| « Back to article | Print this article |

Lenders have reported a surge in their bad loans in the six months to March after an asset quality review ordered by the central bank.

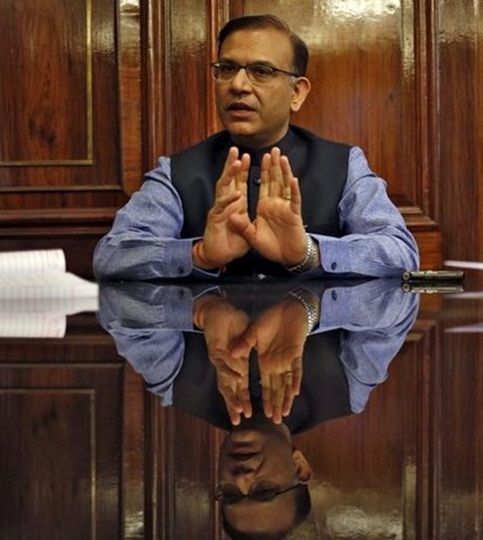

India is looking to start a "significant" fund that will invest in distressed loans held by lenders, Minister of State for Finance Jayant Sinha said on Tuesday, as regulators strive to clean-up non-performing loans in the struggling sector.

"We will have a significant stressed assets fund," Sinha told reporters on the sidelines of an event by credit ratings agency CRISIL in India's financial capital, Mumbai.

"We expect a variety of funds - stressed debt fund, special situations fund, and NIIF (National Investment and Infrastructure Fund) - to then participate in equity investment in these stressed assets," he also said.

Sinha added details were still being finalised.

He also said it was prudent for the Reserve Bank of India to continue with an asset quality review of the banks.

Lenders have reported a surge in their bad loans in the six months to March after an asset quality review ordered by the central bank.

Photograph: Reuters