Are you planning to switch jobs?

Are you planning to switch jobs?

Have you only recently moved into an exciting new career?

You need to check your tax implications.

Leaving a job and starting a new one could alter your tax status, and if your old income-tax payments are not updated with your current employer, you could find yourself running pillar to post with last-minute updations.

More often, while a person enjoys the perquisites of the job change, s/he often ignores the inevitable taxes due on salary income.

Every year we see at least five cases of individuals who have switched jobs in the middle of the financial year and have to empty their pockets in July, just before they file their annual tax returns.

Often, individuals ignore declaring to their new employer salary earned in their previous jobs.

In other cases, although salary has been declared (through salary slips/final-settlement slip) an individual doesn’t take due care to ensure that the amount has been included in his/her current salary workings by the new employer.

In either case, it is the individual (read, tax payer) who has to bear the cost of ignorance.

The problem

The root cause of this problem emerges in the way the tax liability (read TDS) on salary income is calculated by employers.

According to relevant provisions of the Income Tax Act, 1961, every person who is responsible for paying salaries shall at the time of payment deduct income tax on the amount payable at the average rate of income-tax computed on the basis of the rates in force for the financial year in which the payment is made, on the estimated income of the individual.

The rates in force are the slab rates as applicable to individuals and amended from time to time.

In view of the above, when calculating TDS liability, the total salary of an individual for the year is estimated; relevant deductions like interest on home loans, tax-savings under section 80-C and 80-D are deducted, and taxes due on net income are calculated according to the relevant slab rates.

At the present slab rates, income up to Rs 200,000 is exempt from tax; the next Rs 300,000 is taxed at 10 per cent income above 500,000 to Rs 10,00,000 is taxed at 20 per cent, and any income above Rs 10,00,000 is taxed at 30per cent.

At the present slab rates, income up to Rs 200,000 is exempt from tax; the next Rs 300,000 is taxed at 10 per cent income above 500,000 to Rs 10,00,000 is taxed at 20 per cent, and any income above Rs 10,00,000 is taxed at 30per cent.

When an individual changes jobs, the new employer too calculates salary income for the year in a similar way.

In such a situation, if the individual does not declare to the new employer salary income from the previous one, the new employer would calculate TDS liability only on the basis of the salary in the new company.

In case of a job switch where the old salary has not been declared to the new employer, the individual is being given the benefit of tax savings under section 80-C and 80-D twice by virtue of both the employers factoring in such deductions in their calculations.

In addition, the individual enjoys the slab benefit in both cases; meaning that income up to Rs 200,000 is not taxed and the balance is taxed according to the slabs and rates mentioned.

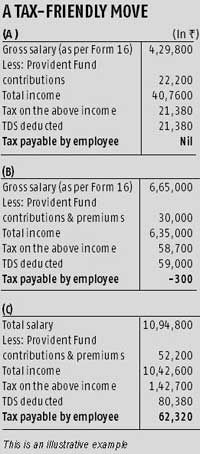

To illustrate, take the case of Manoj.

He worked with employer A from 1st April to 2nd September 2012 and with employer B from 5th September till the end of the year.

Table A illustrates the salary calculation according to Form 16 provided by employer A and Table B illustrates the same by employer B.

From the available data, the appropriate amount of TDS has been deducted by the employers, and the employee’s tax liability has been discharged.

However, Manoj’s total income for the year has to be calculated by aggregating both the salary incomes.

Table C illustrates his tax position by adding the income according to both the tables and after taking credit for the TDS by both companies.

The solution

Manoj’s total tax liability, as determined in Table C, is Rs 62,320 plus the applicable interest levied for non-payment of advance taxes during the year.

Such high tax payments when filing annual tax returns turns out to be a huge burden for individuals, who then face much difficulty in discharging this liability.

Every month of default would only increase the amount of liability by approximately 1 per cent of the liability for the interest payable.

Such unforeseen events also disrupt financial planning of individuals, who then have to look at all possible means to liquidate/break their investments and settle this liability at the earliest.

a. An individual has to ensure that one declares past employment income to one’s present employer when one joins a company through the designated forms;

b. An individual has to see to it that the old salary, as declared, has actually been taken into account for the TDS calculations by the new employer.

The best way to keep track is by keeping a tab on monthly TDS in the new company.

If it drops substantially below the previous TDS amount, the scope for trouble widens. Also, the tax forecast statements, if provided by the employer, can also be checked from time to time.

c. Alternatively, an employee can self-manage the liability with the help of a tax consultant to calculate the liability and pay it by way of advance tax installments.

This helps reduce/eliminate the interest liability.

The additional tax burden that arises because of the job switch cannot really be termed an unforeseen event.

It is sheer discipline on the part of an individual to ensure that emergency funds need not be dipped into to pay tax liabilities.

The writer is a certified financial planner

Photograph: Ivan Alvarado/Reuters