Stock market benchmarks ended nearly 1 per cent higher on Wednesday, halting their eight days of decline, amid gains in Asian and European equity exchanges.

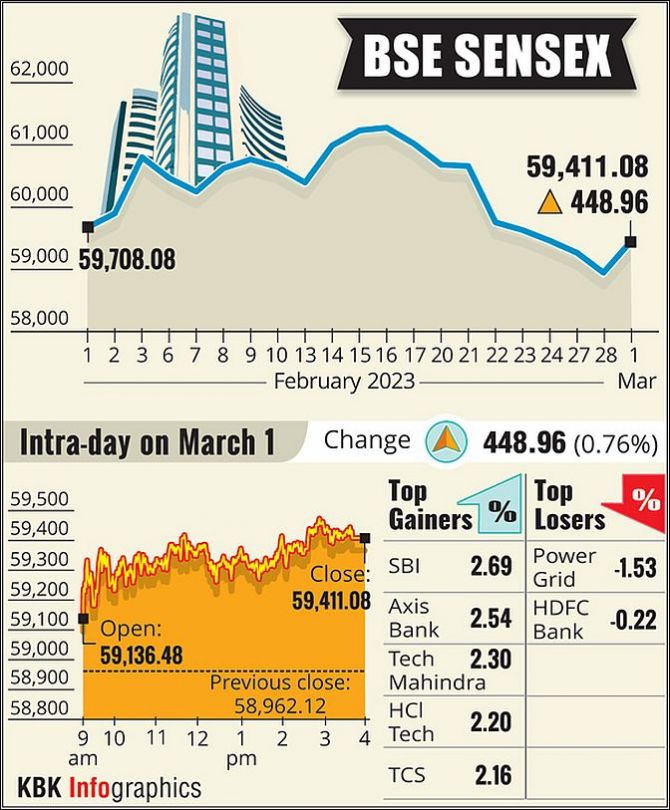

The BSE Sensex advanced 448.96 points or 0.76 per cent to settle at 59,411.08 after a positive beginning.

During the day, it jumped 513.33 points or 0.87 per cent to 59,475.45.

The NSE Nifty climbed 146.95 points or 0.85 per cent to end at 17,450.90.

In the past eight days, the BSE benchmark had tumbled 2,357.39 points or 3.84 per cent, and the Nifty declined 731.9 points or 4.22 per cent.

Markets started the March month on a positive note and gained nearly a per cent, taking a breather after the recent fall.

After the initial uptick, the Nifty index traded in a narrow range for most of the session but buying in select heavyweights kept the tone positive.

"On the sectoral front, recovery in the IT and metal pack combined with continued resilience in banking played a crucial role. Besides, recovery on the broader front further added to the buoyancy," Ajit Mishra, VP - Technical Research, Religare Broking Ltd, said.

From the Sensex pack, State Bank of India, Axis Bank, IndusInd Bank, Tech Mahindra, HCL Technologies, Tata Consultancy Services, Maruti Suzuki, Tata Steel and Tata Motors were the major gainers.

Power Grid and HDFC Bank were the laggards from the pack.

In the broader equity market, the BSE smallcap gauge climbed 1.38 per cent and midcap index advanced 1.35 per cent.

All the sectoral indices ended higher, with metal rallying 2.61 per cent, commodities jumping 2.30 per cent, IT (1.36 per cent), teck (1.28 per cent), industrials (1.25 per cent), bankex (1.15 per cent) and capital goods (1.11 per cent).

The Indian market was oversold and needed encouraging domestic triggers to show signs of revival.

The manufacturing PMI reported was better than predicted at 55.3, even though India's Q3 FY23 GDP statistics came in slightly below expectations at 4.4 per cent.

Solid global markets, bolstered by strong Chinese manufacturing data, also ignited optimism in the domestic market," said Vinod Nair, Head of Research at Geojit Financial Services.

The growth momentum in India's manufacturing sector was maintained in February, with new orders and output increasing at similar rates to January, according to a monthly survey.

In Asian markets, Japan, China and Hong Kong ended in the positive territory.

Equity exchanges in Europe were trading in the green. The US markets had ended lower on Tuesday.

Foreign Portfolio Investors (FPIs) offloaded shares worth Rs 4,559.21 crore on Tuesday, according to exchange data.

International oil benchmark Brent crude dipped 0.18 per cent to USD 83.30 per barrel.