Listed retail companies such as Shoppers Stop, Trent and Future Retail will continue to see higher depreciation charges in the coming quarters due to new provisioning requirement in the Companies Act.

Listed retail companies such as Shoppers Stop, Trent and Future Retail will continue to see higher depreciation charges in the coming quarters due to new provisioning requirement in the Companies Act.

The amended Act says the depreciation charges have to be calculated on the “useful life of the asset” used in the business. In the case of retailing, it is furnitures and fixtures.

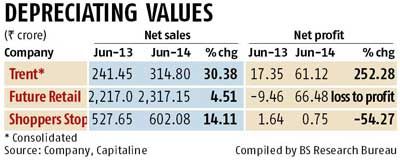

The companies made higher provisions for depreciation in the first quarter of 2014-15, in line with the new norm. This impacted their profits in the quarter.

Kishore Biyani’s Future Retail’s depreciation charges went up 57 per cent in the quarter to Rs 124 crore (Rs 1.24 billion), as compared to Rs 79 crore (Rs 790 million) in the corresponding period of 2013-14. This and a 26 per cent jump in higher interest charges led to its reported loss of Rs 34 crore (Rs 340 million).

Raheja-owned Shoppers Stop’s net profit was more than halved to Rs 75,000 in the June quarter from Rs 1.6 crore (Rs 10. 6 million) in the same period Q1 of last year, as its depreciation charges went up 50 per cent.

Trent’s depreciation charges went up 160 per cent in the quarter.

“The depreciation will continue to be higher in Q2, Q3 and Q4 as well because of the new provisioning. Typically, Q1 is our lowest quarter in terms of top line (revenue). Q2 and Q3 are larger and Q4 again is still higher than Q1.

So, as a percentage impact, it will be much lesser in the coming quarters,” said Govind Shrikhande, managing director of Shoppers Stop at a conference call to announce company’s earnings early this month.

However, Trent and Future Retail had one thing in common in the June quarter earnings, of an exceptional item in the form of sale of asset/investment.

Future Retail posted an adjusted net profit of Rs 66.5 crore (Rs 600.5 million) in the quarter, mainly aided by profit from sale of an investment of Rs 100 crore (Rs 1 billion).

Trent’s profit of Rs 61 crore (Rs 610 million) included an exceptional item of Rs 70 crore (Rs 700 million), the sale of its stake in Trent Hypermarkets to UK’s Tesco.

Future’s net sales went up marginally over a year. It posted 9.2 per cent growth in same-store sales (SSS) in the value segment, led by Big Bazaar, one of the highest for the company. SSS growth in the home segment was 5.5 per cent. SSS refers to sales growth from stores in the business for a year or more.

Trent’s department chain, Westside, posted SSS growth of 10.5 per cent. Shoppers Stop had SSS growth of 3.7 per cent, lowest in eight quarters.

This was mainly because some of the older stores were closed for renovation. It it was not for closure of these, the SSS growth would have been eight per cent, the company said.

Shoppers Stop’s Shrikhande believes SSS growth would be at least seven per cent in the coming quarters.

Analysts say retailers can expect better sales due to the festive season and overall improvement in consumer sentiment.

“Going forward, considering the expected revival in economy, we expect like-to-like sales growth in Westside to continue. Also, the costs in the case of Landmark are expected to reduce, which will increase profitability,” said analysts at Dalal & Broacha in a recent report.

The other main highlight of the quarter was that retailers expanded their Ebitda (earnings before interest, taxes, depreciation and amortisation) margins through various cost cutting measures.

Future Retail posted an Ebitda margin of 10.6 per cent, an increase of around 196 basis points (bps) compared to the quarter ended June 2013, largely due to increase in gross margins and space and cost optimisation.

Analysts said Future focused on improving its sales mix, by stocking more general merchandise, apparel and premium food, which carry higher margins.

Shoppers Stop’s Ebitda margin improved 75 bps to 3.8 per cent in the June quarter, mainly due to cost optimisation.