| « Back to article | Print this article |

Equity benchmarks ended over 1 per cent higher on Monday amid positive trends in global markets and buying in Reliance Industries and IT counters.

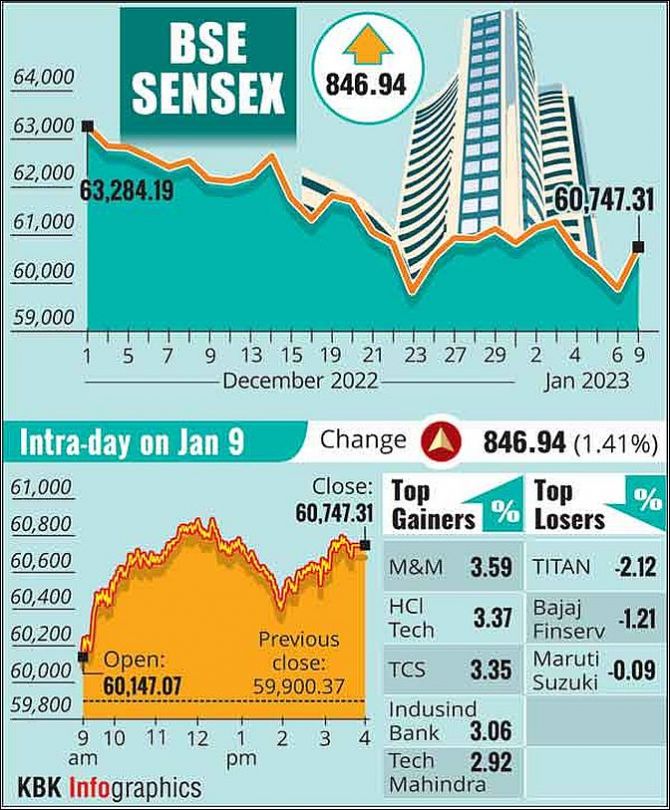

The 30-share BSE Sensex zoomed 846.94 points or 1.41 per cent to settle at 60,747.31.

During the day, it jumped 989.04 points or 1.65 per cent to 60,889.41.

The broader NSE Nifty climbed 241.75 points or 1.35 per cent to end at 18,101.20.

From the Sensex pack, Mahindra & Mahindra, HCL Technologies, IndusInd Bank, Tata Consultancy Services, Bharti Airtel, Tech Mahindra, Wipro, Infosys, Reliance Industries and Axis Bank were the major winners.

IT counters were in heavy demand ahead of earnings from TCS later in the day.

Titan, Bajaj Finserv and Maruti were the only laggards.

Elsewhere in Asia, equity markets in Seoul, Shanghai and Hong Kong ended in the green.

Equity exchanges in Europe were trading higher in mid-session deals.

Markets in the US had ended sharply higher on Friday.

"Wall Street climbed in anticipation of a less aggressive US Fed as wage growth slowed and service activity contracted, fuelling bets that inflation is moderating.

"Furthermore, the December payrolls rising higher than anticipated increased the possibility of a softer landing for the US economy.

"These gains were also absorbed by the domestic market, with IT being the biggest gainer ahead of the release of sector earnings, as the favourable US economy boosted sector optimism," said Vinod Nair, head of research at Geojit Financial Services.

International oil benchmark Brent crude jumped 2.67 per cent to $80.67 per barrel.

Foreign Institutional Investors (FIIs) offloaded shares worth Rs 2,902.46 crore on Friday, according to exchange data.