| « Back to article | Print this article |

Most of the long-only funds are closed-ended.

This means that investors have to lock in their money for a fixed period before they can take it back.

Sophisticated investment vehicles for the wealthy, which can reduce their downsides even when markets are falling, have outperformed regular funds which bet on rising markets.

Funds that only gain from rising markets are called long-only funds.

Those which can also minimise losses or even benefit when markets are in decline are called long-short funds.

These come under the category of alternative investment funds, which along with portfolio management service (PMS) service providers, manage investments for the very rich.

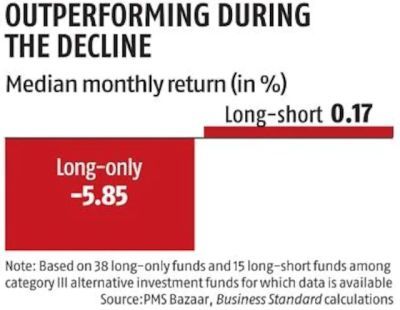

Long-only funds are down 5.85 per cent on a median basis over the last month, according to data from tracker PMS Bazaar.

Long-short funds are up 0.17 per cent in the same period.

The data looked at 38 category III long-only funds. A category III alternative investment fund looks to use complex trading strategies to generate higher returns.

This includes the use of derivatives which help hedge downsides when stocks are falling. They typically have a minimum investment of Rs 1 crore.

The ability to restrict the downside is what helps long-short funds outperform, according to Anshu Kapoor, President and Head, Investment Management at Edelweiss Wealth.

Lower downsides can help add to higher long-term returns when the markets start moving up again, Kapoor added.

The global share of such funds is around 1-2 per cent of total assets, but it is significantly lower in India, according to him.

"It will take time, in my opinion, to catch up," he said.

Taxation and other frictional costs like brokerage can be a factor in how attractive they are seen to be by clients, according to Ashish Shanker, managing director and head of the private wealth arm of the financial services group Motilal Oswal.

Long-only funds remain popular, partly because clients find that their performance is easier to measure, he suggested.

"They know how to benchmark it," he said.

Most of the long-only funds are closed-ended. This means that investors have to lock in their money for a fixed period before they can take it back.

There were 28 closed-ended schemes out of the 38 in the long-only category.

Only one out of the 15 long-short funds was closed-ended.

The rest were open-ended. This means that investors can enter or exit the scheme at will.

The outperformance of the long-short category comes even as the market has been facing headwinds amid foreign investor exits.

Tighter global liquidity is said to be driving flows out of relatively risky assets, including the equity markets of emerging countries like India.