| « Back to article | Print this article |

He said trust and confidence were the backbone of any financial system and one should never underestimate the power of ethics and values.

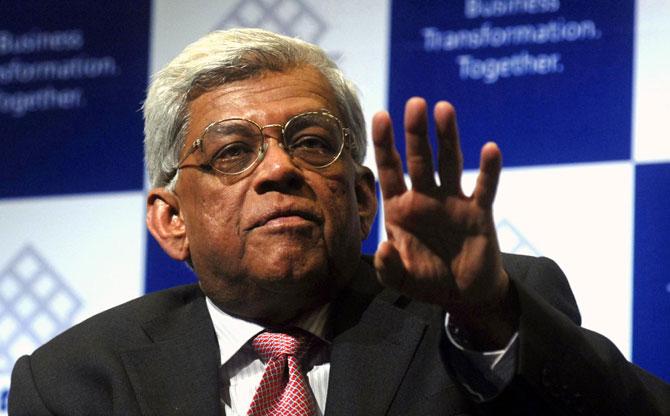

Amid the crisis at Punjab & Maharashtra Co-operative Bank (PMC), HDFC chairman Deepak Parekh said it was “brutally unfair” that there were regular loan waivers and corporate loan write-offs but no financial system to protect the common man’s savings.

The scam at PMC Bank has affected thousands of its depositors as their money is stuck with the urban cooperative bank's after the Reserve Bank of India (RBI) had put withdrawal limits at Rs 25,000 per account last month.

The restrictions from the RBI came in after it found the bank’s exposure to real estate developer HDIL was in too much in excess of what the regulations require and also as the lender hid the NPAs of HDIL.

PMC’s exposure to HDIL is around Rs 6,500 crore, which is 73 per cent of its loan book of Rs 8,880 crore, according to the bank.

“To my mind, there is no greater cardinal sin in finance than misuse of the common man’s hard-earned savings.

"It seems brutally unfair that we have allowed a system of loan waivers and write-offs every now and again, but yet we do not have a robust enough financial system to protect the honest common man’s savings,” Parekh said, without mentioning any particular incident while launching a centre for financial studies by SP Jain.

He said trust and confidence were the backbone of any financial system and one should never underestimate the power of ethics and values.

“It is a pity that this is so often eroded,” he said, adding that this was a problem across the world.

Parekh said despite all the negativity around the realty sector in the past six months, overseas investors have pumped in close to $ 4 billion in realty - commercial, warehousing and logistics, and retail.

Sovereign wealth funds, pension funds and private equity investors are seeing long-term benefits and growth opportunities that India presents, he said.

Parekh said there was not a single large good quality commercial property, which is without a tenant.

“Back-office operations, IT services, and software development have all seen huge growth.

"At new places in Hyderabad, a company is occupying 1 million square feet.

"It is because of the good infrastructure that foreigners are coming,” he said.

“There are two things India needs critically from the world: capital, and oil.

"About 30 per cent bonds issued by governments and companies globally are trading at negative yield.

"The amount is about $ 17 trillion. It makes sense for India to seize the opportunity to attract much more global capital,” he said.

Parekh added that there was no other major economy in the world that had the capacity to absorb the scale of investment that India had.

Photograph: Reuters