| « Back to article | Print this article |

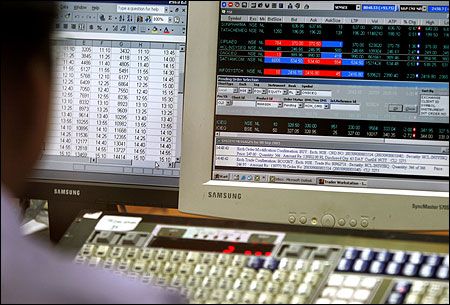

The Indian economy is in doldrums; rupee had touched an all-time low, and the stock markets have turned extremely volatile.

The Indian economy is in doldrums; rupee had touched an all-time low, and the stock markets have turned extremely volatile.

What should the investors do under the circumstances?

In an hour-long chat on rediff.com on Friday, A K Prabhakar, senior VP and Head -- Equity Research (Retail), Anand Rathi Financial Services Ltd, discussed the best stocks to put the investors' money in.

Here is the transcript:

Sir, can I buy Wockhhard at this level, (1056/-) and if I can, how long I should hold it

Ans: A K Prabhakar

Wockhard we are not comfortable with recent correction is almost more than 50% of its higest level whihc is very bad for the stock. So we would suggest to avoid teh stock.

pls advice idfc current level

Ans; A K Prabhakar

We are positive on teh stock and since it has good management and entity for banking license it is a trigger for the stock. Their NIM's have been above 4% for last 2-3 years

How much will sink nifty index ?

Ans: A K Prabhakar

Long term supportf or Nifty comes at 5500 till that doest breach there are chances that towards december market would make all time high.

(Q) H M

Sir, what about Suzlon Energy, good for long term?

Ans: A K Prabhakar

We would suggest to avoid high debt and debt restructuring stocks out of 10, 1 or 2 can be multi bagger but traditionally many of them have eroded wealth of teh investors.

(Q) prakashk

sesa goa current level is best for avg. invested at the level of 245

Ans: A K Prabhakar

if you want to hold the stock for 2-3 years then you can average otherwise you can just hold and donr make any fresh investments.

(Q) prakashk

pls advice one good stock of reality at current level for one year investment...

Ans: A K Prabhakar

We like Oberoi realty, Prestige, IBREAL form this space.

(Q) subhash maji

I have purchased bank of india earlier @294/200 share and today @265/400 share, need your suggestion

Ans: A K Prabhakar

Don average BOI as 10% fall is not big compared to market fall. PSU banks the asset quality and restructuring of assets is still a concern but once the ineterst cycle starts cooling down that should help teh stock.

(Q) mnj

can I buy SUBEX now?

Ans: A K Prabhakar

We would suggest to avoid the stock.

(Q) jignesh patel

what about sugar sector, is good to enter sugar company for three years?

Ans: A K Prabhakar

Sugar sector is very government regulated and with elections appraoching it is going to be volatile so we would suggest to avoid. But if you still insist then we would suggest EID parry and Andhra Sugar.

(Q) TEKRAJ DHARIWAL

HOW IS DENA BANK SHARE.. CAN IT BE PURCHASED

Ans: A K Prabhakar

The stock is trading below the BV that is PB of 0.4 and PE of less than 3x. PSU banks there are concerns of huge NPA but for long term investors PSU banking will benefit.

(Q) Navin Shah

Which stock to buy for long term in pharma..??

Ans: A K Prabhakar

LUpin, IPCA, Torrent Pharma, Cadila and Dr reddy are good for long term.

(Q) anil Singh

sir what is your view on satyam

Ans: A K Prabhakar

Post merger we are very positive on tech mahindra and Satyam.

(Q) raj

Hi Sir,Thanks for sharing your mind.Pls share the prospects of POWER SECTOR ? Should we invest in power sector for long term, say 5 years, in Lanco at current valuation of around Rs 7/- Per Share

Ans: A K Prabhakar

Power sector for 5 years is a good time horizon. but apart from lanco we like NTPC and power grid.

(Q) prakashk

what is ur view on bhel..six month time ,,,,,,,,,

Ans: A K Prabhakar

BHEL would be teh first beneficiary of any recovery in teh economy and execution cycle. with good amount of order book but only due to teh slow execution cycle because of teh sector in dodldums is hitting teh company. So for fundamental basis 6 months is very small period to comment on as unless there is no chnage in policies and economy uptick.

Simple question for A K Prabhakar which is never replied by any expert, Whats your portfolio?

