| « Back to article | Print this article |

If you are not already lost in the zeros this wealth stands at Rs 257 lakh crore or Rs 257 trillion (1 lakh crore = 1 trillion = 1, 000,000,000,000), according to a report unveiled by Karvy Private Wealth for the fiscal year 2014.

Photograph: Ranjith shenoy R/Wikimedia Commons

Significantly, this wealth held by individual Indians -- say, like you, Mukesh Ambani, Prime Minsiter Narendra Modi and I -- stood at just Rs 73 lakh crore in 2009, when Karvy Private Wealth first unveiled this report, and have jumped almost four times to Rs 257.4 lakh crore in just five years.

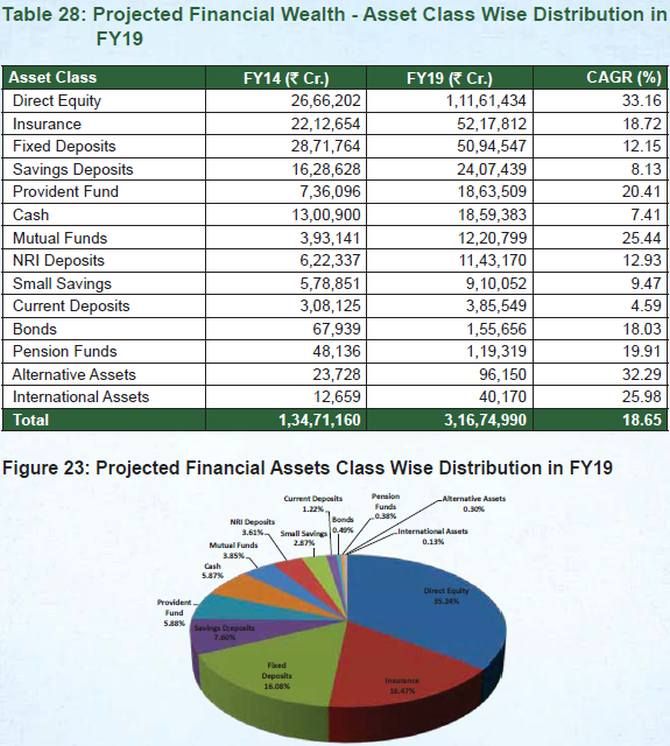

To further put these numbers or euphoria (whatever you may like to call it) into perspective, the 'India Wealth Report 2014: Reforming to Perform' estimates that this wealth would almost double at the end of the next five years.

Put simply, the value of the wealth -- shares, mutual funds, provident funds, insurance, bonds, post office savings, etc (financial assets) and gold, silver, diamonds, real estate, etc (physical assets) -- held by individual Indians in 2019 would hit the Rs 517 lakh crore mark, claims this report that has sourced information from the RBI, SEBI, AMFI, IRDA, World Gold Council and some real estate reports.

To further add to your perspective, this figure of Rs 257 lakh crore for FY 2014 (period from April 1, 2013 and March 31, 2014) stands at almost twice India's GDP at Rs 120 lakh crore for the same period.

The same number for wealth held by Indians in FY2019 will stand at 2.5 times the country's GDP.

Source: India Wealth Report 2014: Reforming to Perform

Are these numbers intimidating you?

Are you getting confused with so many numbers thrown at you?

"Rs 120 lakh crore of revenue is produced every year in India (GDP) and this Rs 257 lakh crore is the wealth collected by individual Indians over the last 60 years. This is like the difference between your salary (which you get once a month) and your bank balance (that you keep accumulating over a period of time)," explains Sunil Mishra, CEO, Karvy Private Wealth.

Mishra, who is full of optimism, says that most of this Rs 517 lakh crore wealth would come from the equity markets, and he stands firmly by the report by Karvy Stock Broking (whose division Karvy Private Wealth is) which claimed that the BSE Sensex (the bellwether of Indian stock markets) would hit 100,000 mark in 2020, and you couldn't resist but ask him...

What's the reason behind your confidence, which almost sounds like euphoria? Where will this 100,000 number come from?

Mishra begins thus:

We are increasingly going overweight on equity now as part of an individual's overall asset allocation because we believe this asset class will give the highest returns in the next four to five years.

We believe Indian equity markets are poised to give 40 per cent returns in FY15, 20 per cent in FY16 and then 25 per cent in the years to follow. This year (from April 31, 2014) we have already seen 25 per cent returns (the figure comes to 20 per cent till December 16, 2014, because of the sharp fall this month) and with reforms kicking in soon and the next Union Budget likely to be very positive we see an additional 15 per cent returns next fiscal year taking it to 40 per cent.

Because of the high base effect equity returns would be in the range of 20 per cent in FY16 but FY17 onwards with UP legislative assembly elections done we expect this government to have solid numbers in the Rajya Sabha too, paving the way for blockbuster economic reforms in FY17, FY18 and FY19.

We expect the equity markets to return 25 per cent on a compounded annual basis in the next six years. That takes you to the Sensex figure of 100,000.

"But how much one should invest in equity would depend upon a person's age, asset allocation priorities and overall financial goals," Mishra adds a word of caution for all those who could perhaps get swayed by his tall claims.

Is he banking too much on just one person to usher in this wealth generation, to bankroll the Indian economy?

Mishra is ready with his counter quickly:

No, that's 50 per cent of the story.

The rest will depend on global factors like crude oil prices (at multi-year lows even as you read this), peace in West Asia, US economy doing well, even as the China economy is slowing but not slowing down too much and the Eurozone not really cracking up.

Of course, we would love Prime Minister Modi to build institutes that will make everybody breathe easier when it comes to the process of quick decision making.

But I am not too keen to let Mishra have the last word and fire another volley at him... Something that would elicit an ounce of caution/pessimism...

I ask him to articulate the factors that, he thinks, could spoil this 25-per-cent-CAGR story and Mishra fires on all cylinders...

"If crude oil prices really go up again," he says, but quickly adds, "which we don't see happening as OPEC guys make an effort to teach the shale gas producers a lesson or two (in economics of oil production)."

"The second is the risk of the leader (Prime Minister Modi) not being there (sounds implausible right now given the huge majority that the BJP has in Lok Sabha, but that is definitely a big risk factor given that so much is riding on Prime Minsiter Narendra Modi's leadership to usher in big bang economic reforms), which no one talks about but which is a real risk."

"That is why we would want Mr Modi to build institutional structures that would be long lasting and help India achieve its true economic potential."

"Third risk factor is the complete crashing of the Eurozone as it stands today and finally, the political crisis in West Asia (could spoil the party)," Mishra observes.

Coming back to the 'India Wealth Report 2014: Reforming to Perform' I ask Mishra about the top salient features of the report, and he responds...

India Wealth Report 2014: Reforming to Perform -- Read the entire report here