| « Back to article | Print this article |

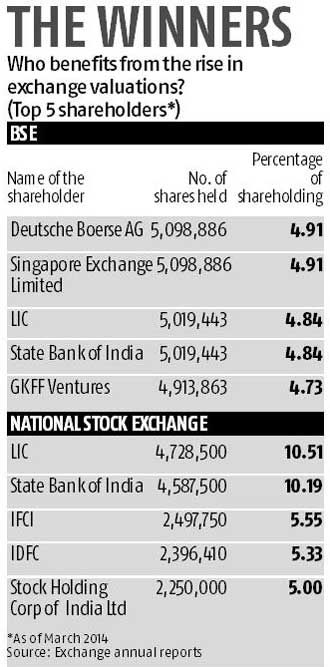

Dealers in shares of unlisted companies are seeing increased demand for the shares of BSE and the National Stock Exchange (NSE), owing to the bullish market sentiment and rising stock exchange volumes.

Dealers in shares of unlisted companies are seeing increased demand for the shares of BSE and the National Stock Exchange (NSE), owing to the bullish market sentiment and rising stock exchange volumes.

Those dealing in unlisted shares said exchanges represented a monopoly business, with only two players in India accounting for all the equity trading volumes.

Besides, the current bullish trend means more people are trading on stock exchanges.

Through the last financial year, average daily volumes have risen about a third, while cash market volumes have increased more than 60 per cent.

So far this financial year, average daily turnover on stock exchanges has risen 30.14 per cent — it stands at Rs 2.72 lakh crore (Rs 2.72 trilion) in FY14, against Rs 2.09 lakh crore (Rs 2.09 trillion) in FY13.

Cash market volumes have risen 60.36 per cent.

During the same period, average daily cash market transactions have risen from Rs 13,214 crore (Rs 132.14 billion) to Rs 21,190 crore (Rs 211.90 billion).

This has resulted in more demand for shares in exchanges.

Since these companies cannot be bought and sold through a trading platform, orders are executed by brokers specialising in such transactions.

Such brokers connect buyers to sellers, taking a commission on the deal.

“The sentiment has improved and there is increased trading volume.

Accordingly, share prices have risen,” said Sandip Ginodia of Abhishek Securities, a Kolkata-based dealer in unlisted shares.