bps. Governor Rajan continued with his approach of surprising the market, with a 50-bp cut in the policy rate on Tuesday.

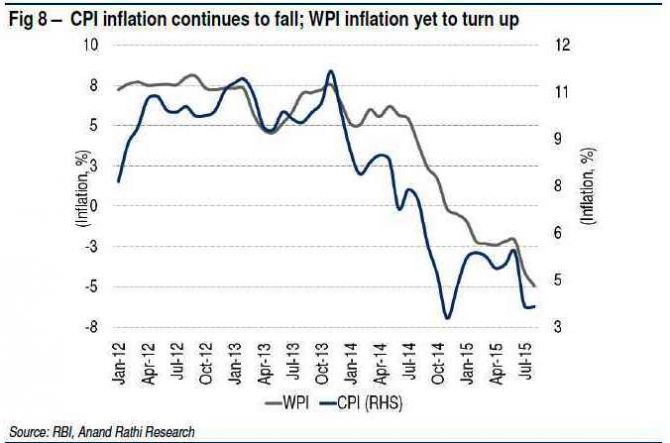

As forecasts suggest, the RBI is expecting a modest softening in growth and a prolonged period of low and falling inflation in 2016.

With these views, he ‘front-loaded’ the rate cut. Incidentally, this is the first 50-bp rate cut in three years (since Apr’12). In addition, the RBI maintained a largely dovish stance in its monetary-policy statement.

Downshifts growth and inflation projections. With the cumulative 125-bp policy rate cut in 2015 so far, we feel that further lowering of the policy rate this year is unlikely unless inflation and/or unexpectedly growth soften.

At the same time, the RBI expects CPI inflation to fall from 5.8% in Jan '16 to 4.8% in Jan-Mar '17.

If this pans out, we expect another 50- to 75-bp rate cut in 2016.

Outlook. The equity market immediately cheered the reduced policy rate.

Outlook. The equity market immediately cheered the reduced policy rate.

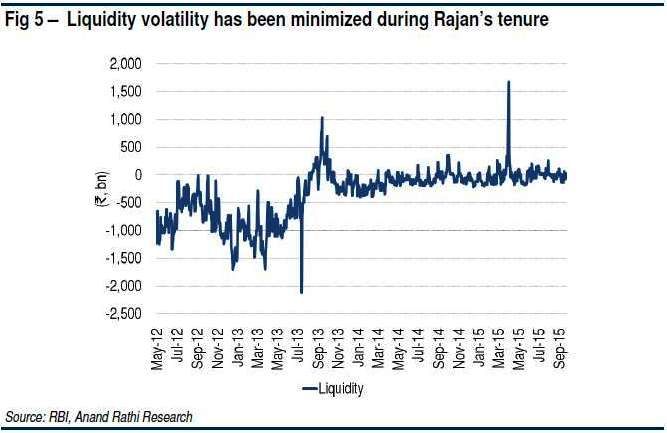

The governor indicated a shift in focus from policy rate cut towards greater credit market transmission of the cuts already effected.

This too would lead to further gains in the equity market, especially in interest-sensitive segments such as construction, capital goods, consumer durables including auto and real estate.

The stance could potentially be negative for banks, however, particularly public-sector ones with, inter alia, high cost-to-income ratios, higher credit costs and mounting employee compensation due to the recent 15% wage hike.

Recommendation. The announcements on Tuesday also largely support the debt market, with the raising of the foreign investment ceiling for government of India securities and a separate cap for foreign investment in state government securities.

Recommendation. The announcements on Tuesday also largely support the debt market, with the raising of the foreign investment ceiling for government of India securities and a separate cap for foreign investment in state government securities.

There are liberalisation measures for foreign investment in corporate debt as well.

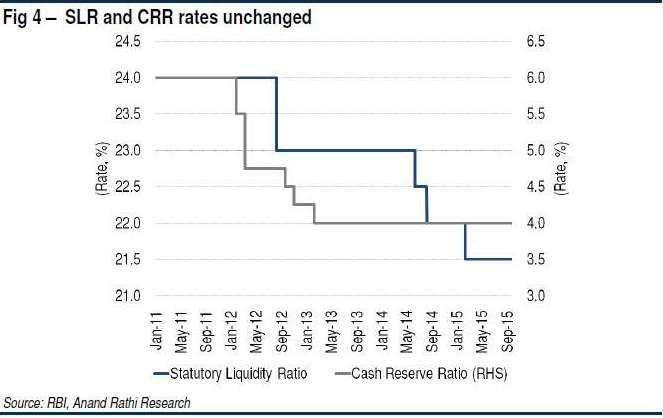

The reduction of SLR requirement is a potentially negative factor for the government-securities ratio; the progressive increase in the liquidity-coverage ratio under the Basel III requirements is a positive factor. And this impact is likely to be trivial.