The bottom line is that if you save regularly and you buy funds that fit your asset-allocation mix, you will do as well as, or better than, most professionals in the financial world. Yes, it's really that simple.

Creating a successful mutual fund portfolio - one that works for your particular life-style and family needs - is really quite simple, as the accompanying chart suggests.

I'm assuming you've made the crucial first step and that you're saving regularly according to your financial plan.

Next, focus on the time you have to invest and on your asset allocations. Then you can improve your position by picking ten winning funds. But the bottom line is that if you save regularly and you buy funds that fit your asset-allocation mix, you will do as well as, or better than, most professionals in the financial world. Yes, it's really that simple.

I list a range of five model portfolio here, but I could have used the same formula to create just three model portfolios, or ten portfolios, that fit along this same continuum. What's important is that you narrow it down to just one that works for your unique needs. These should get you started.

Income Preservation Portfolio

The "Income Preservation" portfolio is designed for investors with fairly immediate financial needs, usually less than two years, and/or those with a very low tolerance for market risk and volatility.

This portfolio relies heavily on fixed-income funds - bond funds, hybrid funds, and money-market (short-term) funds. Stock funds that fit this model would most likely be solid blue-chip growth funds with regular dividends.

Stability of current income and minimum risk of capital loss are of prime importance in an Income Preservation portfolio. Growth and capital appreciation are not. And the timing of investors' withdrawal needs is more important than their chronological age.

As a result, an Income Preservation portfolio may well be just as appropriate for a 65-year-old retiree as for a twenty-something grad student, assuming either one needs steady income and wants to minimize the risk of losing precious capital.

Here are recommended percentages of the types of funds that fit this portfolio model. You can go back and select the specific funds that fit your needs:

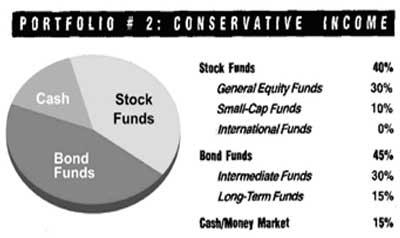

Conservative Income Portfolio

The "Conservative Income" portfolio is also designed for investors who require a steady income flow. However, these investors also want some growth and capital appreciation. Since such investors have at least two to four years before they need the money, they're willing to take some modest risks, although probably few.

Investors with this relatively short-term time frame and a higher risk tolerance may consider some higher-risk stock funds. However, big-cap, blue-chip funds are the safer, more likely choice. The Conservative Income model may be right for families saving to buy a new home in the relatively near future.

Again, here are recommended percentages of types of funds that fit this portfolio model.

Growth and Income Portfolio

This "Growth and Income" portfolio is structured for investors who want capital appreciation and don't need immediate income from their portfolio. Their tolerance for risk is moderate, and they often have a medium-term time horizon of five to seven years, which is longer than an average bull/bear market cycle.

These investors are willing to ride out near-term market fluctuations in search of reasonably solid growth and capital appreciation,

Conservative investors with this time frame should put most of their stock allocation in large-cap, blue-chip funds. Investors with a higher tolerance for risk would select a higher allocation of aggressive-growth and small cap, global, and even some sector funds. This portfolio may work for families putting aside money for a home or for a teenage child's college education.

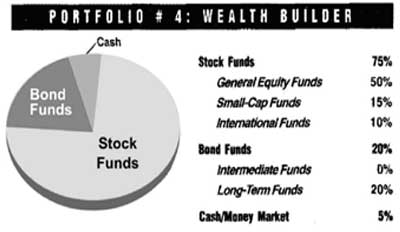

Wealth Builder Portfolio

The "Wealth Builder" portfolio is designed for long term investors seeking strong growth and appreciation in their portfolios. Because the time horizon of these investors is seven to eleven years, and possibly more, they are more interested in building future wealth than realizing current income. Returns are systematically reinvested.

This is a fairly aggressive portfolio, for mature couples planning ahead for retirement or young couples saving for their young children's college education. Investors with this time frame and a higher tolerance for risk may be willing to invest a larger percentage of their stock allocation in aggressive-growth, small-cap, sector, or global funds, rather than blue-chip domestic stocks.

Keep in mind, however, that statistics show that blue-chip funds offer returns fairly comparable to these alternatives, and with less risk. In fact, about two-thirds of all stock fund assets are in the middle-of-the-road growth, equity income, and growth and income peer groups.

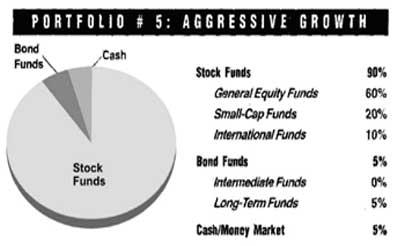

Aggressive growth

The "Aggressive Growth" portfolio is designed for an investor with a long-term horizon (a decade or more), plus patience and a strong tolerance for short-term risks and market fluctuations. Current income is not important.

These investors are responsible and disciplined, building portfolios for maximum long-term growth. They are willing to accept a high degree of risk and near-term volatility, while aggressively pursuing higher returns for the long haul.

The more risk-tolerant investors may buy a larger portion of aggressive-growth and small-cap, sector, and global funds. These investors are planning ahead for retirement, are very knowledgeable about investing, devote a reasonable amount of time to staying on top of the markets, and enjoy the game of investing.

[Excerpt from The Winning Portfolio: How to Choose the Best Mutual Funds. Published by Vision Books.]

(C) All rights reserved