The consumer sentiment hasn’t been hit by the high import duty

Indian consumers’ appetite for gold has increased again, with imports in 2014-15 rising to a four-year high, close to levels seen in the pre-import control days of 2012-13.

Gold smuggled into the country, which has increased in the past two years due to a high 10 per cent import duty, is estimated at 200 tonnes a year by the World Gold Council.

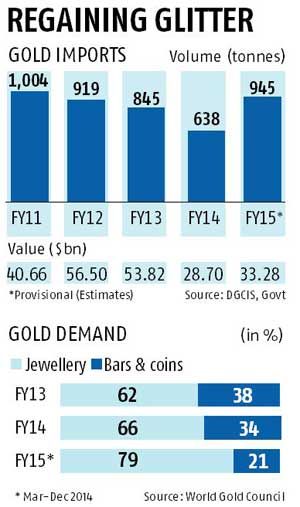

Gold import this financial year is estimated at 945 tonnes, based on gross import data released by the government; this is 48 per cent higher than 2013-14.

The import bill, however, is estimated to have increased only 16 per cent to $33.28 billion, owing to lower prices globally.

Most aren’t too concerned about the bill, as India’s overall current account deficit is under control due to a fall in the crude oil import bill.

In a departure from the past, demand for investment in gold has been replaced by demand for jewellery, as prices have fallen.

The consumer sentiment hasn’t been hit by the high import duty.

“As we have always maintained, controls might only harm the sector, not lead to reduction in consumption.

“The rise in gross imports is evidence to that.

“That said, it is important to acknowledge gold exports in various forms are estimated to have increased about 20 per cent compared to 2013.

“Therefore, the numbers are to be viewed on net terms, not gross terms,” said Sudheesh Nambiath, senior analyst (precious metals), GFMS Thomson Reuters.

In 2012-13, the ratio of jewellery demand to investment demand was 62:38, which changed to 66:34 in 2013-14.

But in 2014-15, investment demand fell significantly, with the ratio at 79:21, according to World Gold Council data.

Import this month is estimated at about 100 tonnes; many say this is double the import in February, due to an empty pipeline of stocks with jewellers.

Compared to the import bill of $1.98 billion in February, the bill for this month is estimated at about $4 billion. Imports this month are the highest since November 2014 (146 tonnes).

Though there was fear of more import controls, on November 28, the Reserve Bank of India) did away with the controls.

A major gold importer said the pipeline with jewellers was empty, as most expected a cut in import duty in the Budget.

However, as that wasn’t the case, import resumed this month.

Though many jewellers hope gold demand will improve further in the coming months, some say the recent spell of unseasonal rain and hail, which affected the rabi crop, will hurt demand in rural areas in the coming months.

Though many jewellers hope gold demand will improve further in the coming months, some say the recent spell of unseasonal rain and hail, which affected the rabi crop, will hurt demand in rural areas in the coming months.