'I have very little faith in economists who tell me that demonetisation will reduce growth.'

'The greater effect of demonetisation is if it creates changes in the financial services system and gets people to shift from cash.'

'The economy is not a trained monkey that will jump around if you lower rates.'

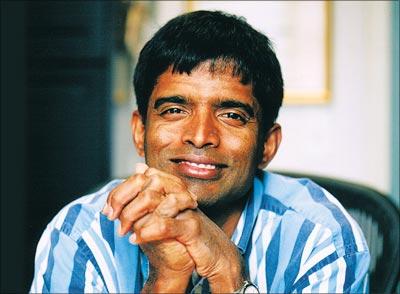

Aswath Damodaran, professor of finance, New York University's Stern School of Business, tells Hamsini Karthik that demonetisation is unlikely to destabilise the economy as expected by some experts.

Illustration: Uttam Ghosh/Rediff.com

Because of globalisation, Professor Damodaran says, the risk premium of emerging markets has halved and that US President Donald Trump's policies will matter more for India and China than for the US.

Equity returns worldwide are becoming anaemic, and more so, in India. With growth being squeezed, will this scenario persist?

There is an increasing disconnect between stock market returns and economic performance.

This is a global phenomenon, not just in India.

You can have a healthy economy, but its stock market would have gone nowhere or vice versa.

This disconnect is because of globalisation.

Even the S&P 500 draws 60 per cent of its revenue from outside the country.

This is becoming true even in emerging markets.

Is that why you believe that the Indian market could soon go past the demonetisation disturbance?

I have very little faith in economists who tell me that demonetisation will reduce growth. They've never been right in the last decade.

While I believe that the effect on black money is going to be temporary, the greater effect of demonetisation is if it creates changes in the financial services system and gets people to shift from cash.

People will change; 10 years back nobody believed that even farmers could have cell phones. Today everybody does.

Importantly, if the Indian economy is so fragile that one demonetisation could shake it up, then it didn't deserve to be strong in the first place and I don't believe India is that fragile.

Are developed nations realising their mistake with negative interest rates now?

We've used central banks as a bogey and bankers are insane because they've been making the same mistake over and over, which is lowering interest rates.

The economy is not a trained monkey that will jump around if you lower rates.

Interest rates are negative in Japan and Europe because of deflation and negative growth.

So you will never see Europe go back to 5 to 6 per cent rates because the underlying growth is zero.

The US market is a bit of an exception; it delivered growth in 2016, which is why money is coming back into the US.

But the US will gain not at the expense of EMs (emerging markets), but from Europe and Japan.

India Inc is fond of lower rates too...

We like to blame the government or the central bank for lack of growth.

To bring back credit growth the best measure taken by the Reserve Bank of India was to increase transparency through the Asset Quality Review.

This will help restart credit demand on a fresh slate and it's important because today there is nothing more opaque than a bank for an investor.

We used the dividend discount model to value banks in the past -- what I call days of innocence -- as they could pay out what they could afford and wouldn't take crazy risks.

But historically in India, banks have lent based on 'connections' more than their financial ability.

These problems can't be fixed overnight, but the government is asking for information on these issues, which is great.

As for equities, both risk premiums and beta have increased sharply the world over. Your view?

Welcome to globalisation.

EMs were tiny economies 30 years back. But when correlation across markets rises, beta will no longer be small.

Everyone is a global investor, whether they want to or not.

There was a big difference between risk premium of EMs and developed markets 15 years ago.

The events of 2008 blurred the lines.

Today the collective risk premium of EMs is half of what it was 15 years ago and they are more susceptible to global shocks.

What Trump does to the US will matter more for India and China than for the US itself.