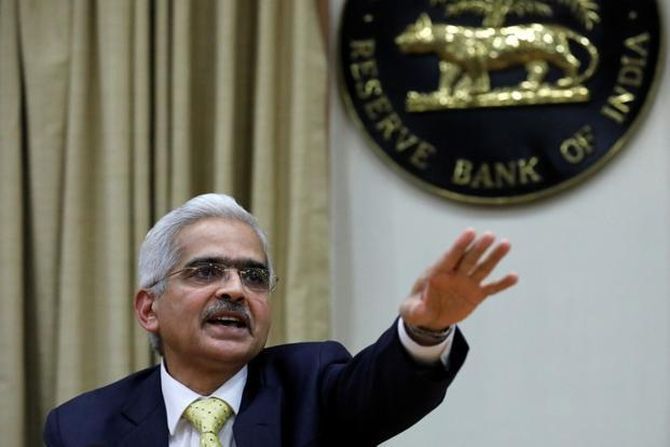

'The banking sector appears to be on course to recovery,' declares the RBI governor.

Anup Roy reports.

The bad assets problem of the banking sector in the country is receding for the first time since 2015, according to the bi-annual financial stability report for December, published by the Reserve Bank of India on Monday.

But the non-performing assets are still too high for comfort.

The banks showed an overall improvement with their gross NPA (GNPA) ratio declining from 11.5% in March 2018 to 10.8% in September 2018.

However, stress was still on the rise in mining, food processing, and the construction sectors.

'The banking sector appears to be on course to recovery as the load of impaired assets recedes. The first half-yearly decline in the gross NPA ratio since September 2015 and the improving provision coverage ratio, being positive signals,' RBI Governor Shaktikanta Das said in the foreword to the report.

Stress-test results showed banks had liquidity and should be able to withstand pressure, while there appeared to be greater discipline in credit assessment, higher sensitivity to market risk, and better appreciation of operational risks, Das said.

The Insolvency and Bankruptcy Code had brought a paradigm shift and had helped bringing in the much-needed discipline in the credit culture of the country, even as some of the resolutions lag behind the envisaged timelines.

'A time-bound resolution of impaired assets will go a long way in unclogging the credit pipeline, thus improving the allocative efficiency in the economy,' Das said.

While the system seemed healthy at present, there were risks nevertheless.

'Among the institutional risks, the asset quality deterioration of banks, risk on account of additional capital requirement, and cyber risk continued to be perceived as high-risk factors,' the report said.

On day-to-day liquidity requirements, 49 out of the 54 banks were found to be resilient in a scenario of assumed sudden and unexpected withdrawals of around 10% of deposits along with the utilisation of 75% of their committed credit lines.

However, banks under the prompt corrective action (PCA) framework needed capital to protect themselves from severe shocks.

For example, if the gross NPA ratio of 54 banks moves up from 10.9% to 14.9%, the system-level capital adequacy ratio (CAR) will decline from 13.4% to 11.1% and the core capital will decline from 11.2% to 9% for these banks.

However, 18 banks, including all 11 under the PCA framework, 'might fail to maintain the required CRAR (capital to risk weighted assets ratio)', if the gross NPA ratio increased by 4 percentage points.

These 18 banks had a share of 31.7% of total assets of all banks.

'As many as eight public sector banks under the PCA framework may have a CRAR below the minimum regulatory level of 9 per cent by March 2019 without taking into account any further planned recapitalisation by the government,' the report noted.

The banks under the PCA are now less risky, as the restricted framework had managed to reduce their systemic footprint.

'Lending and other restrictions imposed on the banks under the PCA framework have led to a reduced impact on the system through connectivity. This has reduced the contagion losses incurred by the banking system in case of the PCA banks' failure,' the report said, justifying the RBI's resolve to continue with the restrictive PCA framework.

Nevertheless, there was capital infusion in banks, leading to an improved credit expansion in September 2018, driven largely by private sector banks.

Non-banking financial companies (NBFC) had also increased their lending activities while 'the relative proportion of domestic bank and non-bank resources was almost evenly matched.'

Mutual funds had emerged as one of the largest financial intermediaries in providing funds.

