| « Back to article | Print this article |

Currently, Maruti Suzuki has 14 car brands, but it has decided to expand into some new segments.

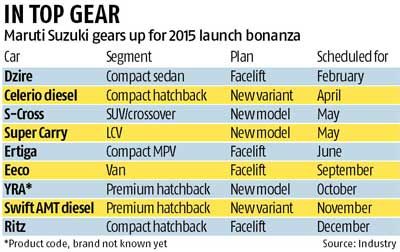

India’s largest carmaker Maruti Suzuki is gearing up for nine launches this year - three new cars and six upgrades and variants of existing models.

Last year, the company had launched the Celerio and the Ciaz apart from upgrades of the Alto K-10 and the Swift.

The launches this year include the ‘S-Cross’ crossover which could hit the roads in May and compete with the Renault Duster.

The light commercial vehicle ‘Super Carry’ is also scheduled for May, while the yet-unnamed ‘YRA’ premium hatchback will be launched around the festive season in October.

The YRA will be positioned above Maruti Suzuki’s popular Swift and compete with the new Hyundai i20 and the Volkswagen Polo. All of the above will be in segments where Maruti Suzuki is yet to be present.

The Celerio petrol, launched in January 2014, will see an 800-cc diesel variant being added around April. This will be the smallest diesel engine powering a passenger car in the market, and possibly the cheapest diesel car as well.

The Swift diesel will also see a new variant with automated manual transmission being launched closer to the end of the year. Meanwhile, the Dzire, Ertiga, Eeco and Ritz are all due for facelifts.

Currently, Maruti Suzuki has 14 car brands, but it has decided to expand into some new segments. With consumer demand this year expected to pick up after a two-year slowdown, a rejigged portfolio is likely to help Maruti Suzuki shore up its market share from the current 45 per cent in India’s 2.5 million units a year passenger vehicle market.

Maruti Suzuki Chairman R C Bhargava had told Business Standard in a recent interview that though fuel prices had dropped, car demand would start rising only when banks would pass on the interest rates cuts started by the RBI.  “My personal view is that from the middle of the year we should see an upswing happening for the industry; that is around the festival season. So far, the overall demand for cars has not improved very much. The increase in prices this month (upon an excise duty hike) for the short term will not help in boosting demand,” he said.

“My personal view is that from the middle of the year we should see an upswing happening for the industry; that is around the festival season. So far, the overall demand for cars has not improved very much. The increase in prices this month (upon an excise duty hike) for the short term will not help in boosting demand,” he said.

Responding to a query on the launches, a Maruti Suzuki spokesperson said, “We do not comment on future model plans.” Added Gaurav Vangaal, senior analyst for light vehicle forecasting at IHS Automotive, “Even in tough times Maruti Suzuki increased its penetration in the market, but this year they have more reasons to cheer as they are entering segments from small diesel cars to premium hatchbacks, from SUVs to LCVs; where they were not present last year. The additional volumes will come when the industry is banking on low oil prices, lower interest rates and positive momentum from last year.”

In times of a slowdown, new launches have been the primary drivers of demand. In 2014, Maruti Suzuki launched three vehicles: the Celerio, the Ciaz, the Alto K10 and an upgraded Swift. That helped domestic volumes grow 8 per cent to 1.15 million units in the year.

In times of a slowdown, new launches have been the primary drivers of demand. In 2014, Maruti Suzuki launched three vehicles: the Celerio, the Ciaz, the Alto K10 and an upgraded Swift. That helped domestic volumes grow 8 per cent to 1.15 million units in the year.

For Hyundai, the second largest player, recent launches such as the new i20 and Grand i10 constituted 50 per cent of sales last year - Hyundai sold 4,10,000 units in India last year. Honda was the other large player to show growth again on the back of launches such as the new City and the Mobilio MPV.