| « Back to article | Print this article |

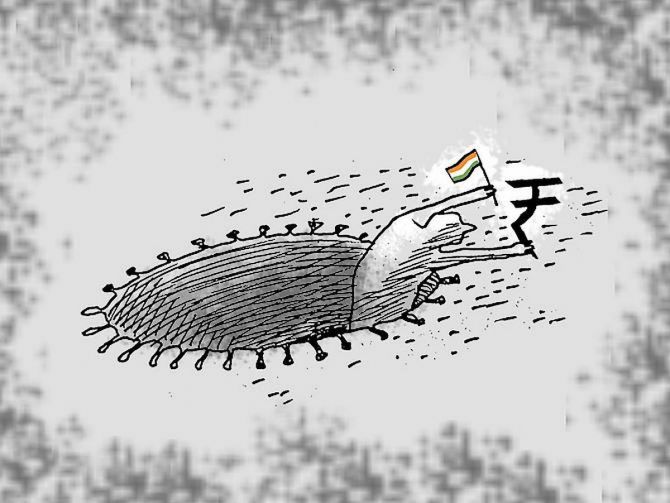

As of March 25, life insurers have paid Rs 1,986 crore towards 25,500 Covid death claims.

Life insurers, 24 in total, have spent crores on Covid-19 death claims, which are over and above the normal death claims they receive every year.

As of March 25, life insurers have paid Rs 1,986 crore towards 25,500 Covid death claims, according to data compiled by the Life Insurance Council. The figures are not in public domain as yet.

The amount paid as claims towards deaths caused by Covid is not yet alarming to the extent that it will impact the balance sheet or solvency ratios of companies.

However, it will take a toll on profitability of companies and prompt them to rework mortality assumptions.

Also, it will have an impact on pricing of product offerings, especially group term policies.

“Our increase in death claims over last year is about 30 per cent.

"Up to March, we have paid around Rs 45 crore towards 682 claims related to Covid.

"This does not impact our balance sheet due to adequate reserves for unforeseen events though it will hit profits for the year,” said RM Vishakha, managing director (MD) & chief executive officer (CEO), IndiaFirst Life Insurance.

“However, it impacts mortality assumptions in new product development.

"The impact will be felt more directly on group term policies that are annually renewable.

"In long-term savings products, companies have higher risk tolerance ability and a longer duration to absorb volatility.

"The pure term plans are dependent on reinsurance and will be impacted based on the response from reinsurers,” she added.

HDFC Life, one of the largest private sector life insurance players, has settled approximately 1,700 Covid claims.

According to a report by Motilal Oswal, SBI Life saw approximately 5,000 Covid claims and paid out approximately Rs 340 crore.

A similar rise in death claims was seen in other insurers as well, with ICICI Prudential Life settling claims worth Rs 340 crore.

Business Standard reached out to SBI Life, Max Life and Bajaj Life but did not get any response.

Vibha Padalkar, MD & CEO, HDFC Life, in response to a Business Standard query, said,“The first quarter of the year witnessed low claim intimations.

"This was largely due to the lockdown when customers were still trying to adapt to the new normal.

"Around the third quarter, we did observe an increase in claim intimations, and a good portion can be attributed to the low submissions earlier in the year. We see that normalising over time.”

The insurer had created a reserve of Rs 41 crore in April 2020 in addition to its regular mortality risk reserve.

This was to allow for potentially higher claims in light of the pandemic but, so far, it did not have to dip into the reserves.

Also, their solvency ratio is over 200 per cent, against the regulatory requirement of 150 per cent.

So, insurers do not foresee any capital requirement.

“So far, our actual mortality experience continues to remain within our estimates,” said Padalkar.

With resurgence in cases, insurers are keeping a close watch on the situation because the claims may go up.

Also, the uncertainty caused by the pandemic has resulted in reinsurers hardening their rates on term portfolio.

Many insurers are set to raise their premiums on term plans from April.