However, the FSR sounded caution on the sector, considering the risk of credit concentration, as was evident from the recent Infrastructure Leasing & Financial Services saga.

MFs had about Rs 6,500 crore of the IL&FS group's exposure out of a total debt of around Rs 90,000 crore.

The degree of interconnectedness in the banking system had been declining slowly over the past five years.

MFs were the largest provider of liquidity in the system, with their gross receivables being around 36.5 per cent of their average asset under management.

The gross receivables were around Rs 8.34 trillion. The top three recipients of their funds were banks, followed by NBFCs and housing finance companies.

Banks asset quality might improve in 2019

Nikhat Hetavkar reports.

The quality of assets in the banking sector may improve in 2019, show stress tests conducted by the RBI.

Under the baseline scenario, the gross non-performing assets ratio (GNPA) ratio of all banks may come down from 10.8% in September 2018 to 10.3% by March 2019.

This could further fall to 10.2% in September, said the RBI's financial stability report.

RBI Governor Shaktikanta Das said the stress test results suggested further improvement in the NPA ratio though its current level remained still high.

The asset quality of public sector banks (PSBs), which have the highest concentration of non performing assets, at 14.8% in September 2018, may also see an improvement.

PSBs's GNPA ratio may decline to 14.6% by March 2019 under baseline scenario, whereas private banks's GNPA ratio may decline from 3.8% to 3.3% in March 2019.

The GNPA ratio of foreign banks under baseline scenario might also decline from 3.6% to 3.1% in March 2019.

Under the assumed baseline macro scenario, system level capital adequacy ratio (CRAR) is projected to come down to 12.9% in March 2019 from 13.4% in September 2018.

Further deterioration of CRAR to 12.1% is projected under severe stress scenario, according to the central bank.

If the GNPA ratio in the banking system increases by four percentage points, the system-level CRAR will decline to 11.1% while Tier-1 CRAR will decline from 11.2% to 9%.

Stress hit of this magnitude will mean that 18 banks, having a share of 31.7% of the banking systems's total assets might fail to maintain the required CRAR.

PSBs were found to be severely impacted with the CRAR of 16 of the 21 PSBs likely to go down below 9% in case of such a shock, said RBI.

Stress test on banks's concentration risk showed that if top three individual borrowers according to their stressed advances fail to meet their revised payment commitments, the impact was significant for 14 banks.

The same scenario with top three individual borrowers according to their exposures would severely impact 12 banks.

Stress tests on group borrowers reveal that as many as 14 banks will not be able to maintain their CRAR level at 9% if top three group borrowers fail to meet their payment commitments, the RBI report said.

The losses could be around 7.6% and 13.6% of the capital at the system level under the assumed scenarios of default by the top group borrower and by the top two group borrowers respectively.

A sector-wise stress test revealed that telecom will register the highest growth in NPAs followed by cement sector, said the RBI's stress test.

Institution scanning necessary after IL&FS crisis

Jash Kriplani reports.

Taking stock of the contagion risks posed by the Infrastructure Leasing and Financial Services (IL&FS) crisis, the RBI's financial stability report underlined the need for fine-tuning the oversight framework related to financial conglomerates (FCs) for more timely action.

'A risk-sensitive FC oversight regime where the intrusiveness of oversight of FCs is proportionate to a combination of the size of the entity and the likelihood of an adverse event (say, over a one-year horizon), may make possible remedial measures more timely,' the report said.

'Some of the suggestive trigger events for conducting an FC's assessment may be adverse rating action, unutilised credit lines falling below a certain threshold and bunching of maturing liabilities,' the report pointed out.

While the current Financial Conglomerate Returns (FINCON) submitted by FCs has an exhaustive list of information set, rhe report added such data is 'backward looking and may not capture emerging risks and vulnerabilities adequately.;

The IL&FS crisis posed serious ramifications for the financial sector with the group having as many as 301 subsidiaries. Financial intermediaries such as banks, insurers and mutual funds were directly or indirectly exposed to the group.

The complex structure added to the opaque nature of the group's financials.

The report highlighted the need to closely monitor conglomerates with such complex inter-group links.

