| « Back to article | Print this article |

Even as the Union government remains the country’s single largest borrower, India Inc’s borrowing has risen at a swift pace over the past decade.

Even as the Union government remains the country’s single largest borrower, India Inc’s borrowing has risen at a swift pace over the past decade.

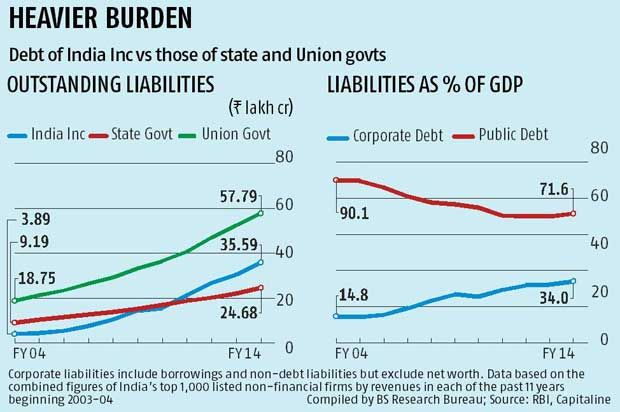

Since 2003-04, Indian companies’ outstanding debt has increased at a compound annual growth rate (CAGR) of 24.8 per cent, more than double the 11.4 per cent rate for India’s public debt during the period.

While corporate debt as a percentage of India’s gross domestic product (GDP) has gradually increased over this period, Indian firms’ incremental borrowings have been higher than the Union government’s on at least three occasions in the past seven years.

In fact, corporate India at present is more indebted than all state governments put together.

In absolute terms, the gap in the outstanding liabilities of the Union government and corporate India has widened a little - from Rs 14.86 lakh crore in 2003-04 to Rs 22.21 lakh crore in 2013-14.

But in terms of multiples, the balance outstanding debt of the Union government now is only 1.6 times as much as corporate India’s liabilities (including non-debt liabilities but excluding net worth), compared with over five times in 2003-04.

Public debt in the past decade has grown at a slower rate than the country’s gross domestic product (at current price).

This has led to a steady decline in the public debt-to GDP ratio. At 71.6 per cent, public debt is close to its lowest since the late 1990s, while the Union government’s debt-to-GDP ratio declined to a three-decade low of 55.2 per cent of GDP in 2013-14. In 2004-15, the ratio was as high as 71.5 per cent.

By comparison, corporate debt has grown at a much faster pace, resulting in a sudden surge in corporate debt-to-GDP ratio.

The outstanding corporate debt is now equivalent to over a third of India’s GDP (34 per cent in 2013-14), up from 14.8 per cent in 2003-04.

As a ratio of revenues, India Inc’s combined debt was equivalent to 57 per cent of revenues last financial year, up from 37.3 per cent in 2003-04.

In a way, India Inc displaced the sovereign from the capital market as public and corporate debt combined hovered between 99 per cent and 105 per cent of GDP during the period.

Experts attribute this to the state desisting from increasing the number of infrastructure sectors in favour of private participation through public-private partnership projects.

A Business Standard analysis, based on the combined figures of India’s top 1,000 listed non-financial companies by revenues in each of the past 11 years since 2003-04 - these companies accounted for an average 95 per cent of revenues and assets of all listed non-financial ones - shows the combined debt of these firms jumped nearly 10 times in the past decade.

It stood at Rs 35.6 lakh crore at the end of 2013-14, compared with Rs 3.9 lakh crore at the end of 2003-04.

By comparison, the Union government’s outstanding liabilities during the period tripled to Rs 57.8 lakh crore in 2013-14 from Rs 18.7 lakh crore in 2003-04.

The state governments’ combined liabilities jumped 2.7 times to Rs 24.7 lakh crore at the end of 2013-14 from Rs 9.2 lakh crore in 2003-04.

The combined public debt is lower, as the Union government’s loans to states gets cancelled in the aggregate figure.

The combined public debt is lower, as the Union government’s loans to states gets cancelled in the aggregate figure.

Experts attribute this trend to the corporate sector’s entry into capital-intensive sectors like highways, power, airports, ports and urban infrastructure, and India Inc’s faster growth.

“This is to be expected when private companies are participating in infrastructure in a big way through PPP projects. Debt is a large component of the capital cost of these projects which leads to growth in corporate debt,” says Devendra Pant, economist & head public finance, India Ratings.

Also, India Inc went for large-scale expansion in traditional capital-intensive sectors like metals & mining, construction, textile and automobiles, which were generously funded through debt.

“Higher debt is an inevitable part of faster growth and capital expenditure; that is what the numbers show,” adds Pant.

Others cite supply-side issues.

“Globally, there is a liquidity glut, thanks to the quantitative easing by the world’s top central banks. This has made it easy and cheaper for companies to access foreign capital. They have raised large capital through the external commercial borrowing (ECB) route in the past decade,” says N R Bhanumurthy, professor at National Institute of Public Finance and Policy.

Some others point to India Inc’s poor financial performance after the global economic slowdown of 2008.

“Not all corporate debt is due to growth or for funding PPP projects. In the past few years, many companies have borrowed only to make up for losses in their operations or to fund working capital,” says Dhananjay Sinha, head of institutional research, Emkay Global Financial Services.

This has made corporate indebtedness crucial to growth revival. In most sectors, companies now hold the key to capex revival but their hands are tied by stretched balance sheets. “Unless there is a meaningful deleveraging by India Inc, it will be tough for the government to revive growth cycle,” says Sinha.