| « Back to article | Print this article |

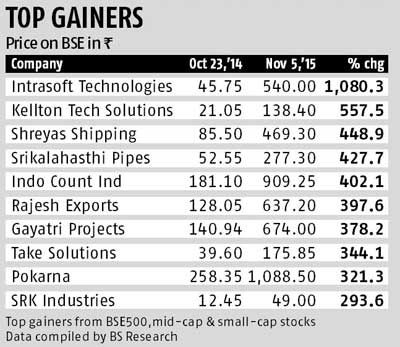

The market price of 77 stocks of from the BSE-500, mid-cap and small-cap segments has appreciated around 100 per cent since October 23, 2014 till date.

Investors who bought into aviation, textiles, mid-cap information technology (IT), automobiles and pharmaceutical stocks have made handsome returns since last year’s Diwali though the S&P BSE Sensex recorded negative returns.

The market price of 77 stocks of from the BSE-500, mid-cap and small-cap segments has appreciated around 100 per cent since October 23, 2014 till date, while 394 stocks out of a total of 922 stocks have gained 15 per cent during Samvat 2071.

These 926 stocks accounted for 97 per cent of the total BSE market capitalisation.

Britannia Industries, SpiceJet, Ajanta Pharma, Dishman Pharmaceuticals, Jubilant Life Sciences, KPR Mill, Nandan Denim, Force Motors, Himatsingka Seide, Nilkamal, Wockhardt and 8K Miles Software Services are among the 77 stocks that have seen their market value double.

G Chokkalingam, founder and managing director of Equinomics Research & Advisory, explains: “Some stocks like Force Motors, KPR Mills etc were beaten down very badly. Their market-cap fell beyond what fundamentals deserved. As the equity market and business prospects also improved, these stocks moved up sharply. As regards aviation stocks, it is cheap oil and successful responses to Indigo, which have led to such run-up. In other cases, it is perception rather than mere fundamentals which have led to over pricing of some the stocks.”

Strong show

The rally in most of these stocks is partly attributed to impressive financial performance.

The aggregate net profit of 220 companies that have so far announced their September quarter results and which gained around 15 per cent have posted an average 25 per cent year-on-year (y-o-y) growth in net profit for trailing 12 months (October-September).

The aggregate net profit of total 469 companies for trailing 12 months increased by three per cent year-on-year during the same period.

The BSE Midcap index returned 12 per cent and the BSE Smallcap gained four per cent, while the benchmark BSE Sensex has lost two per cent since last Diwali.

“Historically, mid-caps have always outperformed the broader market in the long run, especially in an improving macro climate. With macro prospects improving at the margin, we expect mid-cap outperformance to continue over the long-term,” said Arun Baid of Religare Institutional Research.

The laggards

However, metals, real estate, oil & gas, banks - mostly public sector - and telecom stocks recorded negative returns during the period with their respective indices slipping seven to 35 per cent.

Any possible turnaround in real estate, telecom and oil & gas could be only marginal, analysts say.

For telecom, the drag would be severe competition which will be triggered by Reliance Jio and from the fact that the penetration of mobile has peaked out.

However, they expect the banking sector to do well going ahead and outperform the benchmark indices on the back of an anticipated turnaround in the industrial economy and recent rate cuts.

“Going by the forecast of global economy and the recent fall in oil-density of economic growth, the oil price is likely to remain subdued and therefore, these resource producers’ stocks are likely to remain neutral at best. However, oil marketing companies like HPCL are likely to outperform once again due to subdued oil prices. Unless prices of real estate fall significantly, the industry is unlikely to recover significantly,” says Chok-kalingam.

Adding: “While the private banks such as Axis, Karur Vysya would be on the forefront, select public sector banks, which have got net NPA (non-performing assets) of around two per cent and still growing credit in strong double digits like Syndicate Bank would do well. In metals, it would be Hindustan Zinc, MOIL, which due to strong balance sheet can perform well while other metals stocks are expected to turnaround only by the fag end of the New Year.”

Fitch Ratings, however, expects asset quality to remain an issue for the banking sector for some time despite some evidence of ‘green shoots’.