| « Back to article | Print this article |

EV players suggest a reduction in the goods and services tax on batteries from 18 to 5 per cent as it would help push demand.

The two-wheeler electric vehicle (EV) industry had started 2020 in power mode, thanks to the government's Rs 10,000-crore Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II).

New-age EV companies and traditional players such as Bajaj and TVS launched new EVs, and the industry had set itself an optimistic target of 2,50,000 units in FY 21 against 1,50,000 in FY20.

Inevitably, the lockdown slowed this momentum, but once restrictions eased, two-wheelers EV sales surged.

Society of Manufacturers of Electric Vehicles (SMEV) data shows that two-wheeler EV sales between April and December stood at around 80,000 units -- 3,000 units in Q1 (April-June), rising to 35,000 units in Q2 and 42,000 in Q3.

Against projected negative growth for the automobile sector as a whole, said Sohinder Singh Gill, global CEO, Hero Electric and Director-General, SMEV, two-wheeler EV sales will be flat or grow marginally.

Driving this relatively strong performance is the FAME II scheme. Under this, two-wheeler EVs will get a Rs 20,000 per vehicle subsidy to reduce upfront cost for the consumer.

The Centre has also permitted two-wheeler EVs to register without pre-fitted batteries, which accounts for 30 to 40 per cent of the cost.

Tarun Mehta, CEO at Ather Energy, in which the country's largest two-wheeler maker, Hero, has invested around Rs 500 crore since 2016, said 2020 was largely positive as awareness levels have gone up about EVs.

“The pandemic has changed the landscape of personal transport, and we hope that with high-performance alternatives available, people will choose electric vehicles for their daily commute,” he said, echoing an industry-wide view.

This trend has pushed companies to return to investment mode. For example, Ola recently announced that it would set up its first two-wheeler EV manufacturing plant at a cost of Rs 2,400 crore in Tamil Nadu, catering to both domestic and export markets.

This financial year, TVS Motor invested an additional Rs 30 crore in Ultraviolette Automotive, which is expected to roll out a high-performance e-motorcycle next year. In June, Hero MotoCorp put more money into Ather.

Recently, Naveen Munjal, managing director of Hero Electric, said his company would invest around Rs 700 crore over the next year or two to expand its Ludhiana facility to 250,000 units a year from the current 70,000-75,000 units. Hero Electric is also planning to set up a green-field facility in South India.

For the current fiscal year, Hero Electric -- Munjal is a cousin of the Hero Motocorp-owning family but has no business relations with it -- is targeting 10-15 per cent growth over last year's sales of around 50,000 units.

Munjal is confident of achieving the number despite challenges in the supply chain, including those caused by the farmer protests in Punjab and Haryana.

“People are looking at moving away from public transport and also looking at ease of use. The total cost of ownership has always been low, but now the pricing is also very aggressive and lenders have started looking at EV segments seriously,” he said.

This financial year has also seen nearly a dozen new two-wheeler EV launches by various players, including Bajaj and TVS. Royal Enfield is also working on an electric motorcycle.

Bajaj brought back the Chetak brand with an e-scooter. The Chetak Electric was launched on January 14, 2020.

The Urbane variant would cost around Rs 1 lakh and the premium variant Rs 1.15 lakh (ex-showroom Delhi).

The same month saw Ather roll out the 450X, and TVS launched the iQube priced at Rs 1.15 lakh (on-road Bengaluru).

In June, Ampere launched the Magnus Pro, and in October, Hero Electric launched the Nyx-HX range of e-scooters.

Gill said, in 2020, the “City Speed” segment -- e-vehicles that run up to 40-50 kmph -- emerged as a strong driver.

This segment used to account for seven to eight per cent of sales but it is expected to rise to 15 to 20 per cent in the next few years.

Hero Electric's “City Speed” segment features three electric scooters: Optima-hx, Nyx-hx and Photon-hx, which are priced at Rs 57,560 for a driving range of 70 km to 200 km against over Rs 60,000 for a 100 cc petrol two-wheeler.

Currently, low-speed two-wheeler EVs, which run up to 25 kmph, account for over 90 per cent of the market.

In terms of market, 2020 also opened up the B2B segment with plans from e-commerce players such as Amazon and Flipkart and some food delivery chains to acquire huge volumes of two-wheelers.

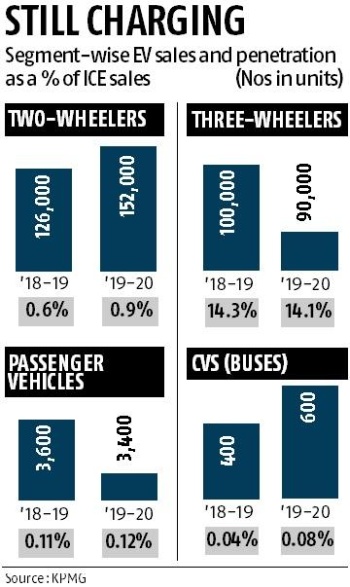

According to a KPMG-CII report, since the running cost of EVs is much lower than conventional vehicles with internal combustion engines (one-tenth in the case of two-wheeler EVs), a strong case emerges for a shift. The report expects two-wheeler EV market penetration at 25-35 per cent.

Though manufacturers have started seeing a surge in demand, they agree that a critical change in the FAME II scheme could be a force multiplier.

This is the removal of the “range criteria” for manufacturers to qualify for subsidies, said Gill.

FAME II stipulates that two-wheeler EVs must have a battery range of 80 km.

The industry contends that this is disruptive since most batteries have a 60 km range, which 90 per cent of customers want.

Besides, the cost differential between a 60 and 80 km range is around Rs 15,000, which unnecessarily ups the price.

EV players suggest a reduction in the goods and services tax on batteries from 18 to 5 per cent as it would help push demand.

Companies are also increasing localisation levels, which may have raised costs by 5-10 per cent in the short term, according to Gill, but will pay off in the long run as volumes increase.

For example, his company Hero Electric, has localised around 70 per cent and expects to increase it to around 80 per cent by April.

But industry-wide localisation is still slow and the dependence on China, especially for batteries, is high.

Right now, it's a chicken-and-egg situation: Until volumes touch half a million, investing in localisation makes no sense.

Feature Presentation: Rajesh Alva/Rediff.com