| « Back to article | Print this article |

Capital market regulator Securities and Exchange Board of India has fast-tracked clearances for new fund offers, helping mutual fund houses cash in on the prevailing positive sentiment created by buoyancy in the equities market.

Capital market regulator Securities and Exchange Board of India has fast-tracked clearances for new fund offers, helping mutual fund houses cash in on the prevailing positive sentiment created by buoyancy in the equities market.

According to industry officials, the time taken by the market regulator to clear NFOs has come down to two-three months from about six months previously.

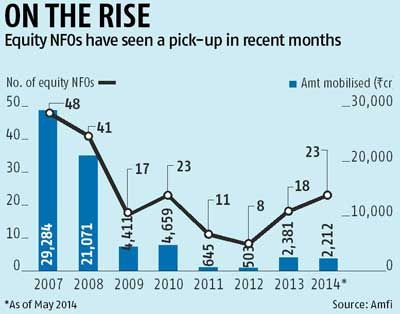

Thanks to speedy approvals, the Rs 10 lakh-crore (Rs 10 trillion) domestic mutual fund industry has been able to mobilise around Rs 4,000 crore (Rs 40 billion) from nearly 30 equity NFOs since October last year.

The improved speed of clearances, which has coincided with the ongoing market rally, has helped fund houses reap the benefits of a revival in investor interest.

India’s benchmark equities have rallied 42 per cent since August last year.

The more broad-based BSE Smallcap and Midcap indices have gained even more, by 102 per cent and 80 per cent respectively, during this period.

“Sebi has become quite efficient,” said Sundeep Sikka, chief executive officer, Reliance Mutual Fund, when asked about the shorter timeline for NFO clearances. H N Sinor, chief executive at industry body Association of Mutual Funds in India, said there are a few administrative issues that need ironing out but overall things have got better than before.

Industry officials, however, said speedier approvals from Sebi do not mean fewer checks and balances while getting NFOs cleared.

Industry officials, however, said speedier approvals from Sebi do not mean fewer checks and balances while getting NFOs cleared.

“It is not that the regulator has become lenient in clearing our proposals. Stringent processes remain.

There, however, is a clear change in the way Sebi used to function in approving our draft proposals,” said a senior executive at one of India’s largest fund houses.

“If the NFO successfully meets Sebi’s requirements, there is no hurdle and the time required comes down sharply," he said.

Please click here for the Complete Coverage of Budget 2014 -15