| « Back to article | Print this article |

PB Fintech, the parent of Policybazaar and Paisabazaar, has set a price band of Rs 940-950 apiece for its initial public offering (IPO), which will open on November 1 and close on November 3.

The company may be valued at around Rs 44,000 crore, and looking to raise an amount of around Rs 5,826 crore.

The IPO comprises a fresh issue of Rs 3,750 crore, along with an offer for sale (OFS) of Rs 1959.72 crore by existing promoters and shareholders.

According to the company’s draft red herring prospectus (DRHP), SVF Python II (Cayman) is offloading shares worth Rs 1,875 crore, and other shareholders will sell shares worth Rs 392.50 crore, of which Yashish Dahiya, chairman and chief executive officer of the company, will sell Rs 250 crore worth of shares.

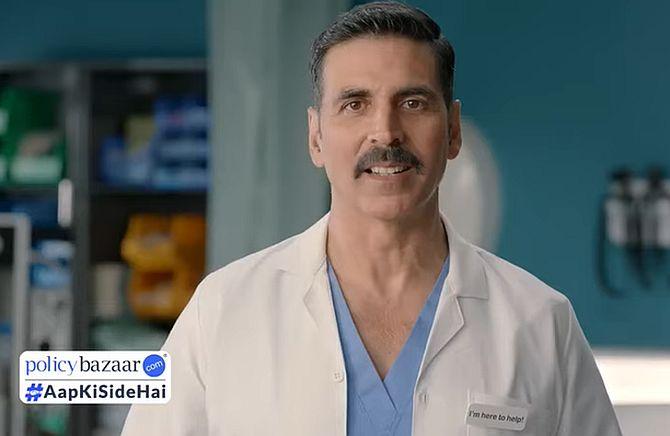

The company said it will use around Rs 1,500 crore out of the net proceeds to fund marketing initiatives over the next three years.

Further, it intends to utilise Rs 375 crore to expand the consumer base, including offline presence; Rs 600 crore for strategic acquisitions and investments; Rs 375 crore for expanding presence outside India; and some portion for general corporate purposes.

Kotak Mahindra Capital, Morgan Stanley, Citigroup Global Markets India, ICICI Securities, HDFC Bank, IIFL Securities, and Jefferies India are the book running lead managers to the issue.

Fino Payments Bank

Meanwhile, Fino Payments Bank’s Rs 1,200-crore IPO will open on Friday and close on November 2.

The bank has set a price band of Rs 560-577 per share.

The IPO comprises Rs 300 crore of fresh fundraise and 900 crore of secondary share sale by promoter Fino Paytech.

The bank will use the fresh proceeds to augment its tier-1 capital base to meet its future capital requirements.

Fino Paytech currently holds 100 per cent stake in Fino Payments Bank.

After the IPO, its stake is likely to fall to 70 per cent.

At the top end of the price band, Fino Payments Bank will have a market cap of Rs 4,800 crore.

This will be the first IPO of a payments bank.

PayTM, which too has a payments bank license, is expected to launch its IPO soon.