Ans: A K Prabhakar

Tata coffee, Yes bank, Bajaj Corp, MRF, LUPIN

(Q) bhavin jain

Views on R Com

Ans: A K Prabhakar

Rcom technically looks good, fundamentally telecom is in competetion stage but recent news on repayment of debt will be beneficial for teh company.

(Q) Anand JK

Does suzlon have any future? Its in single digit. Will it be another KFA?

Ans: A K Prabhakar

Suzlon please avoid as buying low price stock with no fundamentals and huge debt on books and long gestation projects which are again dependednt on teh government policies will fetch no retruns.

(Q) Anand JK

How is MMTC at 60 levels?

Ans: A K Prabhakar

PSU companies where government is disinvesting is very volatile and therefore at current levels also i will not advice.

(Q) suresh babu

give one or two good stocks

Ans: A K Prabhakar

We like Hevalls India, Bata India , Lupin and RIL.

(Q) GAUTAM NANDI

what is the probable range of ril in coming 3 years

Ans: A K Prabhakar

RIL has started to move now and in next 3 years we see it doubling from current levels as fundamnetals like the huge inevstment which it is planning in petrochem business aong with gas output and others egmenst like retail and telecom will also stat playing out.

(Q) jignesh patel

IS it good to buy kaveri seed and wim plast ltd at current price for two years?

Ans: A K Prabhakar

In this segment We like Bayer crop as it is consistent performer with good cash on books, and after teh land deal it is holding good cash. BV is 488. It is a german company with good parental back up and well known brands in teh segment.

(Q)Anand JK

Your views on JSPL around 180 levels?

Ans: A K Prabhakar

JSPL is still looking weak but downside seems to be limited. i will not advice fresh buying in JSPl but if you are holding then hold. in this space we like Hind Zinc, Hindalco.

(Q) Meherwan Mehta

What is the outlook on CIPLA ? Is there any significant upside in the current quarter ?

Ans: A K Prabhakar

CIPLA is more of a domestic play that is 45% revenue, which is getting hit by the domestic pricing policy compared to its peers and now it is diversifying. In long term it looks good but we would prefer Lupin, Sun pharma, Torrent Pharma for next 1 year.

(Q) mvshetty

IS IT GOOD TO BUY EIL AT CURRENT LEVEL

Ans: A K Prabhakar

EIL is a good stock but government disinvestment is a major worry. It is trading at attractive levels almost 7-8x and ROE at 38% and is debt free generate almost 530 crs of free cash next year. For longer term it is a good buy.

(Q) Manish Singhal

what about opto circuits for long term?

Ans: A K Prabhakar

We avoid stocks which have corpoarte governance issue, there are better stocks available, M&M, ITC, LUPIN, MARUTI, L&T.

(Q) jignesh patel

shree lakshmi energy and food can i buy for two years?

Ans: A K Prabhakar

Market cap of the company is 233crs with no great fundamentals, we would avoid.

(Q) prakashk

please advice any long term midcap psu bank..60% return on 2 year

Ans: A K Prabhakar

Dena bank, Andhra bank and Vijaya bank probably meet your expectations.

(Q) prakashk

please advice any long term midcap psu bank..60% return on 2 year

Ans: A K Prabhakar

Dena bank, Andhra bank and Vijaya bank probably meet your expectations.

(Q) Anand JK

Shall I buy MMTC @ 50?

Ans: A K Prabhakar

MMTC is from metal space, this is very cyclical sector and with china growth slowing down which is a major consumption and also domestic demand subdued the companies may feel the heat. MMTC after the OFS offer has been falling continously due to its higher valuations. so we would suggest to avoid the stock.

I want to invest in Pharma stocks..kindly guide me some imp stocks for long term.

Ans: A K Prabhakar

In pharma we like Sun pharma, Lupin, Cadila

(Q) raj muni

please advise few midcap stocks for friday: buy/sell??regards,

Ans: A K Prabhakar

For short term Banking Stocks are looking good but for intraday it is difficult since market is very volatile.

(Q) manohar killedar

Tata Steel Ltd. Shall Buy

Ans: A K Prabhakar

Stocks has short term pressure as management has indicated that it will take 2 years for recovery. If you are a 3-4 years horizon invester you also look at SAIL, Tata steel and Hindalco inds.

(Q) appa

Dear sir, please tell us something about market now.

Ans: A K Prabhakar

Market is looking very good after making an inverse head and shoulder market has almost given a highest close in 35 trading days and now look for 6229 and 6357 for higher levels in coming days.