'Complex and camouflaged inter-group linkages through credit support and potency of spillover effects in times of turmoil (through banking sector linkages) are thus becoming important considerations for identifying FCs in the Indian context,' the report said.

'In addition, it is also important to have an oversight of groups which are engaged in financial intermediation with significant spillover potential and yet have a significant part of their group revenue coming from non-financial businesses,' the report added.

The central bank also welcomed the market regulator Securities and Exchange Board of India's decision on enhanced disclosure norms for rating agencies.

'Sebi has recently overhauled the disclosures by Credit Rating Agencies (CRAs). The enhanced disclosures pertain to parent/group/government support, liquidity position (including forward looking measures for nonbanks like unutilised credit lines and adequacy of cash flows for servicing maturing debt obligation),' the report said.

'Incorporation of such disclosures in the analysis as also periodic discussions with the rating agencies will significantly enrich the quality of the quarterly analysis,' the report added.

Besides highlighting the need for closely watching FCs, the report underscored the risk of concentrated exposures for financial intermediaries such as mutual funds.

'Concentration of exposure in any portfolio has implications for the market stability. A diversified portfolio will be less risky compared to a concentrated portfolio of similar credit,' the report said.

While acknowledging the various safeguards put in place by Sebi, the report said it might be appropriate to consider investor-level concentration limit on the issuer of the debt papers as well.

Sebi, the report, added could consider putting in place a mandatory liquidity limit for the money market and liquid funds.

The RBI reiterated the need for further inter-regulatory co-ordination to 'identify possible regulatory arbitrage opportunities on account of regulatory gaps or perceived and real informational asymmetries amongst the regulators.'

Recapitalisation helps banks' credit flow increase in FY18

Subrata Panda reports.

Following the recapitalisation of banks undertaken by the government, the banking sector's share in the flow of credit increased sharply in FY18.

However, in FY19 (till mid-November), the relative proportion of domestic banks' share in the flow of credit and that of non-bank resources was almost evenly matched, the RBI's financial stability report stated.

Moreover, the report mentions that with regard to the flow of resources from domestic non-bank sources, the share of net credit of housing finance companies (HFCs) in the total flow of credit nearly doubled from 6.2% in FY14 to 11.7% in FY18.

The share of foreign resources in the total flow of credit to the commercial sector was between 16% and 19% with foreign direct investment (FDI) being the dominant contributor.

However, in the financial system, asset management companies-mutual funds (AMC-MFs) have been the largest provider of funds with gross receivables of Rs 8.34 trillion in the period ending September 2018 followed by the insurance companies which have gross receivables to the tune of Rs 5.09 trillion.

Schedule commercial banks, non-banking financial companies (NBFCs) and HFCs have been the top recipients of funds from AMC-MFs and insurance companies, the report mentions.

NBFCs, on the other hand, were net borrowers of funds from the financial system with gross payables to the tune of Rs 7.45 trillion and gross receivables amounted to Rs 56,000 crore till the period ending September, 2018.

'A break up of gross payables indicates that the highest amount of funds were received from the schedule commercial banks (SCBs) followed by AMC-MFs and insurance companies. The share of SCBs has been growing for the last few quarters,' the report said.

Moreover, housing finance companies were the second largest borrowers of funds from the financial system with gross payables around Rs 5.68 trillion and gross receivables of Rs 41,200 crore at the end of September 2018.

In the case of NBFCs and HFCs, long-term loans, long-term debt and commercial papers were the top three instruments through which they raised funds from the financial markets.

Also, following global cues of replacing unsecured inter-bank markets with secure funding line, size of the Indian inter-bank market has seen a continuous decline over the last few years as a proportion of total assets of the banking system.

Fund-based inter-bank exposures have declined from 4.6% to 3.8% of the total bank assets.

However, on the contrary, banks which were big lenders in the inter-bank market, are now lending a greater proportion to NBFCs and HFCs, the report further mentioned.

Public sector banks continued to be the biggest player as a group in the inter-bank market with a share of 53.1%, followed by private sector banks at 31.1% and foreign banks at 15.8% at the end of September 2018.