Some buyers are insisting on a clause in the agreement that the whole deal hinges on physical verification at a later date with some part of payment kept in escrow, reports Dev Chatterjee.

With lockdowns imposed in large parts of India and overseas, the M&A deal process is witnessing a sea change with buyers and sellers meeting only over Zoom calls and physical due diligence of assets taking a longer time than before.

M&A advisors said some buyers are also insisting on a clause in the agreement that the entire deal hinges on physical verification at a later date with some part of payment kept in an escrow account.

India has reported deals worth $47.8 billion year-till-date as compared to $120.3 billion for the entire calendar 2020.

A lot of deals which closed in 2020 like part of Reliance Jio stake sale were in the works for a long time and were announced at the peak of Corona lockdown last year.

Lawyers said despite the pandemic, diligences for M&A continue to provide prospective buyer information on the target's corporate structure and business, understand the assets and liabilities, legal obligations, and the value proposition.

All these ultimately help in determining an appropriate structure for the transaction and an ultimate value for the target.

"What has clearly been affected due to the pandemic and resultant lockdowns is the overall distraction, at times the loss of focus, prolonged deal timelines resulting in deal fatigue, and practicalities around the diligence exercise," said Aparajit Bhattacharya, Partner, DSK Legal.

Site visits, physical searches at public offices (for example at the land registry or at the office of the Registrar of Companies) have clearly been adversely impacted, resulting in delays.

As deal nuances have evolved over the past 14 months, lock-down restrictions have also resulted in physical meetings and on-site inspections disappearing.

Virtual data rooms and online calls have become routine.

Search results (particularly from the public offices) have taken longer to be processed resulting in a longer gestation period between signing and closing.

Deal teams are generally now considering all regional circumstances, well in advance, as they plan diligence scoping and timelines for the diligence workstream to make the process more smooth and efficient, he said.

"Despite the lockdown, the M&A process has not slowed down. Instead we are witnessing a steady growth. The due diligence process has also changed and in one case even a drone was used for physical verification," said a lawyer asking not to be quoted.

One of the potential bidders of Shipping Corporation of India said they asked all the papers to be sent to their offices and did not even visit the headquarter of the company before making the bid.

"All paperwork is being taken care of by our advisors and we don't think it's necessary for us to visit the plants and factories as meetings with company officials are elaborate over zoom calls though deal closing is taking more time," said the bidder, asking not to be quoted.

Interestingly, another buyer said they are involving more local lawyers in the due diligence process who are taking responsibility in far flung places.

Take, for example, if a plant is in Coimbatore, or Tirupur, it's the local lawyers who are assigned the work for due diligence as they have access to local administration and government officials.

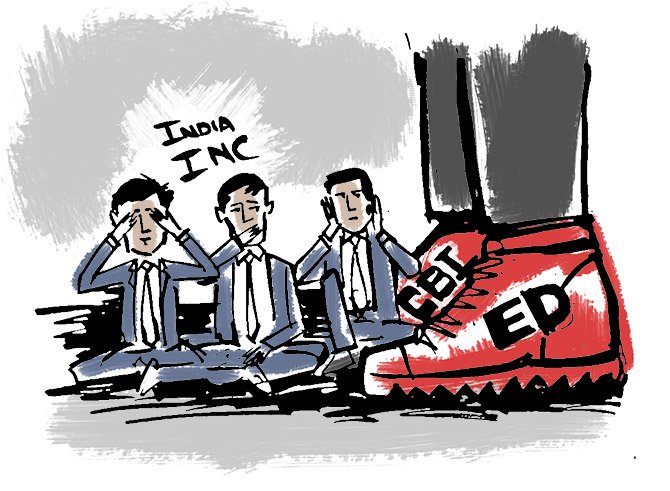

M&A advisors said with several companies facing a sharp decline in their sales due to the lockdown, they will look at selling stake or the entire business.

"This is a buyer market and there are several assets on sale. Since demonetization, several mid-sized and small-sized companies have seen their sales falling and Covid pandemic has just made things worse for them. Most of these assets are on fire sale," said a M&A advisor.

This distress, corporate lawyers said, would fuel a boom in the M&A segment.

"You pick up any industry in India and there is a company for sale due to ongoing distress. This will lead to opportunities for cash rich companies to acquire rivals and increase their market share."

Feature Presentation: Ashish Narsale/Rediff.com