| « Back to article | Print this article |

While seniors seeking a regular income should switch to debt funds from balanced funds, younger investors should invest in balanced funds after understanding their risks, experts tell Sanjay Kumar Singh.

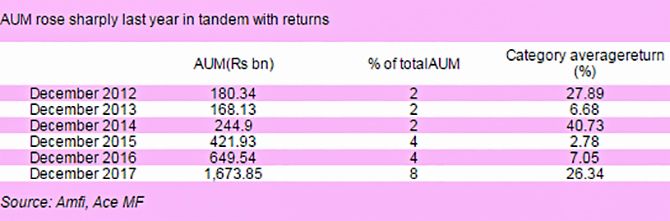

Balanced funds emerged as the favourite investment category of investors in 2017 (See table below: AUM rose sharply).

Not just younger people entering into equity markets for the first time, even seasoned investors who wanted a fund that would handle the asset allocation for them, have bet on these funds.

Even many elderly investors were mis-sold these funds last year with the promise of regular dividend income. All these investors need to prepare for more turbulent times in this category in 2018.

Balanced funds are also known as equity-oriented hybrid funds.

They invest more than 65 per cent of their portfolio in equities, and were earlier entitled to zero long-term capital gains (LTCG) tax earlier, just like pure equity funds.

They will now be taxed at 10 per cent on LTCG gains.

They are recommended to young, first-time entrants in the equity markets, as they can get both equity and debt exposure with a limited amount of money.

They are also suitable for seasoned investors who don't want to do the task of managing the asset allocation and rebalancing themselves.

These funds have certain drawbacks as well.

"Such asset-allocation funds tend to offer the same asset allocation to all investors, irrespective of their needs," says Kaustubh Belapurkar, director-manager research, Morningstar Investment Advisor India.

Investors need to check their risk appetite and investment horizon before they invest in these funds. Since they are predominantly equity-oriented, they will be only slightly less volatile than pure equity funds, and should hence be bought with an investment horizon of at least five years.

Returns from balanced funds were high in 2017 (See table). This was due to a combination of factors.

The equity markets were moving up: The Nifty delivered a return of 28.81 per cent in 2017.

The debt markets were also doing well for the first seven months of the year: From a peak of 7.95 per cent on May 16, 2015, the 10-year G-Sec yield touched a low of 6.23 per cent on December 3, 2016, rose and then fell again to 6.43 per cent on July 25, 2017, before beginning to climb again.

When interest rates are falling, fund managers are able to earn good returns by investing in higher-duration bonds and benefiting from capital gains.

"Past returns in balanced funds may not get repeated in the future," says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

Experts expect the equity markets to be more volatile in 2018. Returns from debt are also likely to be more muted than they have been in the past in a rising interest rate scenario.

Many senior citizens who need a regular income post retirement were mis-sold these funds in 2017 with the promise that they would offer an attractive tax-free return. There are two problems with such a promise.

These funds can only distribute dividends out of the profits generated by them. "These funds may continue to distribute dividend with the gains made in the past, but if the market downturn continues they will have to stop eventually," says Deepesh Raghaw, founder, PersonalFinancePlan.in, a Sebi-registered investment advisor.

With the imposition of 10 per cent tax on dividend in the recent Budget, the promise of tax-free returns has also ended.

Experts say investors who had invested in balanced funds after fully understanding their risks, and with an investment horizon of five years or more, should continue their SIPs in these funds.

They should also not pull out the money already invested in these funds.

Those who invested in them for regular income should accept that they have been mis-sold. They should immediately withdraw their funds before their capital gets eroded and shift to a systematic withdrawal plan (SWP) in a short-term or ultra short-term debt fund.

Illustration: Dominic Xavier/Rediff.com