| « Back to article | Print this article |

Many of these companies have a waiting period from 6-18 months now, indicating a rise in demand.

Small town roads in India are soon likely to witness a surge in the number of some of the most luxurious cars.

All the major luxury brands, such as Mercedes-Benz, BMW, Lamborghini and Lexus, believe that cities other than the metros are going to be their next major growing grounds in India.

Companies highlight higher disposable income in the hands of the rich in small towns, YOLO effect (You live only once) and changing lifestyles as the major reason for the shift in strategy.

A lot of these companies are having a waiting period from 6-18 months now, indicating a rise in demand.

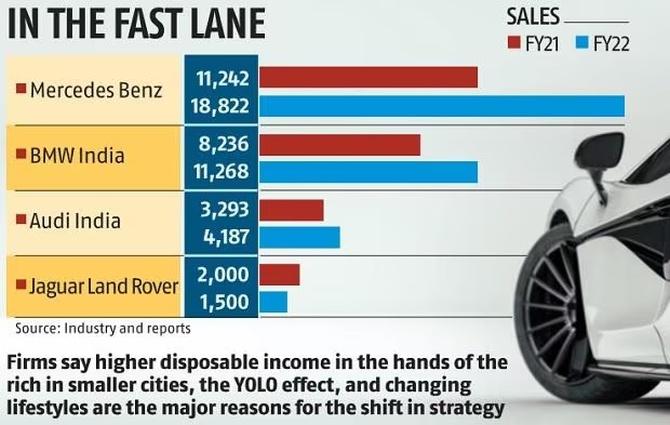

In 2022, Mercedes-Benz topped the sales charts in the luxury car segment, selling 15,822 units, up from 11,242 units in 2021, followed by BMW (11,981 units compared to 8,236 units) and German major Audi with total sales of 4,187 units.

"At Mercedes-Benz we categorise markets as metros and mini metros, underlining their potential and growing semblance in terms of customers' lifestyle, their awareness and disposable incomes, resulting in higher purchase power and increased luxury consumption," says Santosh Iyer, managing director and CEO, Mercedes-Benz India.

"The share of luxury car sales to million-dollar HNIs in these mini metros is also growing, just as in larger metros," Iyer adds.

At present, Delhi and Mumbai alone contribute 45 per cent of Mercedes-Benz's annual sales.

The mini-metros the company is focusing on include Coimbatore, Nashik, Calicut, Mangalore, Bhubaneshwar and Indore.

In 2022, BMW Group delivered its best-ever year in India till date in all three brands -- BMW, MINI and BMW Motorrad.

"We have seen strong contributions from established markets -- metropolitans. At the same time, emerging markets in Tier-II and III cities have grown rapidly and are showing remarkable growth prospects for the future," says Vikram Pawah, President, BMW Group India.

The company is betting big on emerging markets like Chandigarh, Kochi, Jaipur, Goa, Lucknow, where they are already seeing a 'very strong' growth in demand.

Pawah adds that other cities where the company foresees great potential and has already established world-class dealerships include Ludhiana, Udaipur, Kanpur, Mangalore, Calicut, Coimbatore, Vijayawada, Madurai, Trivandrum, Vadodara, Dehradun, Bhubaneswar, Ranchi, Ahmedabad, Rajkot, Surat, Goa, Aurangabad, Indore, Nagpur and Raipur.

BMW Group India will further broaden its horizons by creating more exclusive touch-points to connect with the clientele across the country especially in the emerging markets.

"We will continue to engage the clients from emerging markets with successful platforms such as BMW JOYFEST, BMW M Performance Training, BMW Golf Cup International, BMW GS Experience etc," Pawah adds.

The average waiting period for BMW is currently up to six months, depending on the model.

On the other hand, Tier-I and II cities now contribute to more than 25 per cent of Lamborghini's sales, with the remaining 75 per cent coming from metros.

The company has already started a programme called 'Lamborghini In Your city', through which it is identifying people in smaller towns, who have a passion for luxury cars.

"In India, wealth is not restricted to the four metros. We are already having Lamborghini owners in at least 50 cities in India. We are going to reach out to more tier-I and tier-II cities. We are getting huge demand from these areas and all our models are having a waiting period of around 18 months," says Sharad Agarwal, head of Lamborghini India.

In 2022, the brand sold 92 units, registering a growth of over 33 per cent compared to 2021.

Industry players also stated that the sector is seeing a revival after two years of hiatus and is expected to soon touch the pre-pandemic peak.

"The luxury car market is on V shaped recovery path with strong demand from the luxury consumers mainly attributed to change in consumer behaviour, more successful start-ups, younger affluent consumers, local production leading to a higher sense of value, YOLO (You live only once) effect and an increase in the number of HNIs," says Naveen Soni, President, Lexus India.

Feature Presentation: Rajesh Alva/Rediff.com