| « Back to article | Print this article |

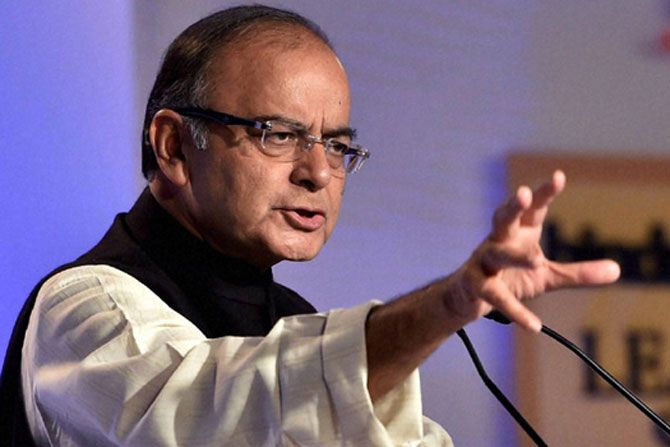

Breaking his silence over the Rs 11,400 crore fraud at India’s second-biggest bank, Punjab National Bank, Finance Minister Arun Jaitley on Tuesday said the state will chase down cheaters to the end even as he took the management of the lender to task for its failure to check the delinquents.

Without naming either the alleged kingpin of the fraud, billionaire jeweller Nirav Modi, or Punjab National Bank, Jaitley questioned the ethics of some businesses in the country and asked as to why the bank’s internal and external auditors could not detect the fraud which had been going on for 7 long years.

“It is incumbent on us as a state, till the last legitimate capacity of the state, to chase these people (fraudsters) to the last possible conclusion to make sure the country is not cheated,” he said.

Modi, whose diamond creations have draped Hollywood stars such as Kate Winslet and Dakota Johnson, and firms linked to him are alleged to have acquired fraudulent letters of undertaking from one PNB branch in Mumbai between 2011 and 2017 to obtain loans from Indian banks overseas. Investigative agencies have raided Modi’s properties and arrested bank employees.

Jaitley said the government had been step by step addressing issues like high-level of bad debts and need for more capital, but the effort has been put to challenge with the unravelling of the fraud.

He reminded the public sector banks that Prime Minister Narendra Modi gave managements the autonomy they needed with none from the government calling.

“When authority is given to the managements you are expected to utilise that authority effectively and in a right manner. Therefore the question for the management itself is were they found lacking? And on the face of it the answer seems yes they were,” he said.

The lenders, he said, were “unable to check who amongst them were delinquent”.

He went on to ask what the auditors were doing.

“Both internal and external auditors really have looked the other way or failed to detect,” he said.

Chartered accountants and those who control the discipline should start introspection and “say what legitimate actions are to be taken”, he said.

“And also there is an important challenge where the supervisory agencies are now to introspect as what are the additional mechanisms they have to put in place to ensure that stray cases don’t become a pattern again,” he said. “And stray cases are nipped in the bud and an example be made out of people that these bad examples itself are never to be repeated.”

Jaitley said frauds have a cost to the country as well as to the tax payer.

“It’s a direct cost and it has an indirect cost that it impinges on development, which impinges on the lending capacity of banks as an institution and therefore impinges upon developmental finance,” he said.

On the banking sector, the finance minister said financing for trade and businesses increases when banks have the ability to lend.

This ability over the past few years has faced challenges in increased bad debt or NPAs. “One of the direct consequences of this was that the ability of the state to spend and lend even for developmental activities itself will get curtailed,” he said.

After struggling to find solution, the government “finally hit upon the right point through the insolvency and bankruptcy code” that provides for recovery of due amounts through sale of assets of defaulters.

Jaitley said initial response to the Code has been encouraging.

Also, he said, government is infusing an unprecedented Rs 2.11 lakh crore capital in the banks.

“That decision itself as some of my friends in Parliament described also had moral issues because at the end of the day when NPAs become unacceptably high, you expect the taxpayer really to fund what unprincipled sections of the industry have been able to take out,” he said.

Stating that though there is a moral hazard in that kind of solution, he said there was no other option and government had to take that difficult course itself.

“As it seems, situation appeared to be coming on track (but) you have now again emerging challenges,” he said. “Therefore these emerging challenges eventually all strike at one of the big purposes, which is development and growth and the need for developmental banks itself. And the need for the increasing the capacity of the developmental finance itself. Any such system of banking really functions on trust.”

That trust is inherent in the lender-creditor relationship. “I think that relationship in India blurred itself out when a section, not so ethical a section perhaps thought that it was not its responsibility to pay back. And therefore we had to come back with hard solutions,” he added.